Most people think Ethereum’s best days are behind it. Analysts claim the bull run is over. But the truth is, we’re standing right before one of the biggest setups in crypto history. There are three specific catalysts unfolding right now. They seem to be invisible to retail traders.

However, these could push Ethereum ($ETH) toward $8,000 by December 2025. Today, I’ll uncover each one. If you think Ethereum is just coasting, you’re in for a shock. This isn’t hype, it’s data, timing, and something the smartest whales already know.

Tom Lee’s Bullish Conviction

Who is Tom Lee? Well, he’s the co-founder of Fundstrat and BitMine president. Fundstrat is an independent financial research firm. It provides strategic market insights. These are rooted in emotion-free, evidence-based research.

On the other hand, Bitmine is a Bitcoin mining company. However, at the same time, it’s also the biggest holder of $ETH. That’s because it switched to a 100% $ETH treasury strategy.

Currently, Bitmine held 3.34 million $ETH on October 20th. That’s 2.7% of all current available $ETH. However, a day later, yesterday, it bought another 63,539 $ETH. That’s worth around $184 million.

JUST IN:

TOM LEE AND BITMINE $BMNR JUST UPDATED THEIR ETHEREUM $ETH HOLDINGS … Here’s what they currently own as of October 19th:

– 3,236,014 Ethereum $ETH up from 3.03 ETH on October 12th

– 192 Bitcoin $BTC

– $219M of unencumbered cash

– $119M stake in Eightco pic.twitter.com/2V0nEoSouz— Tom Lee Tracker (Not actually Tom) (@TomLeeTracker) October 20, 2025

But here’s the crazy part. Bitmine didn’t announce this Ethereum treasury strategy until June 30th. BitMine announced it raised $250 million for this. However, only a month later, BitMine reported holding ~566,776 $ETH or $2 billion at the time, as part of its treasury. So, that escalated quickly.

🔥BitMine Immersion Technologies ( $BMNR ) experienced one of the most dramatic stock rallies in recent memory, surging nearly 1,200% in a single day last week following the announcement of a $250 million Ethereum-centric treasury strategy👀 $ETH $SBET $CRCL 🇺🇸🚀 pic.twitter.com/CteuXXCY01

— Paul Barron Network (@paulbarrontv) July 8, 2025

Tom Lee’s Bitcoin and Ethereum Price Prediction

Back to Tom Lee, though. In 2018, he predicted a $125,000 for Bitcoin by 2022. This was when the $BTC price was still under $10,000. So, yes, he was 3 years off with his time prediction. However, it shows why people are paying attention to him.

In 2019, #Bitcoin was $5K. Tom Lee said: invest 1–2% of your portfolio. CNBC laughed.

Who’s laughing now? pic.twitter.com/tS1avYqMHS

— Documenting Saylor (@saylordocs) October 4, 2025

During the recent Token2049 conference in September in Singapore, he made some other bold $BTC price predictions. He said that in the short term he expects $BTC to hit $140,000.

By year’s end, he expects Bitcoin to be around $200,000 and $250,000. He also had an optimistic long-term view of up to $2.2 million if Bitcoin’s value reaches parity with gold. To put this in perspective, the $BTC price was around 111k to $112k during that time.

On the other hand, for $ETH, he expects price targets of $10,000 to $12,000 for 2025. As you already saw at the start of this video, for $ETH he sees a $60,000 price tag. That’s an easy 15x from its current price. He also expects $ETH to overtake $BTC.

So, Tom Lee and Bitmine are important factors in $ETH reaching a new ATH by the en of this year. What Michael Saylor and Strategy are for Bitcoin, Tom Lee and Bitmine are for Ethereum.

Major Institutional/Treasury Accumulation

Let’s start with $ETH Treasury accumulation. I just told you all about Tommy Lee and Bitmine. They are currently the world’s largest $ETH holders.

Ethereum Treasury Strategies

However, there are more companies with an Ethereum Treasury strategy. So, let’s take a look at some and see how much they hold.

- Sharplink Gaming (Nasdaq: SBET) holds 859,853 $ETH. That’s worth around $3.3 billion at its current price. It also stakes $ETH and earns passive income that way.

- Bit Digital (Nasdaq: BTBT) holds around 150,244 $ETH. This is worth almost $580 million. During the last 30 days, it bought an extra 31,992 $ETH.

- Coinbase Global (Nasdaq COIN) holds 136.782 $ETH. That’s worth a good $527 million. This is a mix of investment and operational $ETH.

- ETHZilla (Nasdaq: ETHZ) holds 102,246 $ETH, worth around $394 million.

NEW: SharpLink acquired 19,271 ETH at an average price of $3,892, bringing total holdings to 859,853 ETH valued at $3.5B as of October 19, 2025.

Key highlights for the week ending October 19, 2025:

– Raised $76.5M at a 12% premium to market

– Added 19,271 ETH at $3,892 avg.… pic.twitter.com/Y4Ewu4EiuF— SharpLink (SBET) (@SharpLinkGaming) October 21, 2025

This gives you an idea what’s going on with $ETH Treasury strategies. In total, CoinGecko lists 14 firms. Combined, they hold a total of 4,663,201 $ETH or $18 billion. So, this is serious business.

$ETH Spot ETFs

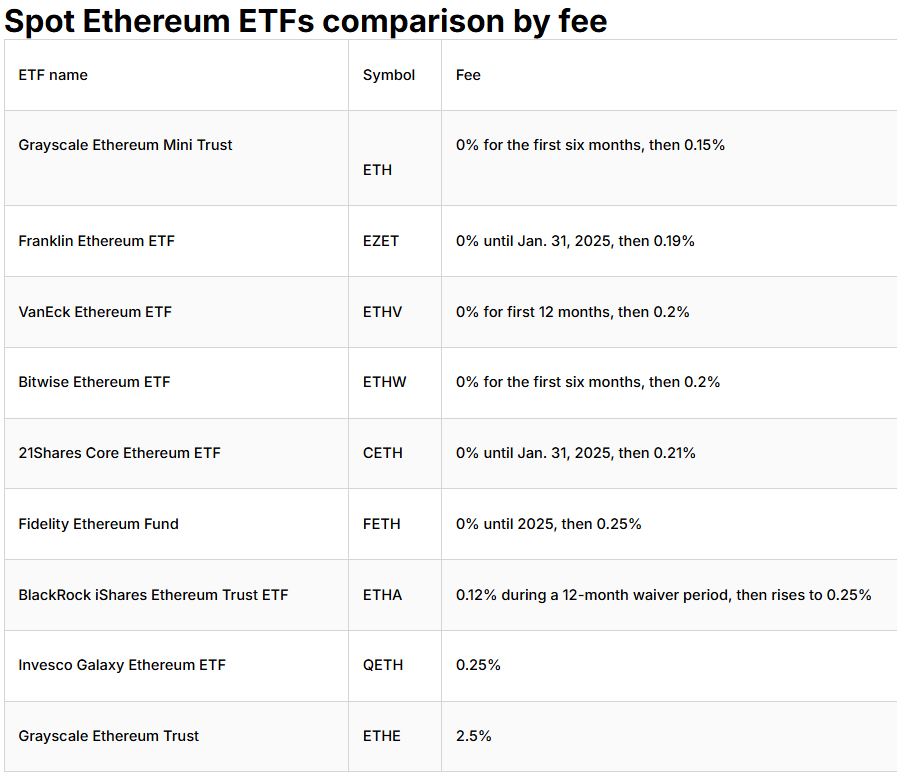

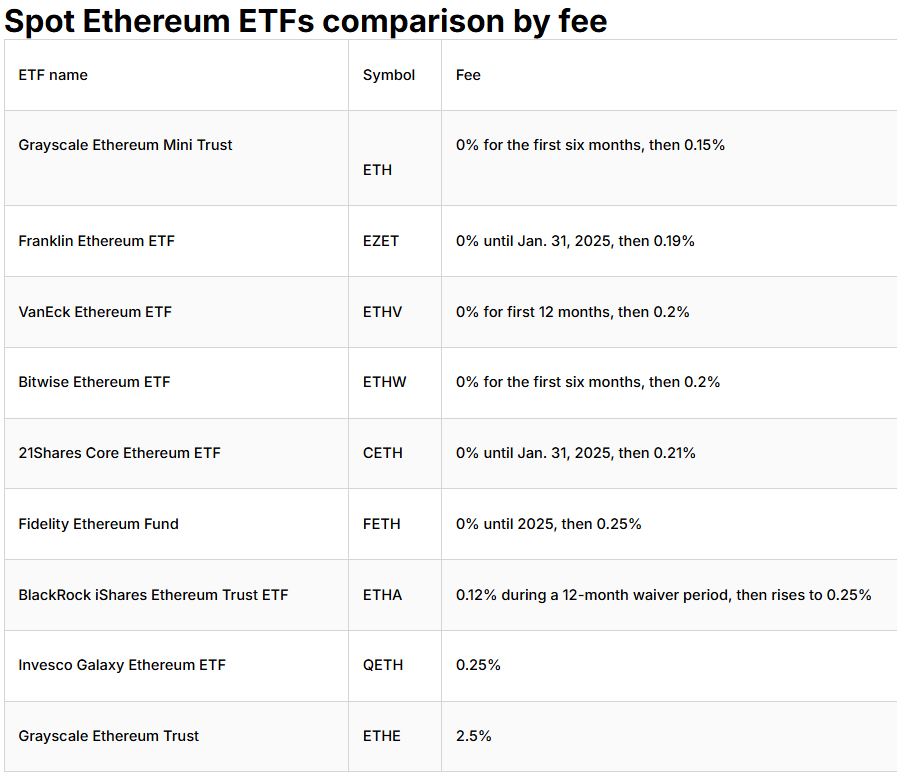

Then there are of course the $ETH ETFs. There are currently 9 of these. The advantage of a spot ETF is that an investor doesn’t need to hold the underlying asset. However, the ETF gives them exposure to the asset. This is attractive for institutions for various reasons. For example,

- Easier access.

- Better tracking of spot prices.

- Enhanced regulatory compliance.

Source: Ledger

Yesterday $141.7M flowed into $ETH ETFs. Out of this, BlackRock and Fidelity were good for $101.6 million worth of $ETH. Currently, many Ethereum spot ETFs are applying or transitioning to staking ETFs. This way, they can offer extra value to investors by earning yield on the underlying ETH holdings.

Big money is eyeing Ethereum again. 👀

$141.7M flowed into ETH ETFs in a single day, with BlackRock and Fidelity grabbing $101.6M worth of ETH.

The institutions are quietly stacking. pic.twitter.com/DVgfvwCzIq

— Lucky (@LLuciano_BTC) October 22, 2025

With staking ETFs, the APY can go up to 10%. This will surely attract plenty of institutions. Currently, institutions and ETFs make up 10% of all $ETH holdings.

🚨 Institutions Now Hold 10% of All @ethereum 💰

Treasuries and spot ETH ETFs have officially crossed 10.11% of total ETH supply — signaling deep institutional trust in Ethereum.

📊 Corporates: 4.54% | ETFs: 5.57%

💡 Unlike BTC, ETH offers staking + DeFi yield — a major draw… https://t.co/VMBxmUoBbN pic.twitter.com/LVkDBtDocC— Ventureburn (@Ventureburn) October 7, 2025

Unlocking RWAs on Ethereum, Making It the Monetary Base

RWA tokenization on ETH could unlock billions of dollars. This year, the RWA market has exploded from $8.6 billion to $25 billion. That’s just for the first six months of this year. By 2030, this market can be anywhere between $10 trillion to $30 trillion.

🌍 The RWA market has exploded from $8.6B → $25B in just the first half of 2025

Analysts project $16T–$30T by 2030 🚀

At the lower end estimate that’s 6X larger 📈 than Bitcoin’s current market cap!

Together, BTC & #RWAs can redefine global finance

⏳ Countdown: 7 days to go pic.twitter.com/PpqNboMAba

— Mintlayer (@mintlayer) October 6, 2025

Tokenizing bonds, real estate, loans, and commodities onto Ethereum bridges TradFi and DeFi. So, this brings me back to Tom Lee. He argues that $ETH will benefit. That’s because institutions will stake ETH while tokenizing their assets on-chain.

Lee also argues that this will increase revenue from fees. This, in turn, will drive up the $ETH value. However, this may become true in the future. If we look at today’s daily revenue numbers, they remained the same. That’s despite a 100x to 1000x increase in tokenized asset value over the last 5 years.

In other words, RWAs will need a much higher turnover in sales to achieve this. Nonetheless, looking at future predictions for RWAs. Lee may have a point. Another feature to take into consideration is fractionalizing RWAs. This also gives opportunities for more transactions.

The Monetary Base

Lee sees Ethereum as the monetary base. That means that it’s the foundational layer supporting DeFi, RWAs, and on-chain finance. He compares it to central banks that control fiat base money. In his view, Ethereum secures digital assets and liquidity.

Furthermore, Lee argues staking demand rises with ecosystem growth. It’s like banks holding reserves. More economic activity means more $ETH locked to ensure trust and security. In other words, $ETH is the digital base money. Now you stake it, and you can earn yield on that monetary base.

⚡ NEW: Tom Lee explains how $6.6 billion in Ethereum generates over $200 million in net income.

“If you hold $ETH and you agree to stake it and validate transactions, you earn the staking fee, which is 3%.”

He plans to use the income to pay BitMine holders a cash dividend.… pic.twitter.com/DrLMAJ3Fgl

— CryptosRus (@CryptosR_Us) August 22, 2025

So, what’s your prediction for $ETH towards the end of 2025? Let me know in the comments. Do join our discussions on X and Discord.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Is Ethereum Dead? Tom Lee Says NO and Predicts $10,000 ETH appeared first on Altcoin Buzz.