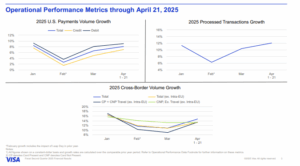

This trend is underpinned by a 6% increase in U.S. payments volume and a robust 9% growth in international payments. Most notably, there’s been no slowdown in consumer spending, signaling confidence in the global economy.

Visa’s CEO, Ryan McInerney, shared insights during the earnings call on April 29. He noted that the company’s continued success is rooted in the expanding adoption of digital payments. The company also revealed that nearly half of its global eCommerce transactions are now tokenized.

Visa’s Q2 Performance Shows Rising Demand for Cashless Payments

Visa’s Q2 performance reflects the growing demand for cashless solutions. The company’s payment volume surged 6% in the U.S. and 9% internationally, highlighting a broadening global acceptance of digital transactions. A standout figure was the 13% increase in cross-border volume, excluding intra-Europe transactions, which rose 13% in constant dollars. This is particularly impressive considering the ongoing global economic uncertainties.

The company’s success isn’t just in numbers—it’s also driven by a fundamental shift in how people pay. Visa continues to benefit from a rapid move towards contactless payments. McInerney emphasized that total credentials, which refer to digital tokens and virtual payment methods, were up 7%. This brought the total to 13.7 billion tokens. The growing volume of digital credentials enables faster, more secure payments, reducing friction in transactions.

Tokenization Leads the Charge

One of the most significant trends emerging from Visa’s earnings report is the rapid growth of tokenized payments. Tokenization replaces sensitive financial data, such as credit card numbers, with unique identifiers (or tokens) that add a layer of security. McInerney highlighted that nearly 50% of Visa’s global eCommerce transactions are now tokenized. This addresses concerns about fraud and data breaches, making digital payments safer and more convenient.

Mastercard just brought stablecoins to 150M+ merchants globally… directly from crypto wallets

Backed by @circle, @Paxos, @okx & @Nuvei, it’s a serious TradFi x Crypto bridge

-> Real-time payments, remittances (via MTN), and on-chain card issuance (OKX Card).@Visa next?… pic.twitter.com/DCtrMLMReu— Presto Research (@Presto_Research) April 30, 2025

In practice, tokenized payments are already making waves. A notable example is the rise of “tap-to-pay” technology. Consumers can simply tap their cards or phones on a point-of-sale terminal to complete a purchase. This technology has gained popularity worldwide, driven by its ease of use and enhanced security.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Visa Sees Growth as 50% of Transactions Get Tokenized appeared first on Altcoin Buzz.