According to a recent report by Wintermute, BTC slipped below $85,000 midweek. ETH dropped under $3,000, triggering sharp liquidations.

On Monday alone, around $600 million in positions were liquidated, with an additional $400 million cleared on both Wednesday and Thursday. These movements underscore how quickly strength can be sold in a choppy market. Even as major tokens continue to attract steady buying pressure.

Major Tokens Lead the Way

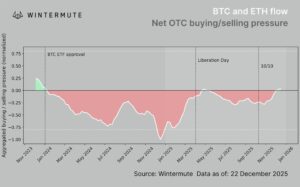

Wintermute’s internal flow data indicates sustained buying pressure for major cryptocurrencies, particularly BTC, which has seen a longer and more consistent period of inflows. Ethereum is also showing signs of increased demand as the year closes. Institutional investors remain a consistent source of capital. This is while retail participants are rotating out of altcoins and back into the majors. This trend aligns with the broader consensus that Bitcoin often needs to stabilize first before risk appetite spreads to smaller assets.

A real-world example comes from the derivatives market, where net buying in BTC and ETH coexists with sharp intraday volatility. Crowded leverage is frequently flushed out, creating air pockets that impact price discovery while spot buyers maintain a steadier base. Funding rates and basis metrics for the majors have remained relatively compressed, even as options markets price in a wide range of outcomes. Implied volatility remains elevated, reflecting split expectations between a further decline toward the mid-$80k range for Bitcoin and a potential recovery toward recent highs.

Market Structure and Adoption

Beyond price action, crypto-specific developments suggest steady adoption by institutions, corporates, and consumers. Traditional financial players are entering the space deliberately, and once capital and activity are established, they tend to remain sticky. Wintermute notes that this ongoing integration is likely supportive for medium-term prices, even if short-term upside momentum is muted.

The report concludes that markets continue to consolidate, with BTC and ETH acting as primary risk absorbers while the broader altcoin market faces pressure from oversupply and limited risk appetite. As year-end approaches, liquidity is expected to remain thin, and trading activity lighter. In the absence of macro or policy catalysts, positioning is likely to drive market movements rather than conviction, with price action remaining range-bound and selective.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Wintermute Report Shows BTC and ETH Market Consolidation appeared first on Altcoin Buzz.