Dune Analytics’ data on the Multichain surge shows that performance and specialization became as important as accessibility. This is the second part of the article; here’s the first part.

This second part of the Multichain Surge story focuses on trading-heavy networks, Bitcoin-focused chains, and the technical upgrades.

High-Speed Chains Powered the Multichain Surge

In 2025, speed mattered more than ever. Trading, prediction markets, and real-time applications pushed blockchains to process millions of transactions daily.

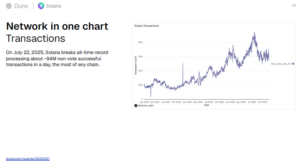

Solana

Solana reached one of the year’s most eye-catching milestones. On July 22, 2025, it processed about 94 million successful transactions in a single day, more than any other chain has ever handled.

This performance supported:

- High-frequency trading.

- Professional liquidity providers.

- Large-scale DeFi activity.

Solana was central to the surge because it demonstrated that blockchains could operate at internet scale.

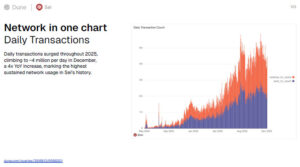

Sei

Sei was focusing on financial activity. By December 2025:

- The transactions were about 4 million every day.

- The network reached speeds of more than 200,000 TPS.

- Sei recorded more than 4 billion transactions.

The Multichain Surge featured Sei, demonstrating its ability to handle complex financial use cases without congestion, thanks to its purpose-built infrastructure.

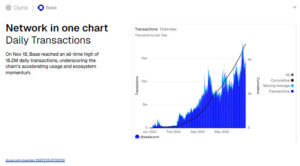

Base and Fuel

Other networks also contributed:

- Base reached 18.2 million daily transactions at peak.

- Fuel jumped from under 100,000 daily transactions to several million in a few weeks.

These chains highlighted how fast adoption can happen once apps gain traction.

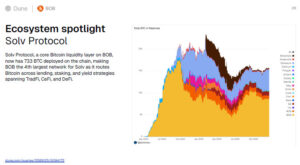

BOB

BOB positioned itself as a network focused on Bitcoin-based applications. In 2025:

- Value locked was as high as 152 million.

- Native BTC tools expanded across several chains.

- Access to DeFi was easier through Bitcoin gateways.

Through BOB, the author demonstrated that Bitcoin did not have to stagnate to lose its fundamental security principles.

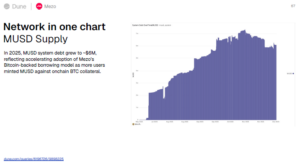

Mezo

Mezo introduced MUSD, a stablecoin backed by Bitcoin. By the end of 2025:

- MUSD system debt reached about $6 million.

- Bitcoin-backed borrowing became more common.

- Onchain BTC liquidity increased steadily.

This was another clear sign that the Multichain Surge includes Bitcoin, not only smart contract chains.

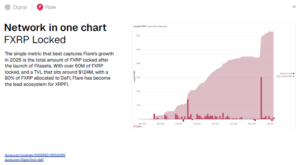

Flare and XRPFi

Flare focused on XRP-based activity. After launching FXRP:

- Over 60 million FXRP locked.

- DeFi protocols used around 80% of FXRP.

- Total value locked sat near $124 million.

This expanded the Multichain Surge beyond Ethereum-style ecosystems.

Developer Growth and Network Upgrades

Builders and infrastructure upgrades also drove the Multichain Surge.

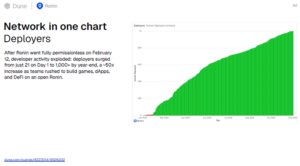

Ronin Goes Permissionless

- Ronin removed its deployer restrictions in early 2025. The result was dramatic:

- The number of deployers increased from 21 to more than 1,000.

- Developers introduced new games and applications at a fast pace.

- There was an increase in the network user activity.

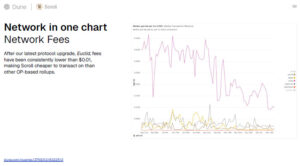

Scroll and Privacy

Scroll introduced low fees and launched Cloak, a privacy-focused payments and finance platform. It showed how specialized features can attract new use cases.

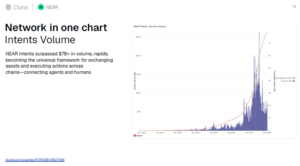

NEAR and Intents

NEAR concentrated on the concept of intents, a framework that makes cross-chain activities simpler. By 2025:

- The volume of intents exceeded 7 billion.

- Block times dropped to 600ms.

- The network boasted 5 years of 100 per cent uptime.

This strengthened reliability as one of the main components of the Multichain Surge.

Why the Multichain Surge Matters

The most important lesson from 2025 is simple: blockchains are no longer competing to replace each other. They are working side by side. Some chains handle payments while others handle trading. Some focus on Bitcoin, and others support games, creators, or institutions.

Conclusion

The Multichain Surge of 2025 was the move away from experimentation and toward real crypto infrastructure. Dune Analytics’ data shows a clear pattern: specialization wins, usability matters, and real activity drives growth.

As the ecosystem moves forward, the Multichain Surge will not slow down. Rather, it will continue to define the application of blockchains across finance, payments, and experiences worldwide.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post 2025 Multichain Surge: Key Insights from Dune Analytics- Part 2 appeared first on Altcoin Buzz.