According to Coinbase Institutional’s 2026 Crypto Market Outlook, the rapid growth of perpetual futures, or perps, alongside options, signals a major shift. This change could eventually integrate crypto derivatives into the global financial system.

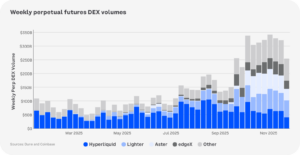

In 2025, decentralized exchanges processed over $1.2 trillion per month in perp volumes, with platforms like Hyperliquid capturing a significant share. The rise of high-throughput decentralized trading venues, paired with increased access via regulated U.S. platforms, has made these products more widely available to traders.

Perpetual Futures Fueling New Trading Strategies

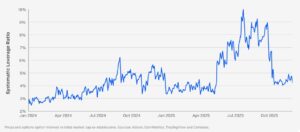

One reason perps have gained traction is the lack of a conventional altcoin season in 2025. Traders seeking outsized returns turned to these instruments for their high leverage. This allows them to amplify potential profits or losses with relatively small capital. Data from Coinbase shows that the crypto market’s purely speculative exposure reached nearly ten percent at its peak in 2025, before a liquidation cascade in October brought it down to 4%.

Beyond speculative trading, perps are evolving into core components of decentralized finance. They can now integrate with other DeFi products, such as lending protocols and liquidity pools. This “composability” allows traders to hedge risk while simultaneously earning passive yield on their assets.

For example, a liquidity pool could use perps to create dynamic hedge layers or even serve as collateral for lending products with adjustable risk parameters. Such innovation makes crypto markets more capital efficient and opens the door for more sophisticated strategies that blend trading and passive income.

Coinbase Institutional also sees equity perpetual futures emerging as a major retail trading tool. Global retail participation in U.S. equities continues to rise, and tokenized equity derivatives offer a 24/7, low-friction alternative to traditional markets.

By combining crypto’s accessibility and efficiency with exposure to stocks like those on the S&P 500 or Nasdaq, equity perps can transform how retail traders interact with traditional assets. They offer highly leveraged access outside conventional trading hours, including nights and weekends, effectively expanding market participation and liquidity.

More About Coinbase

Coinbase recently released its latest Solana Validator Performance Report, highlighting strong performance and growth. Since the last report, Coinbase validators have staked a total of 38.66 million SOL, with a skip rate of just 0.07% from June to December, well below the network average.

Our latest Solana Validator Performance Report is live.

Key updates since our last report:

→ Staked to Coinbase validators: 38.66M SOL

→ June-Dec skip rate: 0.07% (outperforming the network average)

→ Client diversity: 3 clients + 1 on the way

→ Validator distribution: 7… pic.twitter.com/y6PqBrMEBO

— Coinbase Institutional 🛡️ (@CoinbaseInsto) December 18, 2025

The report also notes healthy client diversity, with three clients currently active and a fourth on the way. Additionally, Coinbase’s validators are distributed across seven countries and supported by two bare metal providers, demonstrating a commitment to resilience, decentralization, and reliable network performance.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Coinbase Predicts Perpetual Futures Growth In 2026 Outlook appeared first on Altcoin Buzz.