If you only look at what is trending, you miss what is forming. Crypto rewards speed, but it punishes shallow thinking. Many chains promise performance. Few explain the trade-offs. Sei Network sits in that gap. It is not shouting on social media. It is not chasing narratives.

Sei solves a narrow problem with focus. That makes it easy to ignore and dangerous to misunderstand. In this deep dive, I strip away the buzzwords. I will look at what Sei Network actually does, where it fits, and why builders care more than speculators right now. Understanding this is not about buying. It is about seeing the map before the road gets crowded.

What Is Sei Network?

The Sei Network ($SEI) is a Layer 1 chain that focuses on financial use cases. To be more precise, it offers the infrastructure for these financial use cases. That’s its core, but don’t get me wrong, it offers more. You can also find, for instance, blockchain gaming and NFTs in Sei’s ecosystem. Sei Network also covers various crypto sectors. For instance, RWAs, AI, DePIN, DeSci, and of course DeFi.

Sei Labs, the team behind Sei Network, started in 2021. The co-founders are Jay Jog, Jeff Feng, and Dan Edleback. On August 15th, 2023, Sei’s mainnet launched. That went hand in hand with the $SEI TGE and a very disappointing airdrop. The top 0.1% of wallets received only a $90-$150 airdrop.

$Sei (2023): Cosmos L1. 🪐

– FDV: $1.8B ($0.18/token).

– Allocation: 3% (300M tokens).

– Airdrop Value: $54M.

– Top 0.1% Wallet: $90–$180.Small rewards, bear market struggles.

— MemeH4x0r (@MemeH4x0r) March 21, 2025

However, it appears that Sei left these days behind. Ever since, the project has turned things around. It is now much more of a force to reckon with.

So, what Sei built is what I would call ‘purpose-built’. Keep that in mind, since it carries weight. It means that Sei isn’t looking for attention with hype. In contrast, Sei didn’t change it narrative, and neither does it try to wow you with memes. Instead, it offers institutional-grade reliability. This should attract builders who want strong and top-notch performance.

Sei just got a double nod

In @dynamic_xyz’s Builder’s Guide, @SeiNetwork is recommended twice

• Payments → chosen as a high-throughput L1

Fast finality. Low, predictable fees. 24/7 money movement

• Trading & DeFi → listed as a high-performance L1, alongside Avalanche… pic.twitter.com/3eVwvtM9AK

— DeFi Compass (@DefiCompass) December 22, 2025

Sei Network started out as being part of the Cosmos ecosystem. Nevertheless, from the get-go, it was also EVM compatible. In June 2025, Sei moved its network to an EVM-only architecture.

The industry’s most trusted onchain providers are aligned on real-time, global-scale infrastructure.

With a parallelized EVM battle-tested for over two years, Sei is the high-performance home for modern onchain finance.

Markets Move Faster on Sei. ($/acc) pic.twitter.com/g3pxjV5SdE

— Sei (@SeiNetwork) November 24, 2025

That was an easy choice, as most interaction was EVM based. This became final with SIP-3 (Sei Improvement Proposal) as part of a governance vote. Currently, Sei network is almost done transitioning into a full EVM environment. So, now let’s move on and see how Sei works.

How Does Sei Network Work?

Sei Network works like a high-speed financial highway. It’s purposely built for trading apps. Since it’s a Layer 1 chain, dApps run directly on Sei. They don’t run on another chain, like a Layer 2. Sei offers fast speed, low fees, and scalability.

High performance rails for digital asset markets.

The preferred settlement layer for finance.

The Fastest L1.

Whatever you want to call it,

Markets Move Faster on Sei.

— Sei (@SeiNetwork) August 9, 2025

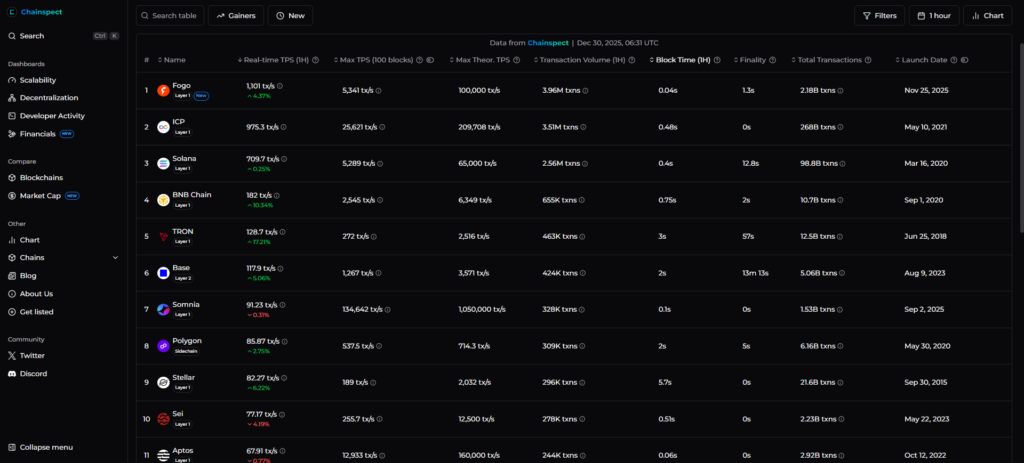

Sei calls itself the fastest L1. This has now transformed into the fastest EVM chain. However, if we look at real time TPS (transaction per second), Sei barely makes it into the top 10. That’s according to this table by Chainspect. See the picture below. Don’t get me wrong, it’s still fast, and it’s good, but it’s clearly not the fastest……….yet. However, this may change when Sei Network launches Giga.

Source: Chainspect

Giga

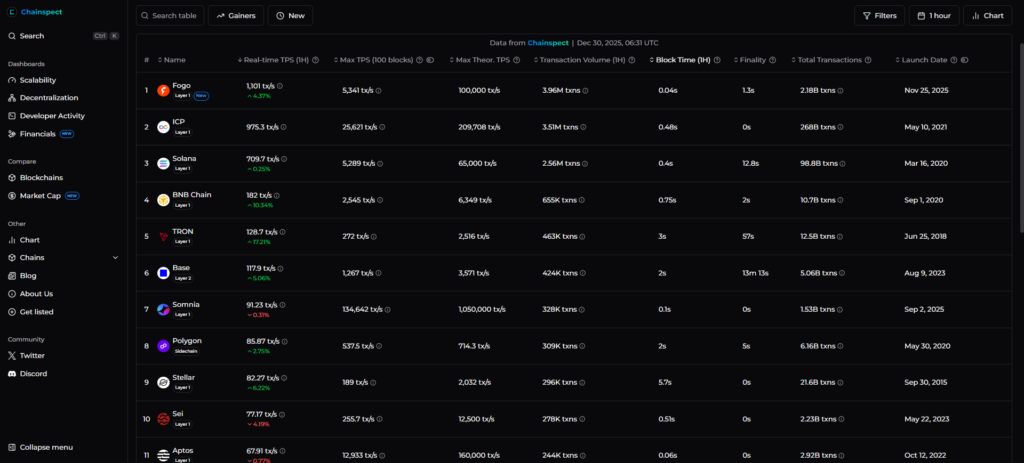

Giga is a major architectural upgrade for the network. It should boost Sei’s blockchain performance dramatically. Whiteboard crypto has a great video on what Giga is. The throughput it aims for is massive! Throughput is the ability to process a huge number of transactions. The team using advanced techniques like,

- Parallel block proposals. This allows various validators to build blocks at the same time. It increases speed and throughput.

- Multi-proposer consensus. Several validators can propose blocks together. This reduces delays and bottlenecks.

- Asynchronous execution. This lets transactions process in parallel, so they don’t have to wait for each other.

Sei already published the Giga roadmap and whitepaper. Currently, it’s still in devnet. However, there’s a clear long-term goal with Giga. These are, to achieve,

- 5 Gigagas Throughput. This means five billion gas units are processed per second by the network.

- Sub-400ms Finality. That’s when you can’t reverse transactions anymore.

- 200K+ TPS for high-performance EVM apps. Already achieved on devnet.

Source: Sei blog

This allows far more transactions and complex apps to run fast. And all this should be without congestion or slowdowns. There’s no current launch date for Giga, but it should be soon, possibly in Q1 2026. Giga has the potential to be a game changer for Sei.

Other Sei Network Achievements

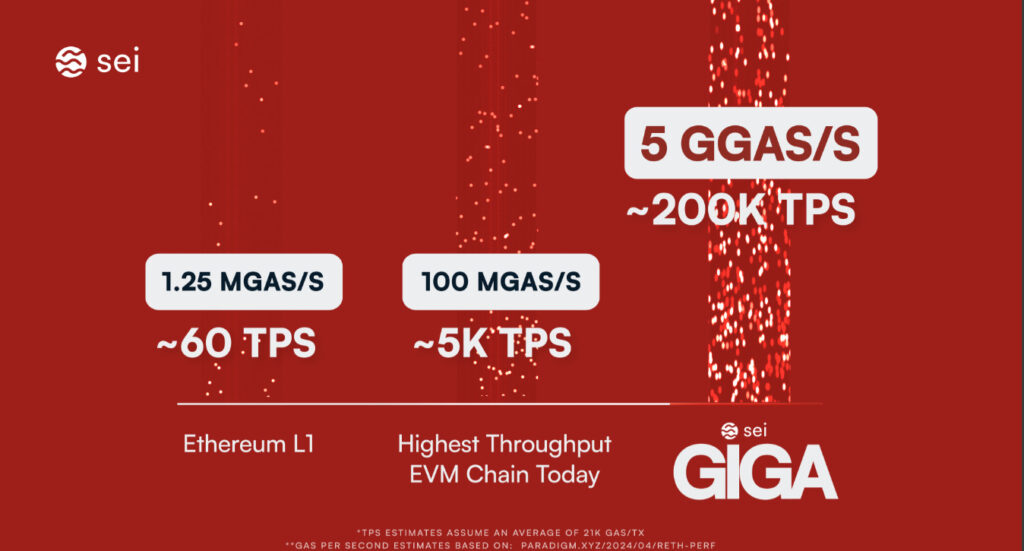

Sei Network is betting big on the RWA market. Currently, this is worth around $19 billion. It’s positioning itself in this market by partnering with big RWA players. For example, Securitize.

Source: RWA.XYZ

The AI agent economy is also a target for Sei. This is a market with a $200 billion potential. Sei can provide payment rails that enable agent-to-agent transactions at machine speed.

The AI agent economy is poised to become a $200B market.

The missing piece? Payment rails that enable agent-to-agent transactions at machine speed.

Sei Giga provides that. Visa for the Agentic Economy.

Dream bigger. pic.twitter.com/gPCDAMTu9i

— Sei (@SeiNetwork) June 19, 2025

Furthermore, Sei is a leading chain in blockchain gaming. It had a great Q3 in 2025 with 116M transactions (+138% QoQ) across an average of 805k daily addresses.

Sei leads in gaming because it’s designed for global, high-frequency markets.

In Q3 ’25, gaming activity on Sei drove 116M transactions (+138% QoQ) across an average of 805k daily addresses.

Gaming is a proxy for global markets—continuous execution at global scale. pic.twitter.com/VW7Nx61Y7t

— Sei (@SeiNetwork) December 20, 2025

$SEI Tokenomics

The Sei Network has the $SEI token as its native token. The tokenomics are solid, but not exceptional. So, let’s take a closer look at them.

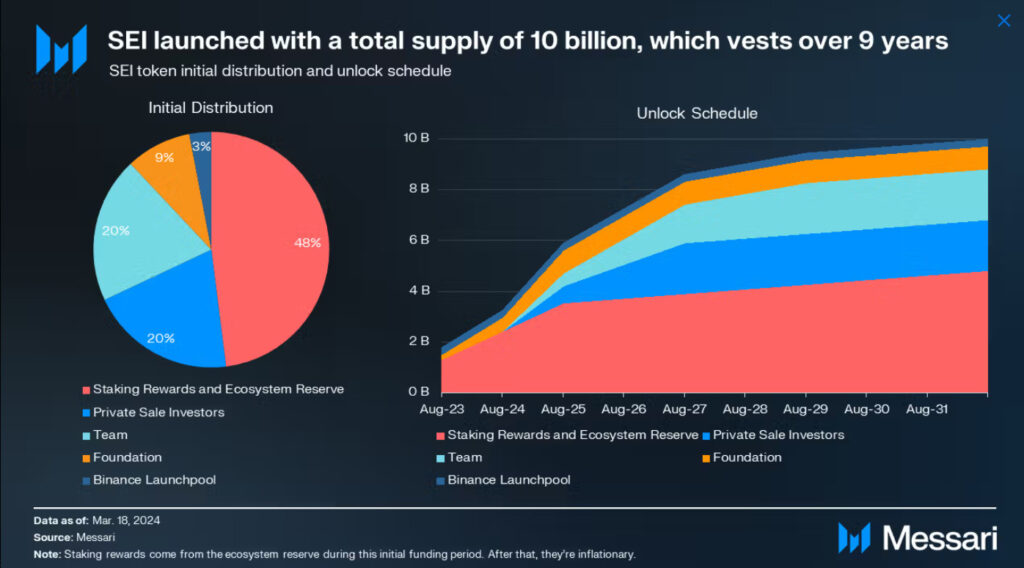

There’s a max supply of 10 billion $SEI tokens. Although this gives long-term clarity, it also limits per-token scarcity. Currently, almost 65% $SEI circulate. So, that’s not too bad.

Source: Messari

The token has a 9-year vesting schedule. It has monthly token unlocks, each month on the 15th. So, the next unlock is on 15th January 2026. That will be 55.56 million $SEI, or $6.10 million at the current $SEI price of 11 cents.

This long vesting reduces supply shocks. Inflation also declines over time, this is healthy. On the other hand, the value capture depends heavily on future usage, not on today’s demand. There’s also no strong burn mechanism to counter dilution. At least not yet, but I also don’t know about any such program coming up. Their tokenomics favor builders and long timelines over short-term price reflexivity.

The token does have various use cases, though. You can use it for,

- To pay network fees.

- Governance.

- Pay trading fees for markets build on Sei.

So, all in all, the tokenomics have good fundamentals but are not explosive by design.

The Verdict

The Sei Network has a lot of potential. It’s active in the financial markets and taps into sectors with potential growth. For example, RWAs and agentic payments. If the Sei Labs team can pull off the Giga launch, it may be a game changer for Sei.

However, it seems that Sei has a lot riding on this launch, which seems a bit risky. On the other hand, devnet results seem promising. Unfortunately, the $SEI token has seen a gradual decline since December 2024. So, to sum up, the potential is there, but it’s time that the team starts to deliver.

What do you think of Sei? Let me know in the comments, and make sure to follow us on Discord and X.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Can SEI Network Succeed in 2026? appeared first on Altcoin Buzz.