Token unlocks do not crash markets by default. Confusion does. January brings a fresh token supply for Ondo, Sei, Plume, and a few more projects. So, the numbers matter. However, the timing matters more. Unlocks change incentives. Early investors think differently from retail. Teams think differently from traders.

So, most people react emotionally. They panic sell or blindly hold their altcoins. Both can be costly. This video gives full context. Who receives these tokens? How often do unlocks repeat? What usually happens days before and after? The goal is simple. Remove surprises. When you understand the unlock, price moves stop feeling random. Hence, this is not a prediction video. It is a preparation video.

Ondo Finance ($ONDO)

So, the first of today’s altcoins with a big token unlock in January is Ondo Finance ($ONDO) on January 18th. Now, Ondo has a bit of an unusual vesting schedule. A typical vesting schedule would see daily, weekly, or monthly token unlocks. However, not for Ondo and its $ONDO token. Instead, Ondo has a vesting schedule with a yearly unlock.

Now, is this an unusual unlock schedule or not? Ondo will have four of these unlocks, and this is the second unlock. So, let’s first take a look at what this unlock is all about, and thereafter, I will take you a year back. I will take a look at what impact that first massive unlock had on $ONDO’s price. And by the way, in my previous unlock video, I explained the difference between a cliff and a linear unlock. If you’re interested in more of my videos about Ondo, you can check out this list.

So, this unlock sees 1.94 billion being released to the market. At the current $ONDO price of 45 cents, that’s around $886 million. That’s no less than 57.23% of the circulating supply. The recipients of this unlock are;

- Protocol development: 825 million $ONDO.

- Ecosystem growth: 792 million $ONDO.

- Private sales: 322.56 million $ONDO.

Source: Ondo Governance Forum

The 2025 $ONDO Token Unlock

So, it’s time to look back at the 2025 unlock. For starters, there’s a big market sentiment difference. The January 2025 unlock happened during a bullish market. The price momentum and demand helped absorb supply without a crash.

However, this year the sentiment is different. Now we’re looking at a consolidation or late-cycle moment. This unlock most likely will have a very different effect on the $ONDO price. That’s because sentiment and liquidity are weaker. I expect a negative price correction. One option can be to sell your bag and buy it back later at a lower price, after the unlock.

Bitget ($BGB)

Next on my list of altcoins for token unlocks is an exchange token, Bitget ($BGB). This token lists as 7th for all exchange tokens. So, we’re talking about a token with a high market cap. However, it also has a high unlock. No less than 140 million $BGB tokens will unlock on January 26th. With the current $BGB price of $3.60, we’re looking at a $504 million unlock. That is 20% of the current circulating supply. There are two allocations;

- Team incentives with 80 million $BGB.

- Branding and promotion with 60 million $BGB.

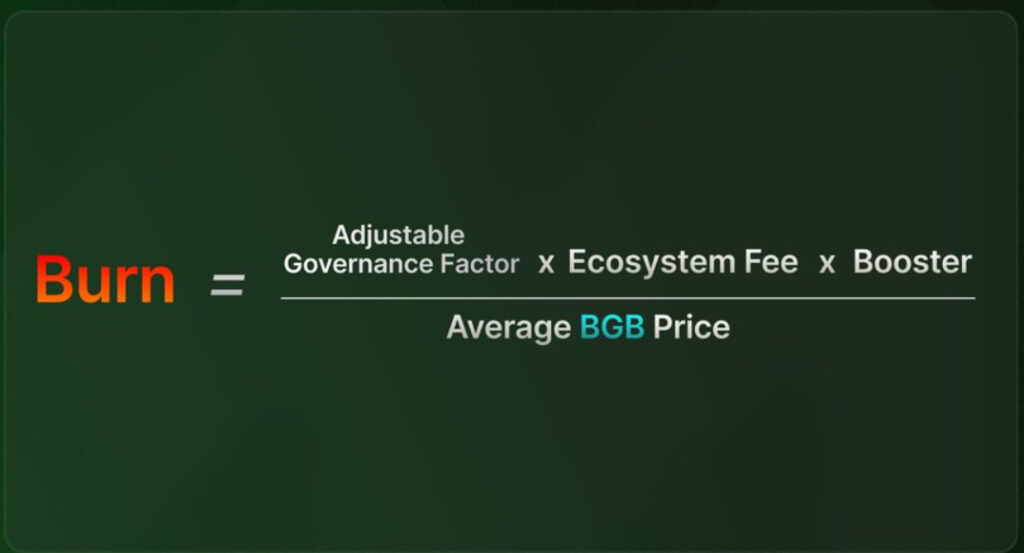

What is interesting about the $BGB token is that it has a very active burn mechanism. They burn tokens every quarter. See the burning equation below.

Source: X

However, in September 2025, Bitget partnered with the Morph Chain. It transferred 440 million $BGB to Morph. 50% of this sum, or 220 million $BGB, was immediately burned. This brings $BGB 7 quarters ahead of its burn schedule.

— Morph (@MorphNetwork) November 18, 2025

It appears that the quarterly burns haven’t affected the token price that much. However, the current price action is a mere reflection of the general market conditions. On October 10th, the $BGB price dumped, as so many altcoins did. Now it appears that the token is on a slight recovery course.

So, for this $BGB token unlock, I see this happen. If team tokens hit exchanges, expect a sharp but short downside (10–30%). If they’re used slowly for marketing or partnerships, the impact will be muted. Watch on-chain flows to exchanges in the 72-hour period around the unlock. You can take a look at my recent dedicated Bitget video here.

Plume Network ($PLUME)

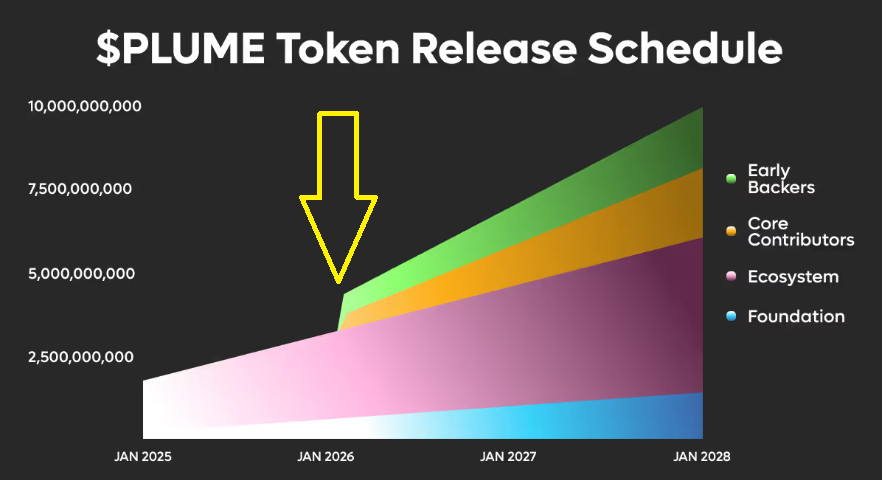

Plume Network ($PLUME) is next on today’s list of altcoins with big January token unlocks. Like Ondo Finance, Plume is active in the RWA sector. It ranks 6th measured by market cap among all other RWA projects. However, since its ATH of 24.75 cents in March last year, the $PLUME price has tanked. The current $PLUME price is around 2 cents. That’s 92% down from its ATH. Unfortunately, many altcoins share the same problem.

I’m afraid that the up-and-coming token unlock won’t help the token price much. On January 21st there will be a 1.37 billion $PLUME unlock. That’s still worth around $26 million. Previously, $PLUME had smaller, monthly unlocks. This time around, we’re looking at a 39.75% unlock of the circulating supply. In other words, this looks like a serious cliff unlock. However, for good measure, this is a one-time big unlock.

Source: Plume tokenomics

Investors will receive 700 million $PLUME. Core contributors receive the remaining 667 million $PLUME. This is, with no doubt, a large supply event. It can cause short-term volatility and downside pressure if selling hits exchanges.

For the short term, consider scaling out near January 20–21 if you see exchange flows rising. However, its longer-term effect depends more on demand absorption and ecosystem growth than the unlock alone. If you’re interested in Plume, here’s a playlist of my Plume-related videos.

Sei Network ($SEI)

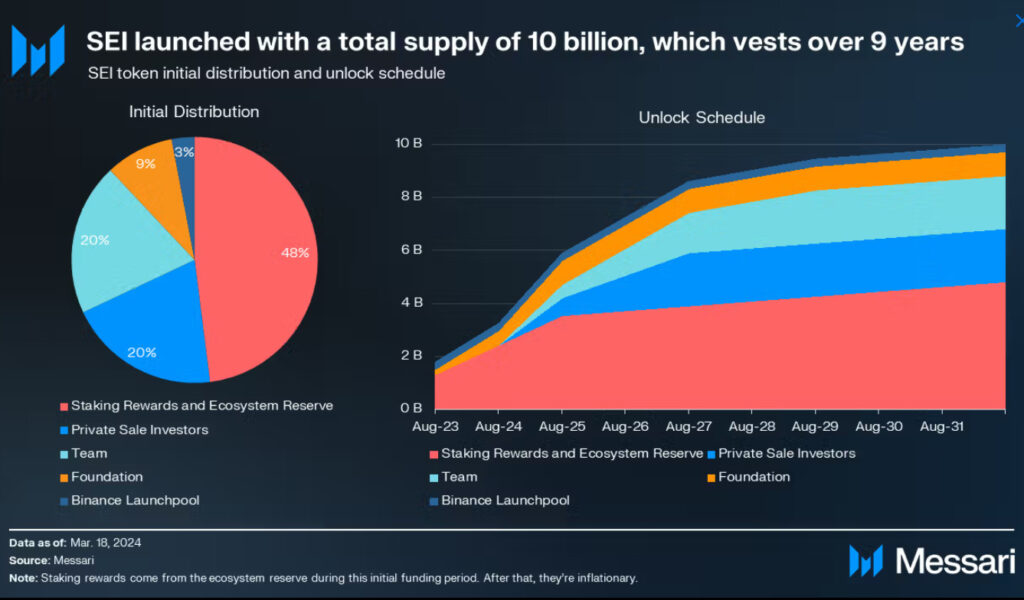

With Sei Network ($SEI) is the last of today’s altcoins. It’s not the biggest unlock at hand, but it is a popular token. Hence, I pay attention to this rather smallish unlock. If you want to find out more about the Sei Network, a week ago I published a deep dive video on Sei. Here’s also a list of other Sei-related videos that Altcoin Buzz published.

Sei is a layer 1 chain that also heavily focuses on RWA. Come January 15th, there’s a 55.56 million $SEI unlock. At the current $SEI price of 13 cents, we’re looking at $7.25 million. This is a regular monthly cliff unlock. Hence, it’s only 1.05% of the circulating supply.

These monthly unlocks typically see a short-term price drop. $SEI also suffered from the October 10th event. Since early January, the price seems to be in a slight recovery mode. As I already mentioned, this is a minor unlock. However, it does add supply. It can cause mild near-term volatility. A modest downward pressure is also possible once selling hits exchanges. The larger trend and demand environment will decide if this is a blip or a deeper correction.

Source: Messari

So, are you aware of these unlocks, and what is your plan of action now? Let me know in the comments, and make sure to follow our Discord and X channels.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post 4 Altcoins with Major Token Unlocks in January 2026 appeared first on Altcoin Buzz.