The Federal Reserve is examining the growing impact of stablecoins on traditional banks. It warned that widespread adoption could change deposits, credit availability, and the structure of financial intermediation.

A recent Fed research note highlights both potential risks and opportunities for banks. This comes as digital tokens gain traction among consumers and institutions. Stablecoins, digital assets pegged to fiat currencies, may shift funds away from conventional deposits.

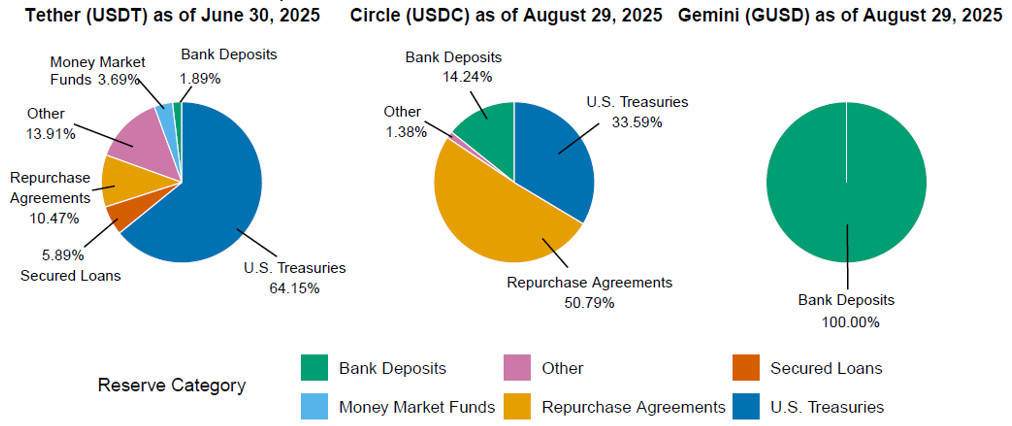

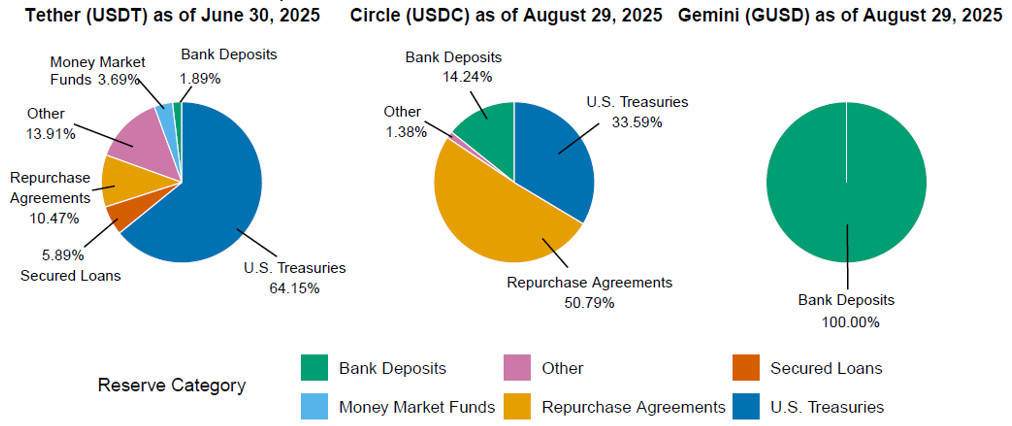

The effect depends on how issuers manage reserves, whether funds are recycled into bank accounts, and the demand from domestic versus international users. U.S. banks could see deposits decline if stablecoins draw heavily from domestic sources, particularly among younger, digitally active consumers.

Banks in the Age of Stablecoins: Fed research discusses some possible implications for deposits, credit, and financial intermediation: https://t.co/AMge3D0azk #FEDSNote #EconTwitter

— FedResearch (@FedResearch) December 17, 2025

Conversely, foreign demand for U.S.-backed stablecoins could boost domestic deposits if reserves are held in U.S. banks. The research also notes that changes in deposit composition, toward larger, uninsured wholesale balances, could increase liquidity risks and force banks to adjust funding strategies.

Credit Provision and Banking Adaptation

Shifts in deposits may reduce banks’ capacity to issue loans. The Fed estimates that significant stablecoin adoption could cut hundreds of billions of dollars from U.S. bank lending, particularly affecting small and medium-sized businesses reliant on relationship banking.

Banks with diversified funding and digital infrastructure are better positioned to adapt, while smaller regional and community banks could face higher funding costs and credit constraints.

Banks are responding with innovations such as tokenized deposit products, partnerships with stablecoin issuers, and enhanced payment systems like FedNow. These strategies aim to retain depositors, generate fee income, and integrate stablecoins into traditional banking services.

The Fed’s research underscores that stablecoins will not end traditional banking. However, their growth could accelerate structural changes. Banks that act proactively may maintain influence in payments and lending, while others risk diminished lending capacity and increased competitive pressure.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Fed Research Explores Stablecoin Impact on Banks and Credit appeared first on Altcoin Buzz.