The Multichain Surge of 2025 marked a turning point for the crypto industry. Dune Analytics’ 2025 Multichain Report shows how this shift reshaped onchain activity.

This Multichain Surge was all about real-world use cases like payments, stablecoins, games, real-world assets, and fast trading.

What the Multichain Surge Means

The Multichain Surge showed that blockchains no longer compete to be everything. Instead, they specialize. Some chains became payment networks. Others focused on trading. Some were for games, while others handled real-world assets.

We asked blockchains live on Dune to recount their 2025: the metrics that mattered, the ecosystem projects that truly moved the needle, and first-hand perspectives from core contributors.

Here’s what the data revealed.https://t.co/mXrsAUVVxK

— Dune (@Dune) December 22, 2025

Dune Analytics supported over 100 blockchains by the end of 2025, adding more than 40 new networks in a single year. That alone shows how fast the ecosystem expanded. But more importantly, it shows how many different needs blockchains are now serving.

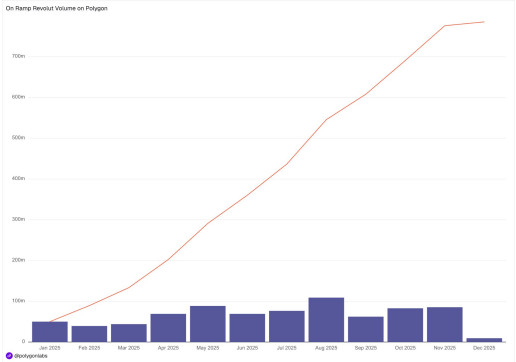

Stablecoins

The emergence of stablecoins is one of the most obvious accounts in the Multichain Surge. In 2025, stablecoins were no longer only for traders. They became everyday money.

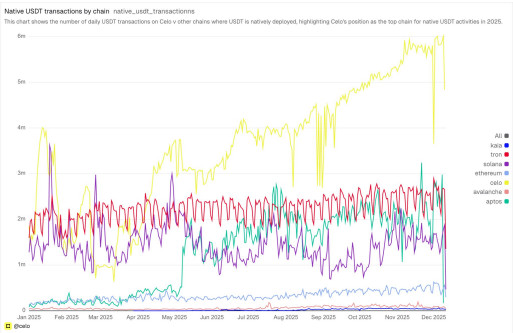

Celo

Celo stood out as a major stablecoin network. Daily USDT transactions on Celo grew from about 1 million per day early in the year to 6 million per day by December. This growth came from real payments, especially in emerging markets.

Celo also reached major milestones:

- Over 1 billion total transactions

- More than 3.3 million weekly USDT users

- MiniPay passed 10 million wallets

These numbers show that stablecoins are now used for daily spending, not only crypto transfers.

Plasma

Plasma adopted an alternative way. It centred nearly all its attention on stablecoins. As of December 2025, Plasma had processed more than 200 billion stablecoin transfers, with most of that traffic being USDT. It resulted in Plasma being one of the most obvious instances of the Multichain Surge.

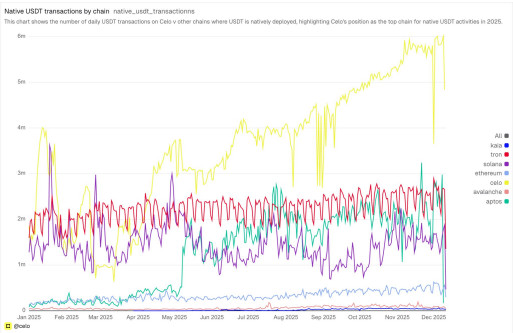

Polygon

Polygon’s role in the Multichain Surge came from payments and fintech. It partnered with Revolut to onboard real-life users onchain.

By the end of 2025:

- Polygon payment applications processed more than 1.27 billion transactions per month.

- Onchain volume of Revolut-generated activity was $780 million.

This demonstrated the ability of blockchains to operate behind the scenes while users experience the same types of payments.

Real-World Assets Took a Big Step Forward

Another major pillar of the Multichain Surge was real-world assets (RWAs). These are things like funds, credit, and financial products that exist off-chain but are also onchain.

Plume

Plume became the standout RWA chain in 2025. In six months, it grew to over 280,000 RWA holders, which is more than half of all RWA holders worldwide.

Plume also experienced some milestones:

- Huge institutions issued assets on the network.

- Approved by the SEC as a Transfer Agent.

- Its staking framework, Nest, had hit 47M in TVL.

This revealed that real-world assets are no longer experimental. They are becoming a core part of the blockchain ecosystem.

Other Chains Supporting RWAs

The surge also included strong RWA activity on:

- BNB Chain, which surpassed $800 million in RWA TVL.

- Sei launched many institutional tokenized funds.

- Arbitrum, which supported tokenized U.S. stocks.

Each chain played a different role, reinforcing the idea that no single network does it all.

Consumer Crypto Finally Found Its Footing

One of the most encouraging parts of the Multichain Surge was consumer adoption. In 2025, millions of users interacted with blockchains without feeling overwhelmed by crypto complexity.

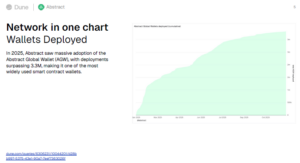

Abstract

Abstract focused on simple user experiences. Its Global Wallet has crossed 3.3 million deployments and is among the most-deployed smart contract wallets. Big brands and entertainment projects launched on Abstract, proving that consumer crypto can scale when the experience feels familiar.

Kaia and Mini Apps

Kaia demonstrated how adoption can happen fast through messaging. By mini apps integrated into LINE:

- The biggest number of its weekly active users was around 12 million.

- Apps have used more than 1.6 million paying wallets.

- Hundreds of millions of transactions were now in effect.

This feature of the Multichain Surge demonstrated that users will embrace crypto when it is naturally integrated into their existing tools.

Conclusion

The first half of the Multichain Surge story is about foundations. Stablecoins became everyday money. Real-world assets moved onchain at scale. Consumer-oriented chains taught us that design is everything.

In Part 2, we will examine how high-speed trading, Bitcoin-based networks, and performance-focused blockchains propelled the Multichain Surge even further in 2025.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post 2025 Multichain Surge: Key Insights from Dune Analytics – Part 1 appeared first on Altcoin Buzz.