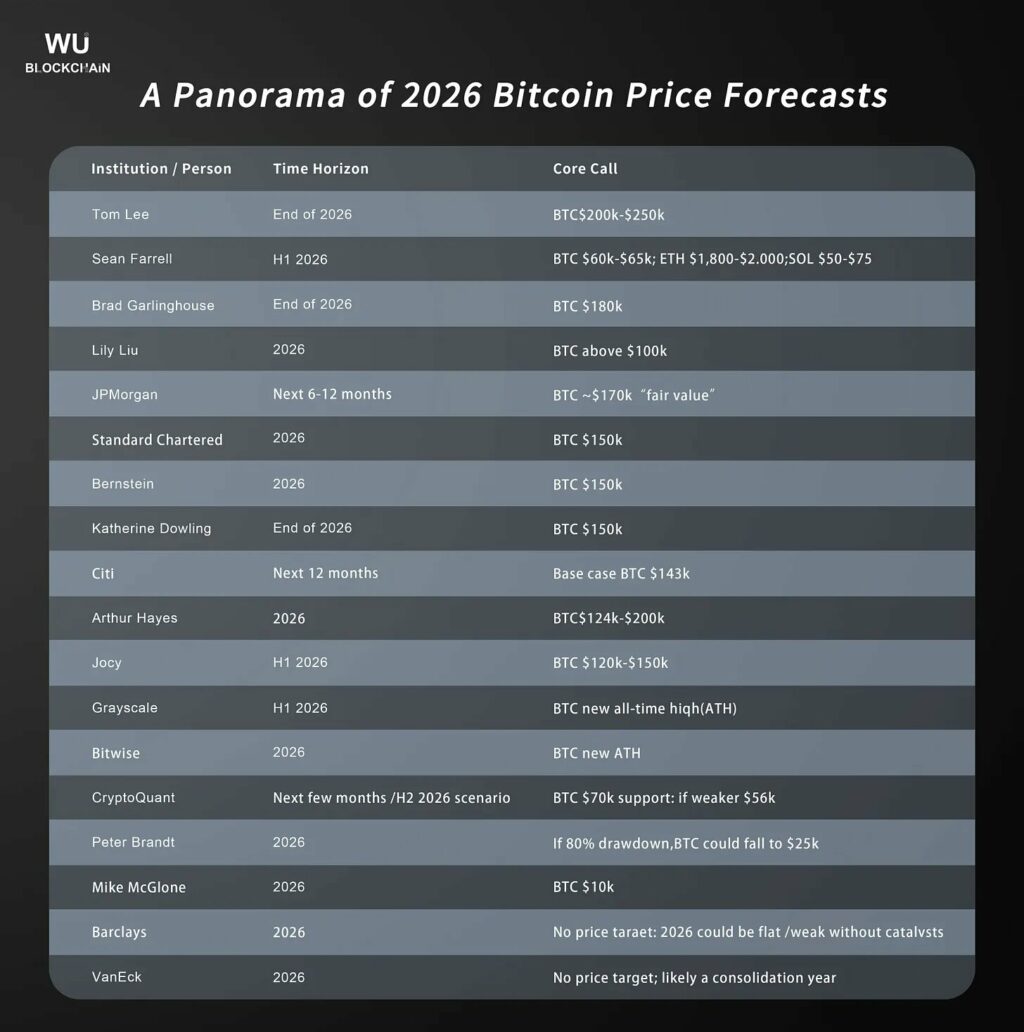

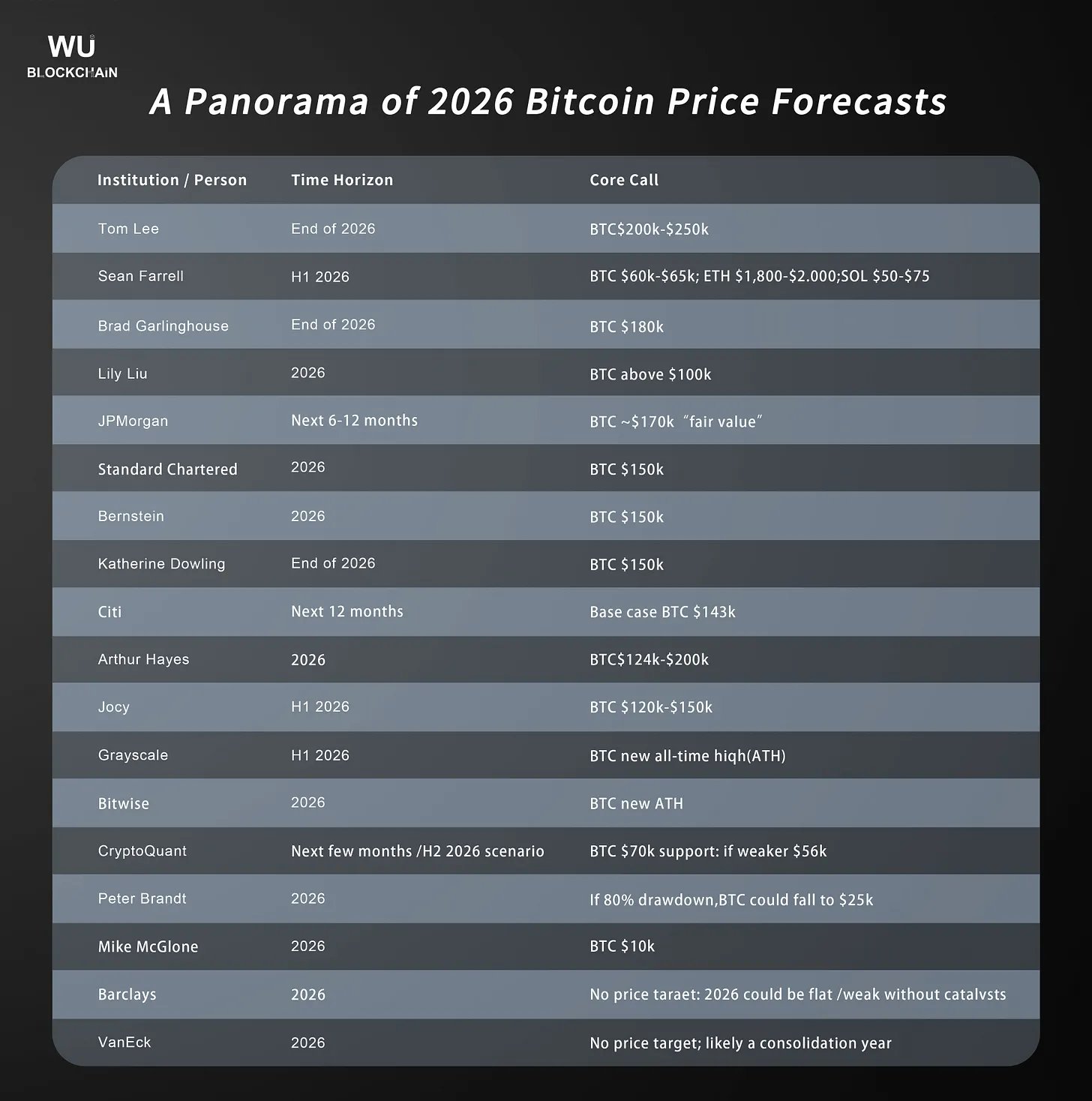

Bitcoin 2026 Outlook discussions are up again, even after many big institutions missed the mark in previous cycles. Analysts and executives are still laying out scenarios to help investors understand what could happen next.

At the same time, the Bitcoin 2026 Outlook is no longer about one single price target. Instead, it’s about ranges, probabilities, and risks.

Forecasts Are Taking A Backseat Now

After what many called a “collective miss” in earlier Bitcoin predictions, confidence in precise price targets has dropped. Most institutions now frame forecasts as scenario analysis, not promises. Bitcoin’s future depends on institutional flows, macro policy, and market structure.

Source: X

The Bullish Camp

Some of the most famous voices remain optimistic about Bitcoin in the 2026 Outlook.

- Tom Lee believes Bitcoin can reach $200,000-250,000 due to ETF inflows and rising institutional allocation. He believes institutional capital changes the traditional cycle structure.

- Ripple CEO Brad Garlinghouse believes Bitcoin will surpass $180,000. Lily Liu, the President of Solana Foundation expects it to stay above $100,000.

- JPMorgan pegs the theoretical fair value at around $170,000, based on a volatility-adjusted comparison of Bitcoin to gold.

- Standard Chartered aims to achieve $150,000 in 2026.

- Katherine Dowling, President of Bernstein and BSTR, mentioned a target of $150,000. She based this on regulatory clarity, ETF adoption, and institutional demand.

- Citigroup gives a base case of $143,000 and a bullish case of $189,000.

All these perceptions show that ETFs, Wall Street adoption and regulations are supportive structures.

🚨𝐁𝐑𝐄𝐀𝐊𝐈𝐍𝐆: 𝐁𝐫𝐚𝐝 𝐆𝐚𝐫𝐥𝐢𝐧𝐠𝐡𝐨𝐮𝐬𝐞 𝐒𝐚𝐲𝐬 𝟐𝟎𝟐𝟔 𝐖𝐢𝐥𝐥 𝐁𝐞 “𝐓𝐡𝐞 𝐌𝐨𝐬𝐭 𝐁𝐮𝐥𝐥𝐢𝐬𝐡 𝐘𝐞𝐚𝐫 𝐢𝐧 𝐂𝐫𝐲𝐩𝐭𝐨 𝐘𝐞𝐭” — 𝐅𝐫𝐚𝐧𝐤𝐥𝐢𝐧, 𝐁𝐥𝐚𝐜𝐤𝐑𝐨𝐜𝐤 & 𝐕𝐚𝐧𝐠𝐮𝐚𝐫𝐝 𝐀𝐫𝐞 𝐍𝐨𝐰 𝐄𝐧𝐭𝐞𝐫𝐢𝐧𝐠 💥

During today’s @Binance Blockchain… pic.twitter.com/W9977rIBoy

— Diana (@InvestWithD) December 3, 2025

The Cautious and Bearish Scenarios

Not everyone expects a smooth ride.

- Fundstrat analysts warn of a possible early-2026 pullback toward $60,000–$65,000 before any major rally.

- According to Citigroup’s bearish case, Bitcoin will be close to $78,500, and the important level is approximately $70,000.

- A few technical and macro factors persist, indicating extreme stress cases as low as $25,000 or even $10,000. These are tail risk, not base cases.

The takeaway is that downside risk hasn’t disappeared.

2/n TLDR: Fundstrat is home to several analysts with independent frameworks and time horizons, designed to serve different client objectives. My work is geared toward crypto-heavy portfolios and a more active approach to the market.

— Sean Farrell (@SeanMFarrell) December 20, 2025

Across nearly every Bitcoin 2026 Outlook, institutions are not sending more transactions. They are sending bigger ones. ETF flows, monetary easing, and regulatory transparency matter more now. Hype cycles and retail speculation matter less.

Conclusion

The Bitcoin 2026 Outlook is bullish, but far from guaranteed. Upside targets are between 150,000 and 250,000; downside targets serve as a wake-up call to investors that volatility remains the order of the day.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Bitcoin 2026 Outlook Bullish Overall, Wide Downside Scenarios appeared first on Altcoin Buzz.