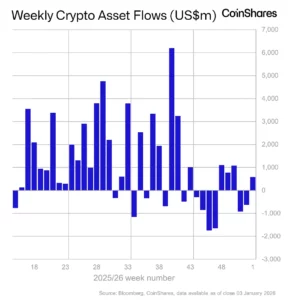

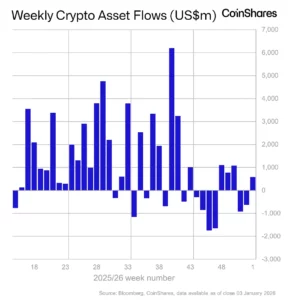

The year started on a high note, with last Friday alone seeing US$671 million in inflows, bringing weekly totals to US$582 million despite midweek outflows.

These figures highlight continued appetite for crypto exposure even amid price swings, and signal where capital is moving across different markets and assets.

Regional Trends Show U.S. Dominance with European Recovery

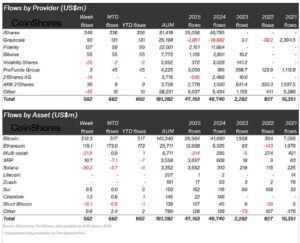

The United States remained the largest source of inflows in 2025, accounting for the majority of the US$47.2 billion, though down 12% compared to 2024. Europe and Canada showed notable recoveries. Germany flipped from outflows of US$43 million in 2024 to inflows of US$2.5 billion in 2025, while Canada reversed a US$603 million outflow to record US$1.1 billion in inflows. Switzerland also saw a modest increase, with inflows rising 11.5% year-on-year to US$775 million.

Source: Coinshares

These regional shifts suggest renewed investor confidence in digital assets outside the U.S., reflecting both broader adoption and regulatory clarity in countries like Germany and Canada. Investors can view this as an indicator of growing institutional and retail participation in crypto markets globally.

Asset Rotation Highlights Ethereum and Select Altcoins

While overall inflows remained strong, Bitcoin experienced a slowdown. Inflows into Bitcoin products declined 35%, totaling US$26.9 billion. Some investors turned to short Bitcoin products, which received US$105 million in inflows, though total assets under management remain small at US$139 million.

Source: Coinshares

Ethereum led the gains, attracting US$12.7 billion in inflows, up 138% from the previous year. Other altcoins also saw impressive growth, with XRP inflows increasing 500% to US$3.7 billion and Solana surging 1000% to US$3.6 billion. Meanwhile, remaining altcoins experienced declining interest, with inflows falling 30% year-on-year to US$318 million.

A real-world example is Ethereum-based decentralized finance platforms, which continue to attract both retail and institutional investors. The rotation toward select altcoins may reflect investors seeking exposure to projects with growing adoption, active development, and utility beyond speculative trading.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post 2025 Sees Record Inflows Despite Crypto Market Volatility appeared first on Altcoin Buzz.