Zcash is staging one of crypto’s most dramatic comebacks despite the market drawdown.

The 2016 Bitcoin fork created by computer security expert Zooko Wilcox has surged more than 700% since September and is trading at $430, thanks to real infrastructure progress and growing attention to privacy.

That’s according to a new report from Galaxy Digital, which said that over 30% of the Zcash supply is now hidden from the public eye in private pools — an all-time high for this particular stat.

The new Zashi wallet has also made private transactions simpler for users, research analyst Will Owens said, which also contributed to more users going private.

Owens added that cross-chain integrations now let users move funds between transparent and private networks while keeping their steps hidden.

The milestone marks an attitude shift in crypto, where privacy, once treated as a liability and attacked by state actors, is now being rebranded as a core feature to protect users.

It’s not just Zcash that’s doing well. Monero is up over 130% this year while Dash is up 400%, both significantly outperforming Bitcoin.

Railgun, a key Ethereum privacy tool recently mentioned in the Ethereum Foundation’s institutional launch, was also cited by Galaxy Digital as a core project.

‘Technically, Zcash’s fundamentals haven’t radically changed overnight.’

Galaxy Digital’s Will Owens

Old tech, new attention

To be sure, Owens acknowledged that some are sceptical.

Prominent voices are split on whether the price action is sustainable. Economist Lyn Alden called the move “a coordinated token pump,” warning traders against becoming “exit liquidity.”

But tech investor Naval Ravikant countered that Zcash represents a deeper truth about the future of money, writing that “transparent crypto won’t survive a government crackdown.”

Venture capital giant Andreessen Horowitz has also said that demand for privacy “is more urgent than ever,” highlighting record user metrics for Zcash and Railgun this year.

Horowitz’s venture firm a16z cited multiple notable privacy milestones in 2025, including the Ethereum Foundation’s launch of its new 47-member “Privacy Cluster” and an uptick in the usage of the privacy programming language Noir.

“Technically, Zcash’s fundamentals haven’t radically changed overnight,” Galaxy Digital said. “But the perception around the technology has. This rally is driven by both constant vocal support from some of crypto’s top voices and also a reminder of how important privacy is for permissionless money.”

Originally a Bitcoin fork, Zcash was designed to fix the privacy issue that the Satoshi 2008 whitepaper acknowledged.

Its zero-knowledge proof system, known as zk-SNARKs, allows users to validate transactions without revealing who sent what to whom.

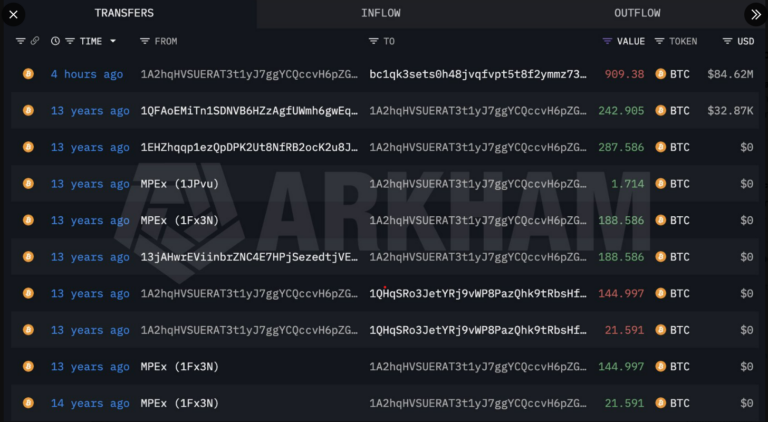

By contrast, Bitcoin’s public ledger exposes transactions to public analysis.

Still under fire

State actors are not relinquishing control just yet.

In 2024, the European Parliament voted through a bill that will ban listing tokens like Zcash and Monero on EU exchanges, with implementation expected in 2027. The argument is that the EU wants to fight financial crimes such as money laundering.

Cypto exchanges like Kraken and Binance have also either delisted or considered delisting privacy coins in the EU.

A Dutch court convicted the co-founder of privacy tool Tornado Cash, Alexey Pertsev, of money laundering in 2024. Across the Atlantic, his fellow co-founder, Roman Storm, was convicted in the US in August of conspiracy to operate an unlicensed money-transmitting business. Both of them have appealed their verdicts.

Meanwhile, some of the industry’s best-known privacy projects – mixers like Samourai and Wasabi – have been crippled by regulatory action, with founders arrested and charged.

Even so, the US Department of Justice has said it intends to reject similar cases going forward.

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.