It’s the start of a new year, and in crypto, that usually means predictions. Everyone wants to guess what will pump, what will flop, and what will disappear.

Most people make forecasts based on hype. Not facts. Not performance. They also don’t look at the work a project actually put in for the last 12 months. If you want a real compass for what’s coming, look at what a project built last year. And by that measure, very few projects stand out. One that does? Sui.

Here’s why I’m keeping a close eye on it in 2026. And you should too.

Sui Helps Bitcoin Move From Passive to Active

Bitcoin has long been treated as a passive asset. Buy, hold, hope for gains. That’s fine. But it limits what you can do with it.

xBTC on Sui takes Bitcoin from passive storage to active capital.

Multichain. Composable. Yield-generating.

Your BTC can finally work for you.

— Sui (@SuiNetwork) January 2, 2026

On Sui, that changes. xBTC lets you put your BTC to work. Lend it. Trade it. Generate yield. Multichain, composable, and fast. Bitcoin stops being a static store of value. It becomes productive capital.

Sui now hosts multiple BTC representations. xBTC for exchange users. tBTC for trust-minimized setups. WBTC bridges for Ethereum. Sui also made WBTC cross-chain ready through BitGo and LayerZero.

wBTC is now crosschain ready on Sui ⚡️@BitGo is bringing native WBTC to Sui through @LayerZero_Core, giving it instant movement across ecosystems with gas only fees and no wrappers.

Clean, fast, native BTC liquidity. pic.twitter.com/ijVZumU7ut

— Sui (@SuiNetwork) December 5, 2025

This enables Bitcoin to move instantly across ecosystems with no wrappers and minimal fees. That’s clean, native liquidity. It’s exactly what developers and traders need. The ecosystem is building pathways for Bitcoin holders to do real work with their assets.

For investors, that means BTC can earn. For developers, it means apps can leverage the world’s most valuable crypto natively.

Stablecoins and Payments That Work on Sui

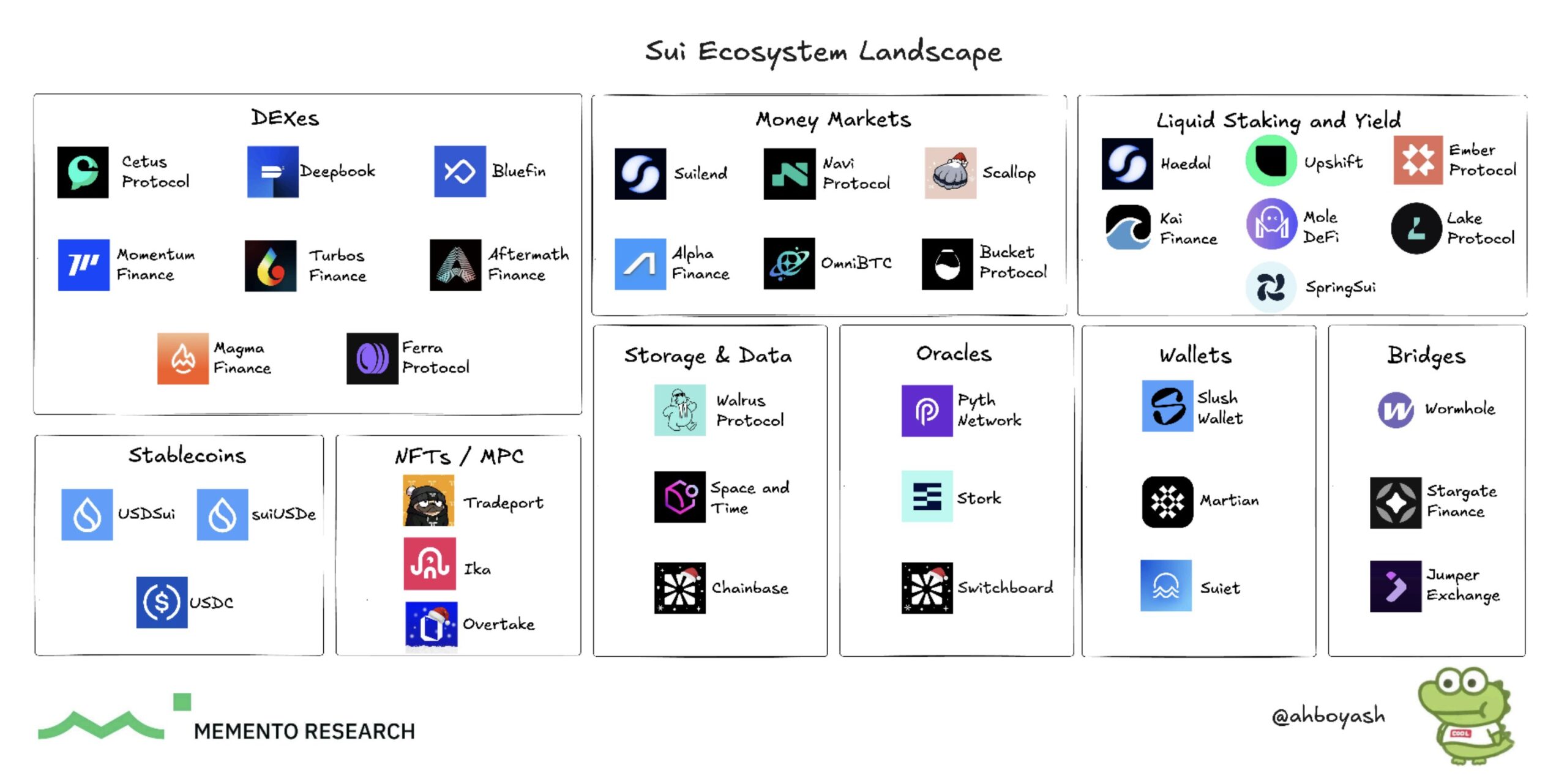

Stablecoins are boring until they aren’t. On Sui, they power payments, apps, and yield strategies. USDC, suiUSDe, and a growing ecosystem of native options provide both stability and flexibility.

By the end of the year, these developments were no longer isolated.

Stablecoins supported payments.

Payments supported applications.

BTC liquidity expanded across multiple paths.

Institutions participated with long-term intent.— Sui (@SuiNetwork) December 26, 2025

Sui payments aren’t just a theory. They already have integrations with virtual Mastercard networks, local currency stablecoins, and consumer apps. All of these show that the chain can handle transactions in the real world.

For developers, this is huge. Reliable rails mean they can focus on user experience, not plumbing. For users, it means crypto feels usable, not experimental.

Programmable Transactions for Smarter Apps

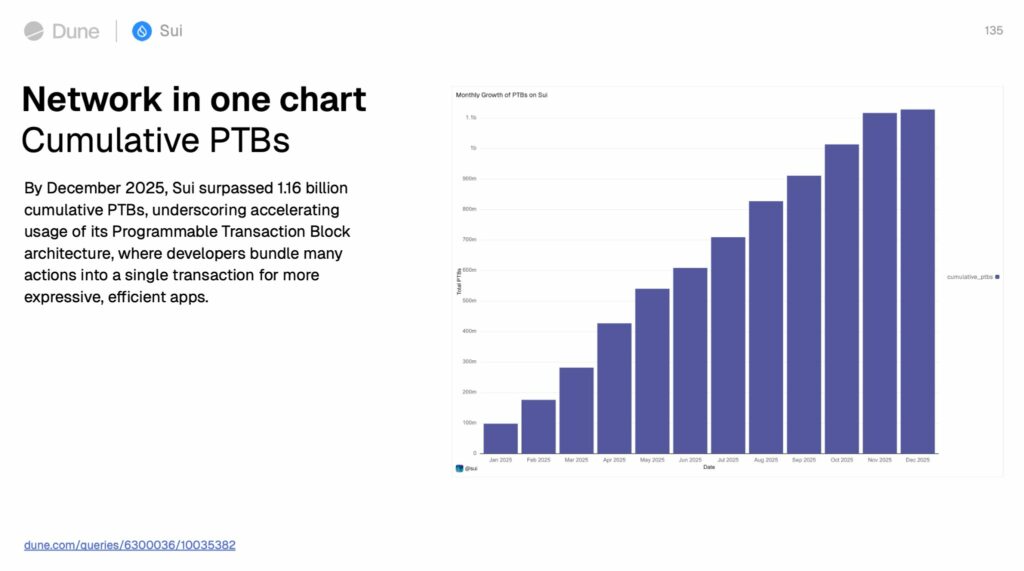

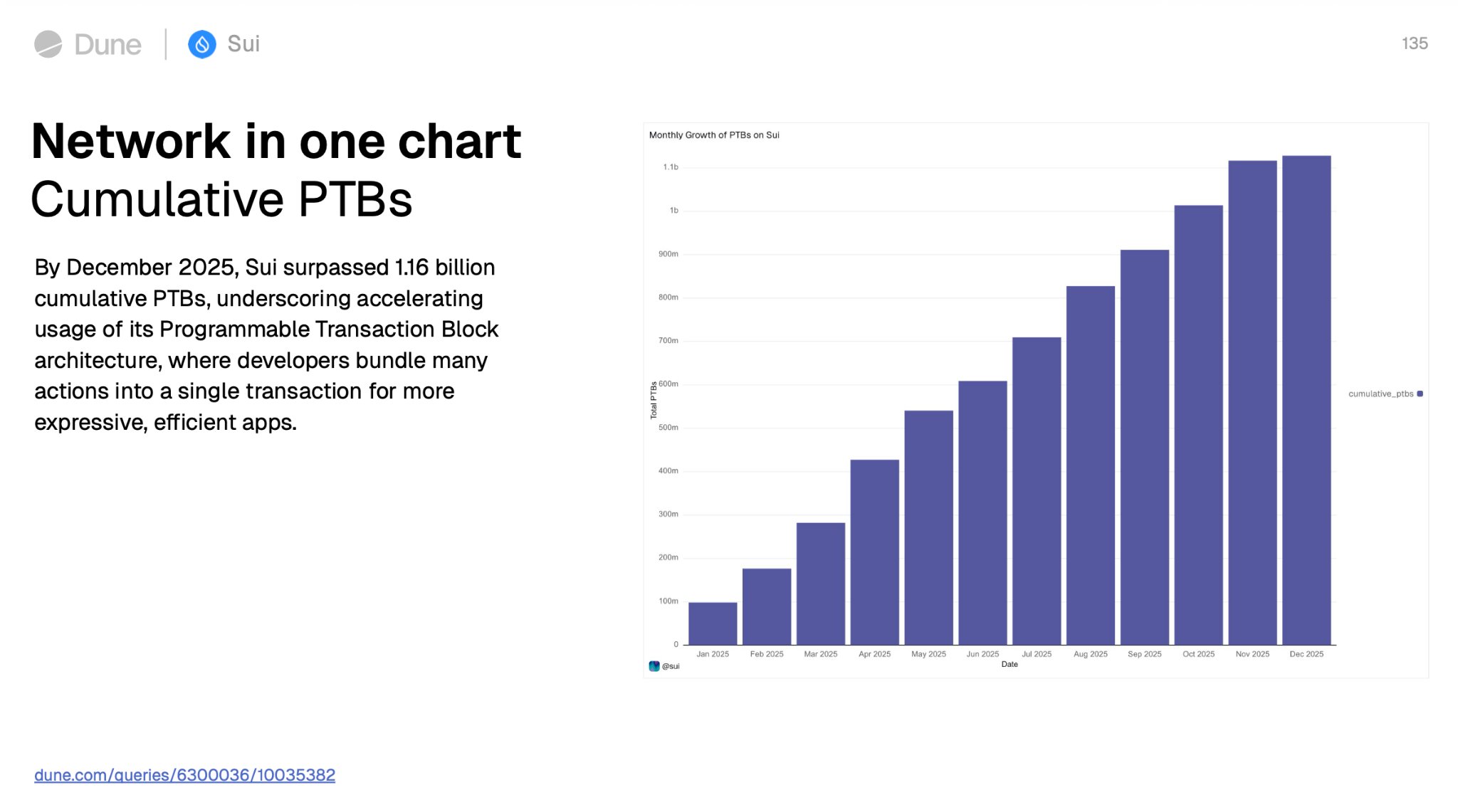

In 2025, developers ran over 1.16 billion programmable transaction blocks on Sui. These are transactions that do more than send tokens. They can bundle multiple actions, enforce rules, and execute logic in a single call.

Combined with tools like Seal, Walrus, Nautilus, SuiNS, and zkLogin, developers can control privacy, storage, identity, and computation.

Most blockchains leave these layers to outside tools. Sui bakes them in. Builders don’t need workarounds. They can focus on making apps faster, smarter, and more private. They call it the Sui Stack.

Sui is now a complete developer platform – giving builders everything they need to ship decentralized applications.

2026 is the year of the stack! https://t.co/qfkQQb26EG

— Sui (@SuiNetwork) January 1, 2026

Institutions Are Paying Attention

Big players are entering the space. Grayscale filed an S-1 for a Sui trust. 21Shares launched a leveraged SUI ETF. VanEck, Franklin Templeton, and others are exploring products on the network.

⚡ LATEST: GRAYSCALE FILES S-1 FOR $SUI TRUST

The “Grayscale Sui Trust,” is a spot-style ETF designed to provide direct exposure to the $SUI token.

Grayscale’s goal is to mirror SUI’s market performance, minus fees, giving long-term investors a regulated, hassle-free way to… pic.twitter.com/mPQMINLrYC

— CryptosRus (@CryptosR_Us) December 6, 2025

Institutional involvement isn’t casual. It signals confidence in infrastructure, liquidity, and compliance readiness. For investors, it’s proof that Sui can handle large capital. For developers, it signals market potential.

The SEC has approved the first-ever 2x leveraged SUI ETF (TXXS), live on Nasdaq via @21shares_us.

A first for Sui in public markets – offering amplified, regulated exposure to SUI.

A new chapter for Sui investing begins. pic.twitter.com/y6h4gqMlnP

— Sui (@SuiNetwork) December 4, 2025

Real-World Assets and DeFi Integration

Sui isn’t just about crypto apps. Real-world assets are now part of the ecosystem. Vaults, tokenized investments, and yield-bearing instruments went live in 2025.

Payments support apps. Apps generate liquidity. Liquidity powers DeFi. And all of it attracts developers and users. That cycle is rare. Most chains struggle to integrate all these layers smoothly. But Sui is doing that with ease. And that’s why we expect more developers to rush there, which means serious momentum.

Players crave seamless worlds.

Developers deserve infrastructure that can deliver them.Sui’s gaming stack is designed for both: fast experiences, empowered creators.

Make games, play games 👇https://t.co/fNJO9NRMNq pic.twitter.com/7OIUhpTLWU

— Sui (@SuiNetwork) December 30, 2025

Gaming and Community Momentum

Gaming momentum is picking up on Sui, and the project is also building a gaming stack. What’s Sui offering? Fast experiences. Empowered creators. Cross-chain asset support. Players can trade, earn, and interact without slow networks or clunky wallets.

2025 took Sui around the world IRL.

17 cities.

13,000+ people.

Dubai, Singapore, Seoul, and everywhere in between.Conversations, connections, and moments we’ll be carrying forward.

If you were there, you know. If not, 2026 is warming up 👀Read on 👇https://t.co/TR9ksJqS8K pic.twitter.com/0Wx2jHchwn

— Sui (@SuiNetwork) December 29, 2025

Added to that, community growth is real. Sui hosted events in 17 cities in 2025, engaging 13,000 people. These numbers show adoption, education, and real-world reach.

Why 2026 Could Be the Year

Why do I think this could be Sui’s year? Sui enters 2026 with momentum in multiple directions:

-

Bitcoin-backed assets are productive.

-

Stablecoins provide usable rails for payments and apps.

-

Programmable transactions allow smarter, cheaper, and faster apps.

-

Institutions validate infrastructure and liquidity.

-

Real-world assets expand use cases.

-

Gaming and community adoption increase engagement.

Each layer reinforces the others. Payments enable apps. Apps generate liquidity. Liquidity attracts institutions. And developers see the potential to build complex, privacy-first, scalable products.

Sui isn’t experimenting anymore. It’s building the infrastructure for the next wave of adoption.

If you want to watch one project in 2026, Sui deserves serious attention. Developers have tools. Investors have regulated access. Users get usable crypto. And the ecosystem is ready to scale.

It’s not hype. It’s what the project built last year. And that foundation makes 2026 a year to watch.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd. This article was sponsored by Sui

The post Why Sui is a Project to Watch in 2026 appeared first on Altcoin Buzz.