Most people lose money in crypto, not because they pick bad altcoins. Instead, they look at the market at the wrong time. 2026 will not reward speed. It will reward positioning. So, crypto cycles do not announce themselves. They whisper first. This video is about listening to those early signals.

The emphasis is not hype, but discipline. Pay attention to structure. React to the market, not emotion. If you get the process right, the gains become a side effect, not the goal. So, in this video, I focus on three altcoins that deserve attention now, not later.

Chainlink ($LINK)

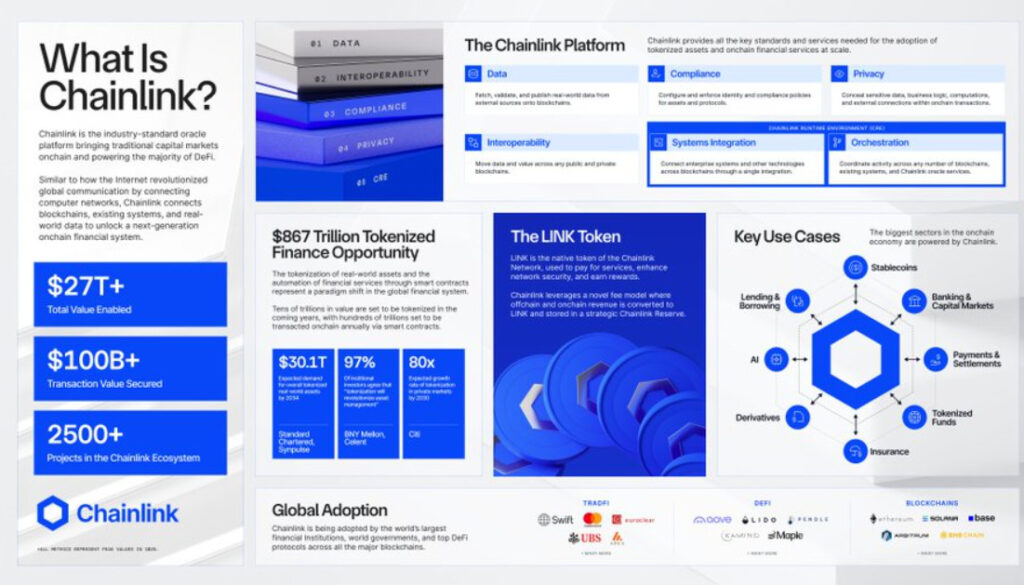

Chainlink ($LINK) sits in the center of the crypto sector. It connects the crypto sector at various levels. It’s an oracle that provides real-world data to blockchains. But that’s not all. It also provides blockchain infrastructure. This allows chains to connect with each other but also to get the most out of their features.

Source: X

Chainlink provides fundamentally sound tech. Its $LINK token also has various use cases. Web3 and DeFi are growing, and Chainlink sits at the center of this demand.

Institutional Interest

So, it should come as no surprise that there’s also institutional interest in Chainlink. This shows with the first US-based $LINK ETF by Grayscale. This ETF launched in early December 2025. To this date, it hasn’t yet seen a single day of outflows.

Grayscale Chainlink Trust ETF (Ticker: $GLNK) with 0% fees is now trading¹.

The first @chainlink ETP in the U.S. — from Grayscale, the world’s largest crypto-focused asset manager².

Gain exposure to $LINK, the core infrastructure for connecting blockchains to the real world.… pic.twitter.com/CjoemYxyEI

— Grayscale (@Grayscale) December 2, 2025

Keep your eyes peeled for another $LINK spot ETF by Bitwise. It’s now listed on the DTCC. The DTCC is the Depository Trust & Clearing Corporation. This indicates an imminent launch. However, the SEC still needs to approve it.

Chainlink. The leading decentralized oracle network—and the bridge between blockchains and the real world.

Now in the Bitwise 10 Crypto Index ETF (NYSE: BITW). pic.twitter.com/SpCdpZdr7G

— Bitwise (@BitwiseInvest) December 9, 2025

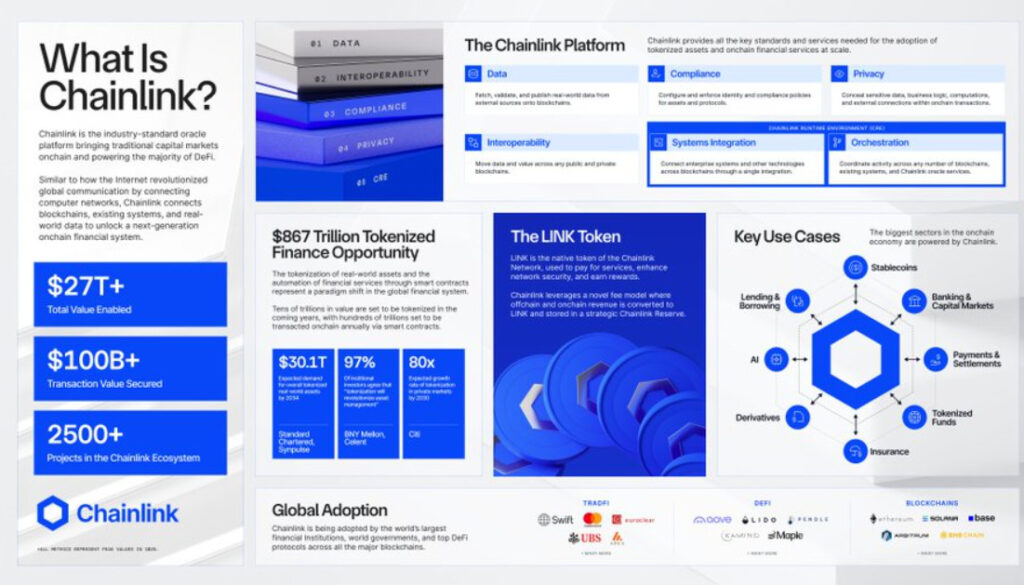

CCIP

I already mentioned that Chainlink has a cross-chain feature. That’s its CCIP. In October 2025, Swift integrated with Chainlink’s CCIP. This took many by surprise, especially in the $XRP camp. They had for a long time expected a partnership between Swift and Ripple. So, instead of $XRP replacing Swift, Chainlink connects Swift to over 70 blockchains. This also emphasizes the institutional interest in Chainlink. By the way, the first collab between the two dates to September 2022.

Source: Chainlink blog

Tokenization

Tokenization, or RWA, is another area in which Chainlink is active. This is a crypto sector with massive growth potential. Chainlink mentions an $867 trillion market. It already has collabs with major market leaders in this segment. For example, J.P. Morgan. Swift, Mastercard, UBS, and more.

With the current $LINK price around $12 to $13, this is a steal. At Altcoin Buzz, we have plenty of videos about Chainlink. Check out this list here.

Ondo Finance ($ONDO)

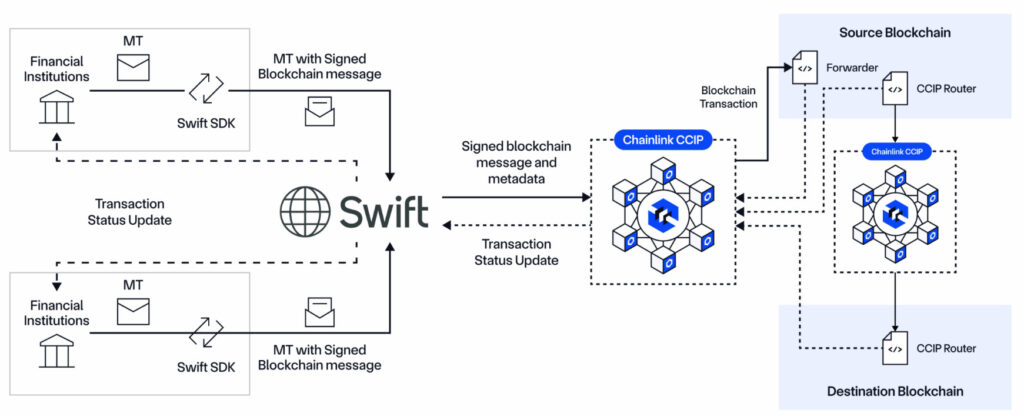

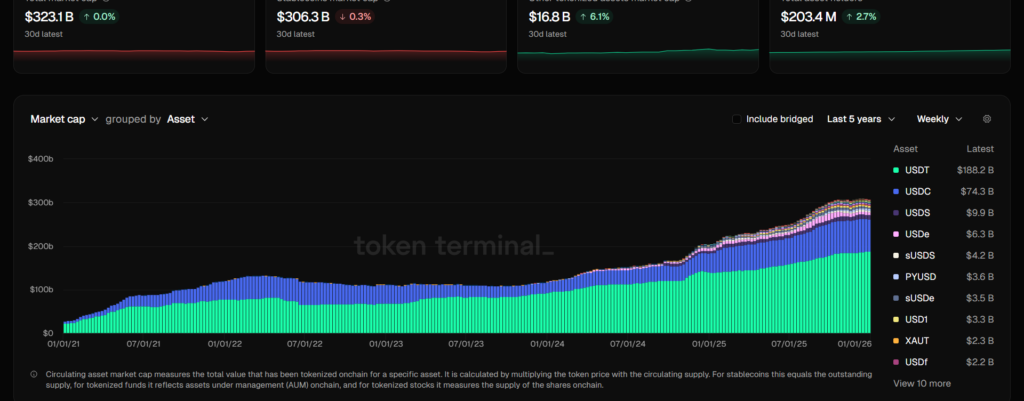

Ondo Finance ($ONDO) is the leader in the tokenization of RWAs. And, yes, Chainlink tops this chart, but they provide the infrastructure. However, Ondo Finance is where all the wheeling and dealing happens. Ondo quietly keeps building on growing its market share in the RWA sector. And that’s where it becomes interesting, since the RWA sector also keeps growing. See the picture below.

Source: Tokenterminal

RWA Sector Keeps Growing

It looks like everybody and his or her dog, with all due respect, keeps saying this. And I mean everyone with a name in finance, whether it’s TradFi or in crypto. Leading this pack is BlackRock’s Larry Fink. For crypto, Brian Armstrong is a great example.

And it shows in numbers as well. In 5 years’ time, this sector grew by 24x. From $1.5 billion in 2020 to $36.27 billion in 2025. Predictions see it go to anywhere between $16 and $30 trillion. As the picture below shows.

Source: RWA.xyz research report

Global Markets

In other words, Ondo is doing just fine and is positioning itself to make the most out of this growth. Its flagship is its Global markets. Unfortunately, that’s still not available in the US market and to retail. However, this offers hundreds of tokenized stocks and ETFs across every major sector on their app. Of course, one of the major advantages is that Ondo is open 24/7. No 9-5 days or weekends off.

Ondo Chain

Ondo Finance also gears up towards institutions. It offers regulated and compliant products on its own blockchain. That ‘own blockchain’ part is also important. Ondo chain is custom-built to meet all legal requirements. It’s part permissionless and part permissioned. This allows it to be compliant and attract institutions.

1/ Today, we’re thrilled to announce Ondo Chain, our new Layer 1 blockchain purpose-built for institutional-grade RWAs.

Design advisors for the chain include new members of the Ondo Ecosystem: Franklin Templeton, Wellington Management, WisdomTree, Google Cloud, ABN Amro, Aon,… pic.twitter.com/a35GHB7OFW

— Ondo Finance (@OndoFinance) February 6, 2025

In early 2026, Ondo will be offering its services on Solana. Ondo was already available on the BNB chain and its native Ethereum.

It’s coming.

The largest platform for tokenized stocks and ETFs is coming to @Solana in early 2026.

Wall Street liquidity meets internet capital markets. pic.twitter.com/CmMFT2UTFu

— Ondo Finance (@OndoFinance) December 15, 2025

Unfortunately, there’s a real gap between Ondo’s potential and the current $ONDO price. The current $ONDO price is around 40 cents. If you believe in RWA and Ondo, this is an excellent entry point. Keep in mind that Ondo is here for the long run.

Like with Chainlink, we also published plenty of Ondo-related videos. Check out this list.

Uniswap ($UNI)

My next pick of altcoins is in the DeFi sector, with Uniswap ($UNI). On this chart, Uniswap is the first real DeFi protocol that’s listed. It was launched in November 2018 on Ethereum. However, nowadays, it’s available on 40 chains. Its TVL is $2.8 billion, which gives it the first spot among all DEXes. Traders like Uniswap’s deep liquidity and markets.

There’s an increased interest in DeFi. Uniswap positioned itself to gain a big market share of renewed interest. The protocol also keeps developing and innovating itself. Currently, it’s already on V4.

Just blinked and Uniswap v4 crossed $100B in all-time volume

Accelerate 🦄 pic.twitter.com/nMWIX4jRLZ

— Uniswap Labs 🦄 (@Uniswap) July 21, 2025

UNIfication

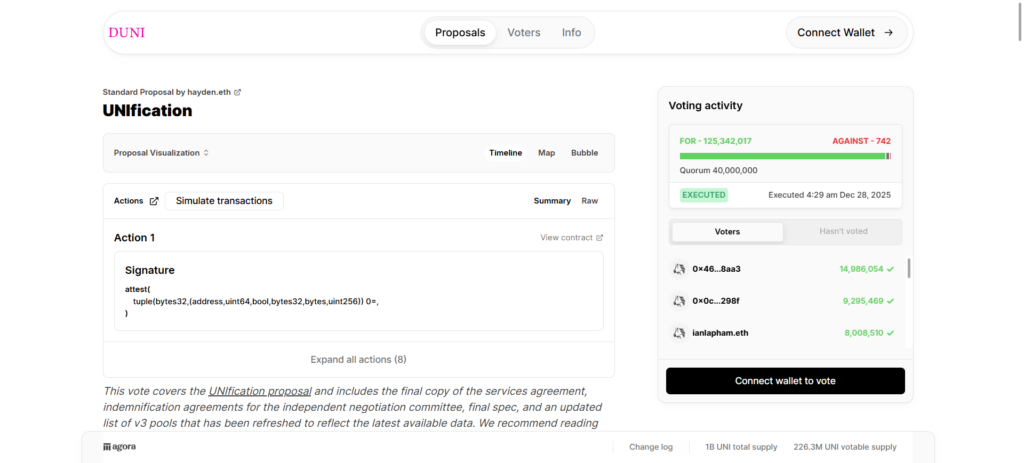

Uniswap caught the recent spotlight with a historic token burn. $UNI is also the third and last of today’s list of altcoins. Its governance passed a proposal to burn 100 million $UNI. That’s worth around $596 million and is around 16% of its current $UNI in circulation. It’s also 10% of its max supply. As a result, the $UNI price is up by 16.4% over the last 14 days. The current $UNI price is around $6. This was an almost unanimous vote. At this scale, that’s rather rare. It shows that $UNI holders have a strong conviction.

UNIfication has officially been executed onchain

✓ Labs interface fees are set to zero

✓ 100M UNI has been burned from the treasury

✓ Fees are on for v2 and a set of v3 pools on mainnet

✓ Unichain fees flow to UNI burn (after OP & L1 data costs)

Let the burn begin pic.twitter.com/fcr3WY3gPc

— Uniswap Labs 🦄 (@Uniswap) December 27, 2025

This governance proposal went by the name of ‘UNIfication’. There were over 125 million votes in favor. Only 742 votes were against the proposal. See the picture below. And there’s more. New fees collected from trades on Uniswap will now go to a burn mechanism. This makes $UNI now also a deflationary token, with more burns in the pipeline. So, instead of going to liquidity providers, it will go to the burn mechanism. That’s a big change, opted for by the token holders themselves.

Source: Uniswap Foundation governance

To sum up, $UNI transformed from a pure governance token into a token with economic value. It’s now tied to protocol usage.

So, which one of these three altcoins is your favorite token? Or did I not mention your favorite altcoins? Let me know in the comments, and make sure to join our X and Discord channels.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post We Found The Altcoins That Could Pump in 2026 appeared first on Altcoin Buzz.