Altcoin pumps feel random. They are not. Altcoins follow macro cycles. Liquidity expands. Risk moves outward. Capital looks for returns. Right now, four altcoins sit directly in that flow. That is why they are pumping. The mistake investors make is assuming pumps last forever. They do not.

Most people only ask if the price will go up. The better question is how much time is left. In this video, I explain why these altcoins are running now. What signals suggest continuation? And what signs would tell us the move is ending? If you invest without context, you chase. With context, you position. This is about spotting opportunity before it looks obvious.

Which Macro Factors Favor this Pump?

Let’s first take a closer look at the current macro winds that are pushing the markets higher. I will also look at whether this trend can continue or might stall. Finally, I will look at four altcoins that are enjoying this current ride. So, what are the current macro trends that favor this early January pump?

Easing Global Liquidity and Rate Expectations

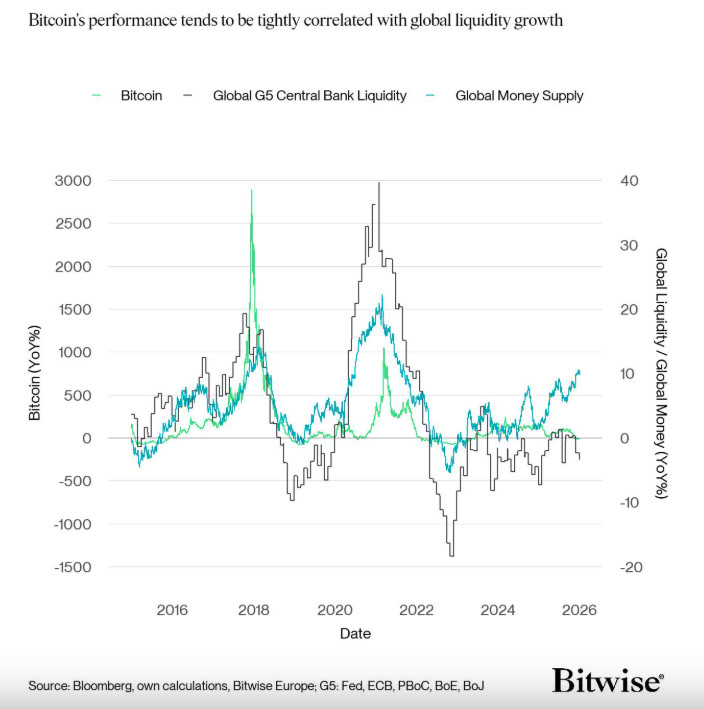

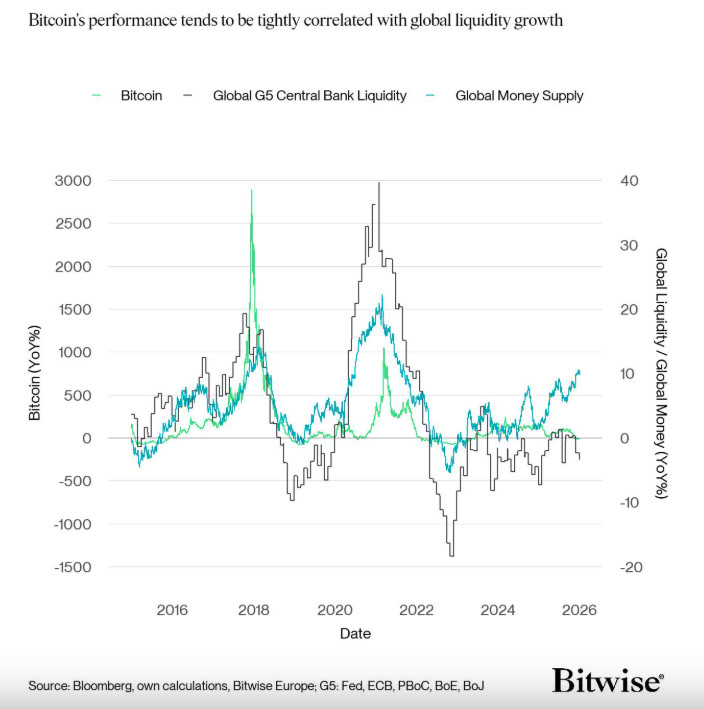

Central banks are talking about the easing of financial conditions. There’s also the expectation of more rate cuts this year. This benefits the crypto markets. With lower yields, we can see capital moving into higher-risk markets. Bitcoin also tends to follow global liquidity. See the picture below.

Source: Bitwise

Institutional Flows and ETF Dynamics

U.S.-listed spot crypto ETFs experience a return of institutional demand. This reverses the net outflows during late 2025. Bitwise Investments predicts that there will be massive $BTC and $ETH ETF purchases.

Reduced Selling Pressure Due to Seasonal Effects

This is simple. On January 1st, tax loss selling eased. The beginning of the new year also typically renews risk appetite. There’s this old saying: how markets trade in the first five days of the year often sets the tone for what follows. Well, the first five days of this year have been mostly green.

TOM LEE’S “FIRST FIVE DAYS” RULE APPLIES TO CRYPTO TOO 👀

Tom Lee reminded everyone of a simple but powerful signal: how markets trade in the first five days of the year often sets the tone for what follows.

Since 1950, when stocks were up in the first five days, the full year… pic.twitter.com/v7GX38qvGN

— CryptosRus (@CryptosR_Us) January 7, 2026

So, these are some major macro factors that give crypto some wind in its sails.

Why This Pump Can Continue or Stall

Let me start with four reasons why this pump can continue.

-

Macro Tailwinds Remain Supportive

Three factors are key here. Easing rates, improved liquidity, and institutional adoption. This is the setup in which risk assets outperform over time.

-

Structural Rotation into Crypto

Institutional interest normalizes crypto allocations. The Bank of America now officially recommends investing up to 4% of your portfolio in Bitcoin and crypto. Worldwide, we see continuous ETF inflows.

JUST IN: 🇺🇸 Bank of America officially begins recommending that clients invest up to 4% of their portfolio in Bitcoin and crypto. pic.twitter.com/SGZBxnwHKn

— Watcher.Guru (@WatcherGuru) January 5, 2026

-

An Oversold Market in Late 2025 4

Analysts see past price weakness not as failure. Instead, they see it as a shakeout before renewed upside. This increases the probability of trend extension.

-

Early-Year Bullish Sentiment

This swings back to what I said a moment ago. When the first five trading days of January are positive, they bode well for the year.

When first five trading days of January are positive, it bodes well for the year. Since 1950, the S&P 500 averaged +14.26% with an 83.7% positivity rate. When the first five days are negative, the average gain drops to +1.07%, with deeper drawdowns and lower odds of gains. $SPX pic.twitter.com/whwE1Bc6cf

— Bluekurtic Market Insights (@Bluekurtic) January 6, 2026

So, that looks good. But………………. we’re not there yet. There are also a couple of reasons why this pump can stall or even end.

-

Liquidity Is Still Thin

Market depth remains shallow. In thin liquidity conditions, price spikes can reverse quickly if flows dry up. To sustain this rally, it requires prolonged participation and improving market depth.

Liquidity may get a bit tighter at the start of 2026

(source: Capital Wars) pic.twitter.com/ZhgikbQABz— Global_Macro (@Marcomadness2) January 1, 2026

-

Macro Fragility and Economic Risk

Inflation and geopolitical tensions could tighten conditions abruptly. This can force risk assets down.

-

Failure to Reclaim Key Levels

If major price supports do not hold, confidence can crumble quickly. For example, Bitcoin is below the critical technical level between $90 and $92.9k. On the other hand, a break above $94.78k could be a signal for another leg up.

-

Profit-Taking and Derivatives Expirations

Options expiries and short-term profit-taking can trigger volatility and trend exhaustion.

Of course, I hope that the positive signs win this contest. We sure do need a break. So, let’s take a look at some coins that can profit from this pump into 2026.

Chainlink ($LINK)

My first pick of altcoins is Chainlink ($LINK). As you may know, this is one of my all-time faves. And for good reasons. For example, there’s a rising demand for critical infrastructure. The $LINK token has real-world use cases. It offers utility and real infrastructure. Its use isn’t speculative; instead, it’s functional.

Chainlink just confirmed a new patent for its CCIP protocol. It’s like a privacy “kill switch” that major banks have been waiting for. Furthermore, the SEC approved the Bitwise spot Chainlink ETF.

Chainlink just patented the future of “hostile” cross-chain finance.

A new patent confirms $LINK CCIP is building a “Risk Management Network” that can “bless” or “curse” transactions in real-time.

This is the privacy “kill switch” that banks like JPMorgan and UBS have been… pic.twitter.com/JGaTYd8UmK

— Altcoin Buzz (@Altcoinbuzzio) January 7, 2026

The $LINK price is on the up again and is closing in on $14. A great entry.

Sui Network ($SUI)

My next pick is the Sui Network ($SUI). Check our recent article on why you should keep an eye out for Sui in 2026. And as so many times during 2025, $SUI saw some of the biggest gains during this pump. It’s up 34.8% during the last 7 days. The current $SUI price is $1.91, up from $1.41. That’s a promising start to the new year for Sui.

Privacy is currently one of the dominating sectors in crypto. Well, guess what? Programmable privacy and free stablecoin transfers are in the pipeline for Sui.

Bittensor ($TAO)

Another one of my fave altcoins is Bittensor ($TAO). That makes three in a row in today’s list. Bittensor is currently the leading AI project. AI is a sector with incredible growth potential. Agentic AI integration in 2026 will be up 5% to 40%. And everywhere in these sectors, Bittensor has its nose in front.

The $TAO price is up by 26% over the last 7 days. The current $TAO price is ranging between $275 and $290. With institutional interest rising, this is something to keep an eye out for.

Interested in $TAO exposure?

Bittensor helps leverage economic incentives and decentralized networks for open and accessible AI development.

Grayscale Bittensor Trust (Ticker: $GTAO) is the first publicly listed U.S. product providing direct exposure to $TAO. pic.twitter.com/ifxymtQpo9

— Grayscale (@Grayscale) December 19, 2025

Render ($RENDER)

My last pick for today is Render ($RENDER). Over the last seven days, Render saw the biggest growth, with over 80%. The current $RENDER price is $2.37, but it tipped into $2.55 only a day or two ago.

As I already pointed out, interest in AI keeps growing. Render is one of the leading decentralized GPU compute platforms. That means that it offers what AI projects need: GPU power. This demand is exploding. Especially for AI model training, 3D creation, and virtual environments. This makes Render’s utility more relevant.

Distributed GPUs can (and will) power AI and rendering without the need for massive centralized datacenters.

A global pool of compute unlocks lower cost, lower latency, and massive scale.@JulesUrbach shared this vision at RenderCon 2025.

How far will we have come by RenderCon… pic.twitter.com/kO3mpGXSEG— The Render Network (@rendernetwork) January 3, 2026

So, do you expect this pump to continue? If so, what is your favorite project or token? Let me know in the comments.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post 4 Altcoins to Consider During Improving Crypto Conditions appeared first on Altcoin Buzz.