Futures trading is both a good way to make money trading and a good way to hedge your long-term positions.

So today we get into the basics of trading futures and how to get started trading futures on Weex, one of our favorite platforms. And remember, even Americans and Canadians can trade here….. So let’s check it out.

The Basics of Futures

First, we need to understand futures vs perpetuals, or perps. Most trading platforms in crypto offer perps, including Weex. Perpetual means forever or no expiration date. Traditional futures are called futures because they trade with an expiration date sometime in the future.

For example, this crude oil contract on the NYMEX expires in March at its current price of $58.08. See the picture below. This means in March you need to close out your position and either move it to a later month like May or June or cash out OR take delivery of 1000 barrels of oil.

Source: CME Group

But we have none of this with perps, as they have no expiration date. So that’s one less thing to worry about.

Weex Perps Denominations

Weex has 2 denominations for its perps. They are:

- USDT-M

- Coin-M

And what this means is a Bitcoin perp can be denominated in USDT, as the BTC-USDT pair is, OR the contract can be denominated in Bitcoin. For most of us, the USDT-M is just easier to use, and it has more volume and liquidity too.

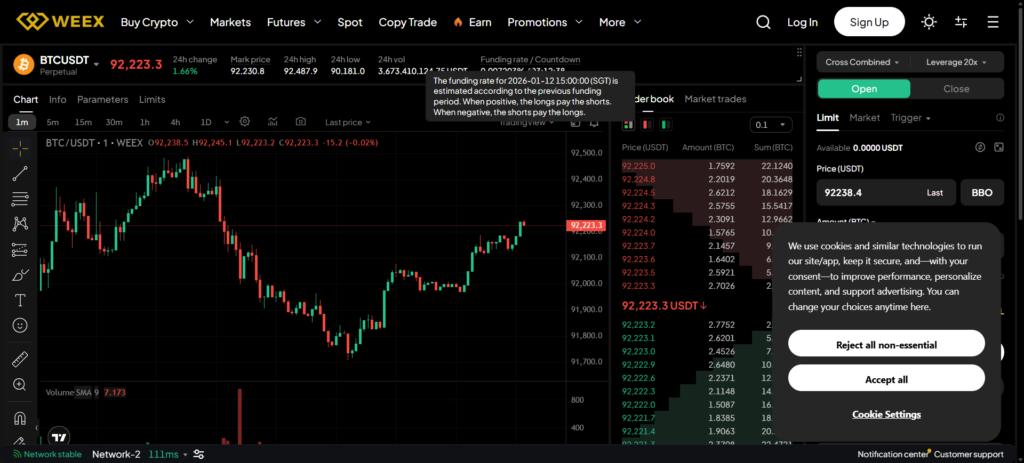

This is what the USDT-M futures screen for BTC-USDT looks like. See the picture below.

Source: Weex UI

You can bring in or use your TradingView charts as you see on one side of the screen with the order book right next to it with prices in both USDT and BTC moving in real time. This alone gives you a good idea of what the sentiment looks like.

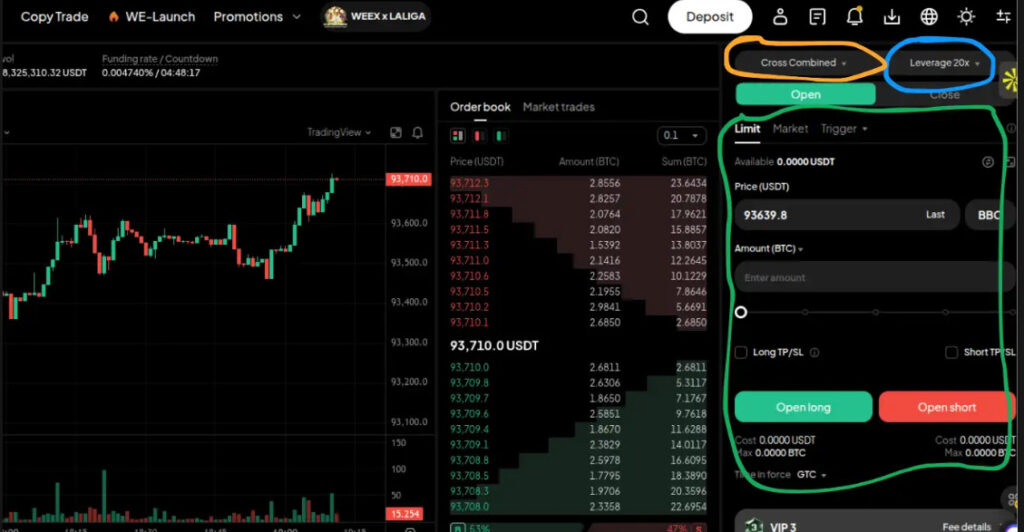

In the picture below, in the green circle, this is where you make your long or short trade.

Source: Weex UI

Like all good exchanges, you can do market orders or limit orders. A limit order is when you only buy when it hits your price. Right now, as I write this, Bitcoin is a little over $93,000. So with a limit order, I can say: only buy when Bitcoin hits $92,000. OR, if you want to trade momentum, wait for the price to rise and say only buy when Bitcoin gets to $96,000. You can also set points to take profits or stop losses where they automatically sell for you at a loss to prevent further losses. Good traders use these points, shown here as TP and SL, to limit their losses but let their winners run.

But there’s more on this screen and some other colors besides the green and red. And they are even more important…… So let’s get into them now.

Leverage

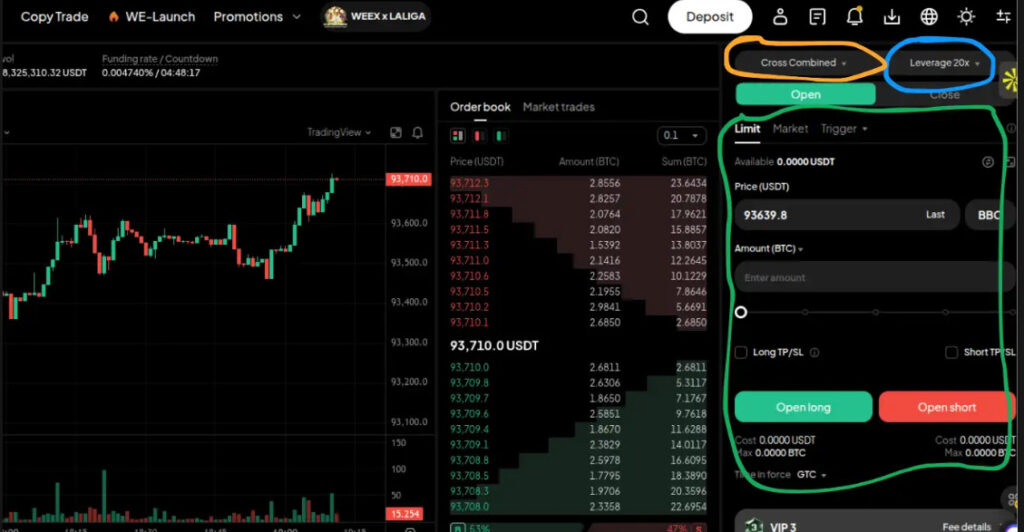

I’m devoting a whole section of today’s video to leverage because that’s how important it is. Most new traders only look at the upside and say, “I can control $20,000 worth of crypto for only $1000?!” Well, yes, you can. However, what’s your liquidation price?

Source: Weex UI

You can see this with the blue circle here. And in this picture above, you see it’s at 20x. DO NOT DO THIS unless you really know what you are doing. If you trade with ZERO leverage, then your liquidation price is zero. You can ride out any short-term and even long-term volatility if you have strong hands.

But at 20x, what’s your liquidation price? It’s only a 5% drop, so a drop from $93,000 to $88,350. We’ve seen drops like that happen in minutes. This is how big market makers like Wintermute can scout out where you will be liquidated and take trading down to that point. Don’t let it happen to you and the less leverage you use, the better.

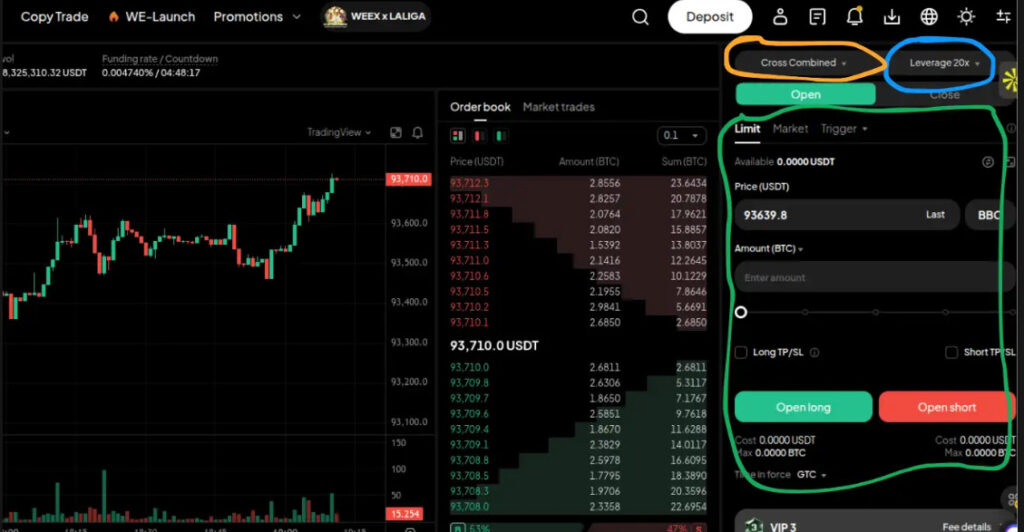

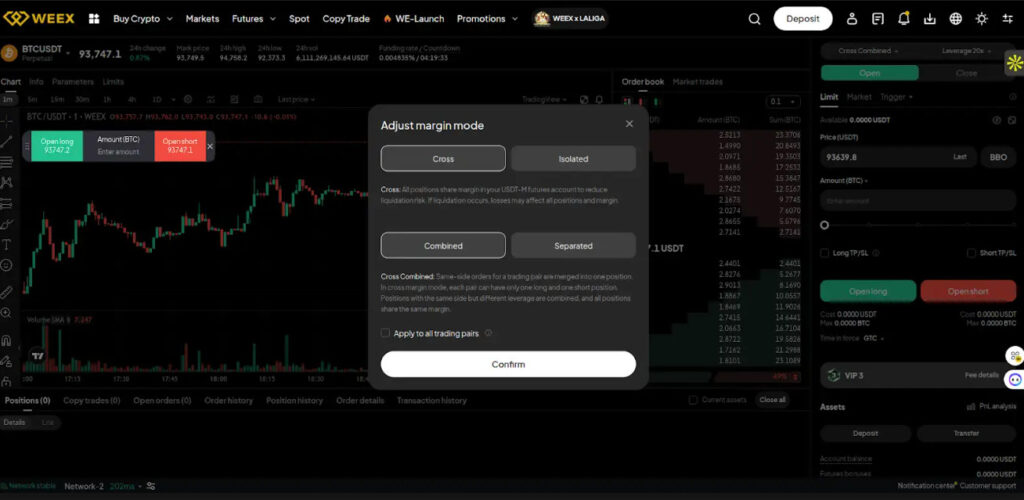

Isolated vs Cross Margin

Now, look at the orange circle in the picture below. That’s your margin. Or in this case above, the $1000 you are putting up to control $20,000 at 20x.

Source: Weex UI

This is one of the most important adjustments to your trading screen that you can make to lower your risk.

Your isolated margin means only the $1000 you put up for this trade is at risk. When you are trading a smaller coin, this is by far the safest route you can take. It means the maximum you can lose is the $1000 you are putting into this one trade.

However, there is cross margin, too. With cross margin, your entire portfolio is at risk. That’s the obvious downside. One bad trade can wipe you out entirely. But what if you really believe in what you are trading, such as Bitcoin and not some meme?

If you use cross margin, then you can decrease your chance of liquidation because now it’s not at a 5% drop but something much lower. Cross margin CAN bail you out of short-term volatility if you have other good risk controls in place. But that downside risk is a big one, so make sure you understand it.

Most exchanges have your leverage set to Cross automatically. Weex does this as well. Yet, Weex has a nice feature here where you can combine or separate your margins. Depending on how you trade, this could lower your overall risk. You should get to know whether combined margins work for you, whether you do isolated or cross-margin trading.

Source: Weex UI

Conclusion

There are entire courses on how to trade futures with strategies and different ways to make money. We are just scratching the surface here.

Today, we wanted to show you the basics, including

- How easy it is to get started with futures on Weex

- How to set up your account to manage risk sensibly

- How to avoid the risks of leverage trading and

- How to get started

Weex is one of the easiest exchanges to get started with. Just click this link, get some bonuses for signing up, and start trading today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Weex.

Copyright Altcoin Buzz Pte Ltd.

The post How To Trade Crypto Futures Contracts For Beginners on Weex appeared first on Altcoin Buzz.