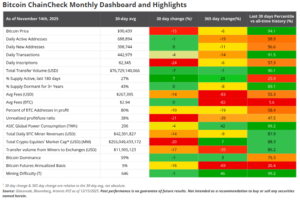

GEO scores three key pillars to cut through daily price noise, helping investors understand the market beyond short-term swings. In December, Bitcoin experienced a turbulent month, with the price falling 9 percent and volatility reaching levels not seen since April 2025.

The low point came on November 22, when Bitcoin traded near $80,700. On-chain metrics showed a struggling market, with hash rate down 1 percent, daily fees falling 14 percent, and new addresses stagnating.

Investor Behavior and Bitcoin Holdings

Despite the challenging environment, some segments of the market showed resilience. Digital Asset Treasuries, or DATs, took advantage of the dip, purchasing 42,000 BTC in the past month and bringing total holdings to 1.09 million. This represents the largest DAT accumulation since mid-2025, when 128,100 BTC were added. Many DATs, constrained by current market NAVs, are now shifting their strategies from issuing common stock to financing purchases through preferred shares.

For instance, the Japanese DAT Metaplanet plans a shareholder vote on December 22 to issue preferred stock for Bitcoin purchases. Meanwhile, Bitcoin ETP investors appeared less bullish, with total holdings declining by 120 basis points to 1.308 million BTC.

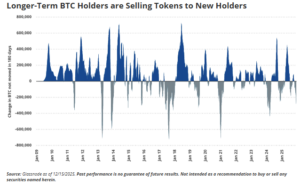

Hodler behavior also offers insights. Older, long-term holders continue to hold steady, with coins older than five years largely unchanged. However, medium-term tokens between one and five years saw reductions, suggesting short- and medium-term traders are rotating or selling. Understanding these cohorts can help investors identify trends in market sentiment and gauge long-term confidence versus cyclical trading pressures.

Mining Economics and Network Health

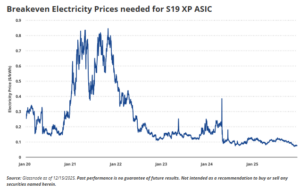

Bitcoin mining remains a critical component of network security, but rising hash rate and falling prices have squeezed miners’ profitability. The breakeven electricity price for a standard S19 XP miner dropped from $0.12 in December 2024 to $0.077 in December 2025. Recent hash rate declines, partly driven by Chinese miners shutting down 1.3 GW of capacity, may appear concerning.

However, historical data shows that periods of falling hash rate often precede positive forward returns. When 90-day hash rate growth was negative, 180-day BTC returns were positive 77 percent of the time, averaging 72 percent gains, compared with 61 percent positive returns during periods of growing hash rate.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post VanEck GEO Framework Reveals BTC’s Structural Market Health appeared first on Altcoin Buzz.