Combining TradFi with DeFi is not an easy task. Many projects are looking into achieving this. Yellow Network is one of these projects. However, it plans to do this in a new and innovative way by using state channels. This is a different way to use blockchain tech for scalable, secure transactions.

So, let’s take a closer look at what Yellow Network is planning.

What Is Yellow Network?

Yellow Network is a Layer 3 solution that uses state channels to offer P2P trading. With this setup, they found a groundbreaking solution to combine TradFi with DeFi. That sounds like quite a mouthful, but let me explain.

Worried about paper assets suppressing prices?

The solution is simple: remove trust from the equation.

Yellow’s smart contract-clearing with collateralized deposits keeps P2P trading secure, without concentrating risk like traditional exchanges do. pic.twitter.com/7VXUtyPTwy

— Yellow (@Yellow) April 14, 2025

A Layer 3 solution is the dApp that is built on top of a Layer 2 solution. As we know, the Layer2 chains are built on top of the Layer 1 chains. A Layer 2 focuses on making the underlying Layer 1 better. For example, with scalability and cheaper transactions. On the other hand, a Layer 3 can improve and expand the potential and reach of a chain. Yellow is built on the Linea Ethereum L2.

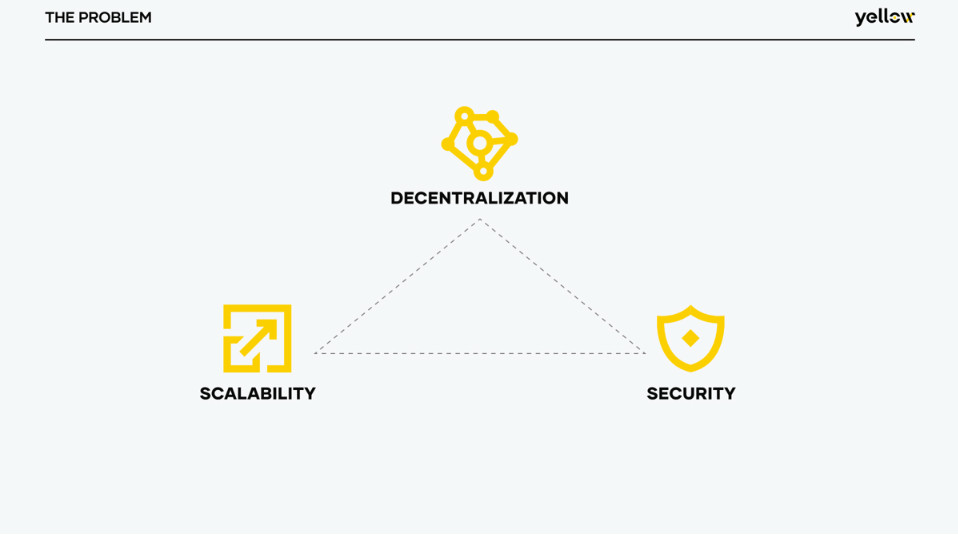

Trading Within The Blockchain Trilemma

Yellow Network is tackling some essential issues in blockchain tech. This refers back to the blockchain trilemma. To be precise, issues with scalability, security, and decentralization. The issues that Yellow Network sees are,

- Scalability — There’s a fragmented ecosystem with isolated markets. This hinders interoperability and scalability.

- Security — Bridges, used for interoperability, are prone to attacks and exploits. CEXes can also be victims of a hack. This puts your assets at risk, since the CEXes are the custodians of your assets, and for institutions, too.

- Decentralization — DeFi is not as decentralized as we often think. So, if a DEX has centralized components, it should follow regulatory guidelines for CEXes. That would make sense, right? However, this regulatory framework is not in place yet. Liquidity is typically stuck on a single chain.

Source: Yellow Network docs

By introducing state channels (we’ll explain what this is in a minute), Yellow Network works around these issues. For example, state channels offer high-speed trading. The project wants to set up a decentralized clearing and settlement framework. Like a clearing house in TradFi. In the US, the most popular is the DTCC. However, thanks to blockchain, the clearing house comes in the form of their smart contracts. Yellow calls this smart contract ClearSync. But one thing at a time.

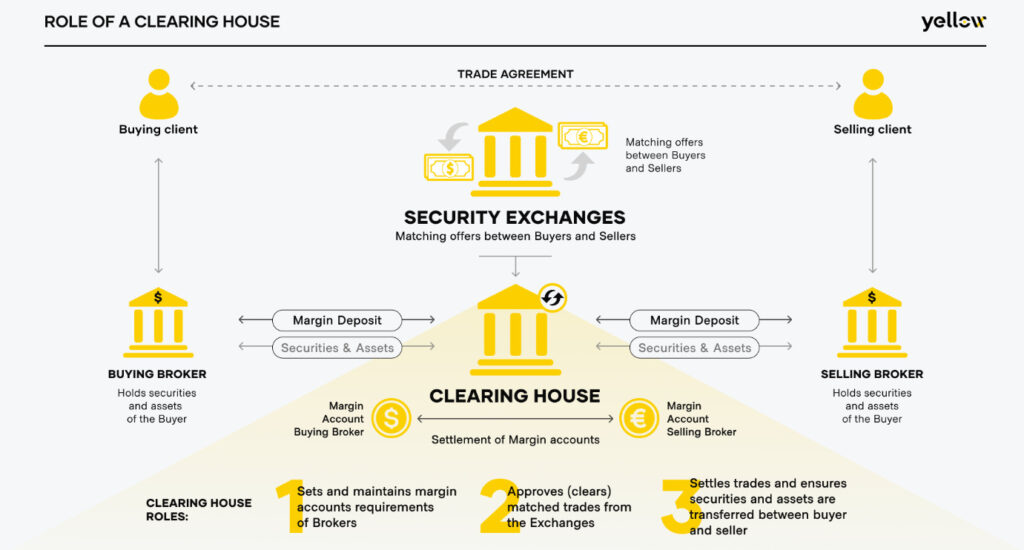

What Is a Clearing House?

A clearing house in TradFi is an intermediary that validates and finalizes transactions. It is like a safe house and makes sure that the buyer meets its financial obligations. On the other hand, it also makes sure that the seller delivers the purchased assets. Typically, this requires collateral. While most of us have no experience with clearing houses, we do have experience using escrow services. They do similar things.

Source: Yellow Network docs

What Is a State Channel?

A state channel allows making off-chain transactions. So, not on the main blockchain. It allows this between two parties, so P2P (peer-to-peer). However, you can add many transactions. So, you don’t need to add each individual transaction to the chain. Once it reaches the final ‘state’, you record it to the blockchain. Many L2s work this way by batching many transactions together for settlement on the main chain.

Yellow Network’s ClearSync smart contract acts like the Clearing House. It makes sure both parties fulfill their obligations. Besides being efficient, state channels are also private. Furthermore, they offer extra scalability, are fast, and reduce costs. There’s also no need for bridges anymore. Liquidity can flow freely between platforms and chains.

Bitcoin’s Lightning Network works similarly, also with state channels. However, the Lightning Network transfers funds. Instead, Yellow transfers profit and loss in real time. It’s trustless trading. Only at the end do the parties settle up the profits and losses.

Bridging today is slow and risky. But in most cases, crypto users don’t have a choice

At Yellow, we’re changing that. Our P2P state channel network connects brokers across chains, making it easy to move value without relying on bridges.

Less friction. More flow. This is how… pic.twitter.com/Ze0FbxtCap

— Yellow (@Yellow) April 17, 2025

This can be enticing for big TradFi players and institutions. They may not be familiar with smart contracts or trust them as we, the average crypto guys, do. An intermediary, like Yellow Network’s smart contracts, establishes that trust. It also gives TradFi a framework more similar to what they are already used to for settling trades.

Alexis Serkia, Yellow’s CEO, sees Yellow not only as a new product. He says that Yellow introduces a new philosophy. One that makes decentralized systems more effective.

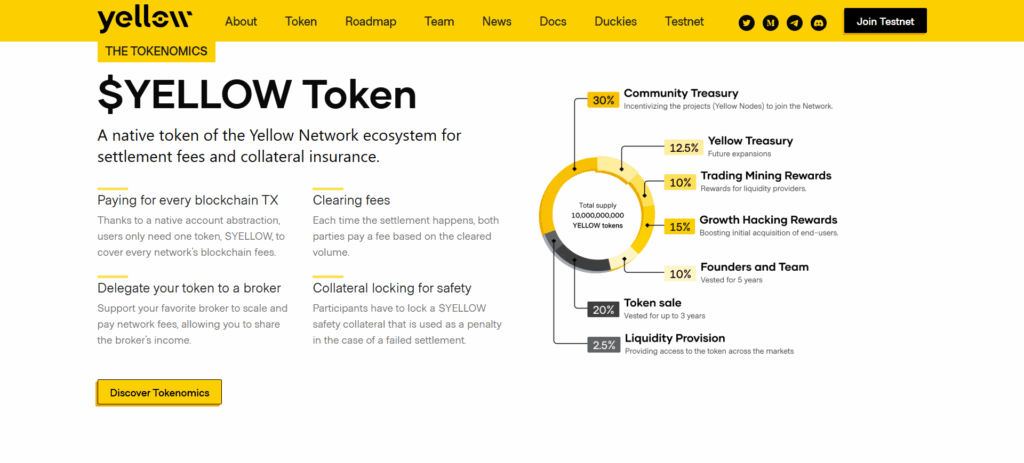

The $YELLOW Token

The Yellow Network will launch its $YELLOW token later this year. This is their native token and is an essential part of their ecosystem. Yellow’s mainnet launch is also imminent. Most likely, they will launch close to each other.

The Yellow Token Sale is Coming Soon!

Yellow’s token sale is on the horizon, and this is your chance to be part of the next big thing since Bitcoin.

By leveraging Layer-3 state channels, Yellow Network is redefining crypto trading for the masses – tapping into a… pic.twitter.com/9D0MKOJhAN

— Yellow (@Yellow) February 21, 2025

Here are some of the use cases for the $YELLOW token,

- You pay for blockchain transactions with $YELLOW.

- The $YELLOW token will be used for settlement fees and collateral insurance. Each time, both parties agree on the final state of a channel, a settlement happens. Both parties pay a fee in $YELLOW based on the cleared volume.

- You can delegate your $YELLOW tokens to a broker of your liking and share part of their income. Thus, generating passive income.

- All participants need to use $YELLOW as a safety collateral. In case of a failed settlement, Yellow’s smart contract burns the collateral.

Yellow looks for B2B adoption (business-to-business) with their $YELLOW token. So, don’t expect any airdrops. However, retail can still buy and trade the $YELLOW token. The total supply is 10 billion tokens.

Source: Yellow Network tokenomics

Conclusion

The Yellow Network is about to bring an innovative solution to bring TradFi closer to DeFi. It does this with the state channels. These bring privacy, scalability, cheaper costs, and reduce liquidity fragmentation between chains.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This post is sponsored by Yellow Network.

Copyright Altcoin Buzz Pte Ltd.

The post Yellow Network, an Introduction appeared first on Altcoin Buzz.