The new Etherealize report makes a strong case for ETH L2s. The report shows that ETH L2s are already shaping how institutions move money, settle assets, and run global operations.

ETH L2s are developing into infrastructure that banks, fintechs, and payment providers can actually use.

What Are ETH L2s?

ETH L2s, or Ethereum Layer 2 solutions, are networks built on top of the Ethereum network. Ethereum is the foundation that provides access to many unique features. ETH L2s let businesses handle large volumes of activity while still relying on Ethereum for security and final settlement.

The most harmful myth that keeps you from making money:

“L2s block fees from going to L1 and hurt ETH.”

That take comes from people with zero depth on the topic, often pushing AI-written content.

Reality is the opposite.

The gas you pay for a swap or any single action doesn’t…

— Mercek (@WorldOfMercek) December 8, 2025

Types of Ethereum Layer 2 solutions

There are a few main types:

- Optimistic Rollups assume transactions are valid but allow challenges if they suspect fraud.

- ZK Rollups use advanced cryptography to prove transactions are correct upfront, making them faster.

- Validiums and Optimiums offer efficiency but rely on external data sources, which introduces more trust assumptions.

New Report 🚀 The Future of Financial Infrastructure: Ethereum’s Layer 2 Landscape

Today we’re releasing a comprehensive analysis of how Ethereum L2s will transform institutional finance: From scalability and privacy to compliance, settlement, and global market structure.… pic.twitter.com/ysz57EdNTJ

— Etherealize (@Etherealize_io) December 4, 2025

Why do ETH L2s Matter for Institutions?

ETH L2s present enormous benefits:

- Cost & Speed: It is also cheaper and faster than the entire Ethereum main layer.

- Privacy & Compliance: Companies do not need to disclose sensitive data to prove their regulatory compliance.

- Interoperability and Customization: You can customize them to meet specific needs. You will still stay connected to Ethereum while you do this.

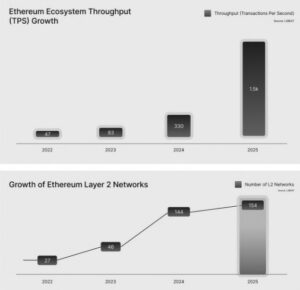

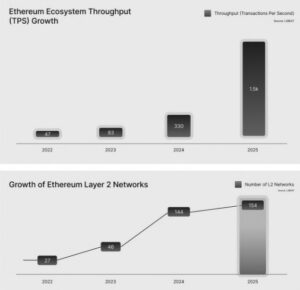

Source: Etherealize Report

Public L2s are available to anyone, whereas they use private or permissioned L2s to control and supervise regulated businesses. Institutions with high-value settlements can operate on Ethereum L1 and L2s in their day-to-day operations.

Why Act Now?

Stablecoins settled over $27 trillion last year, and major firms like J.P. Morgan and BlackRock are already building on Ethereum. The EU, US, and Asia are becoming less uncertain due to regulatory clarity. First adopters of the ETH Layer 2 solution can influence standards for tokenized assets and identity, gaining a strategic advantage.

Tom Lee’s BitMine has bought 138,452 $ETH worth $437.7 million last week.

They now hold 3.86M ETH worth $12.4B (3.2%) of the entire supply, making them the #1 ETH treasury in the world.

But here’s the bigger story:

ETH demand is rising because Wall Street is quietly building… pic.twitter.com/Iyf5fTrA9b

— Bull Theory (@BullTheoryio) December 8, 2025

Conclusion

ETH L2s are a gateway to a faster, cheaper, and more secure financial system. Institutions that embrace them today will not just keep up; they will lead the future of finance. With L2s, Ethereum becomes a practical and enterprise-ready platform.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Etherealize Report Highlights ETH L2s Shaping Finance- Part 1 appeared first on Altcoin Buzz.