Aster’s removal from DeFiLlama has stirred more than gossip. It has exposed a deeper issue. And that is how much the DeFi world depends on trust, even in a system built to remove it.

Aster, a derivatives exchange backed by YZi Labs, shot to fame after its trading volume jumped past Hyperliquid. For a brief moment, it looked like the new leader among perpetual DEXs. Then, DeFiLlama delisted Aster.

We’ve been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there’s… pic.twitter.com/MwVD7rRyEn

— 0xngmi is hiring (@0xngmi) October 5, 2025

The reason? Its numbers looked too good to be true. The data site said Aster’s volume closely matched Binance’s perpetual market, raising suspicions that the activity wasn’t organic. Once delisted, Aster’s rise began to look less like growth, and more like a warning sign.

The Problem With Fake Volume

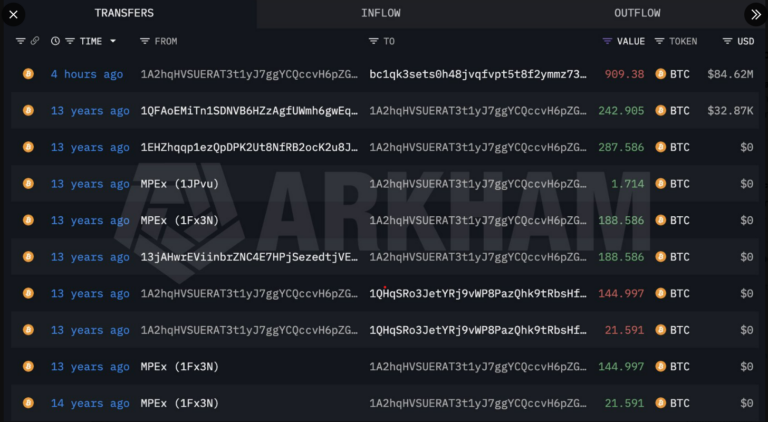

Fake or “wash” trading isn’t new in crypto. It happens when wallets trade with themselves or use bots to inflate numbers. Sometimes it’s done by users chasing airdrop rewards. Other times, by exchanges trying to look busier than they are.

Experts say about a quarter of exchanges still show signs of inflated activity. It’s easy to do, and hard to spot. Real trading leaves traces such as locked collateral, open interest, and funding fees. Fake trading often skips those. That’s why many analysts now look beyond volume to gauge real activity.

Why the Debate Feels Bigger Than Aster

After the delisting, some accused DeFiLlama of acting like a centralized gatekeeper. Others said it did the right thing by protecting data integrity. The irony? Some users who ran to Dune Analytics for “independent” stats later found their dashboards used DeFiLlama’s own data.

Shoutout to @0xngmi, founder of DeFiLlama, for making the tough call to delist Aster’s volume data, prioritizing data integrity and protecting users.

I’ve been saying for a while that Aster’s volumes looked heavily manipulated and full of wash trading. Slowly but surely, their… pic.twitter.com/UCInmADCJL

— Simon Dedic (@sjdedic) October 6, 2025

The episode shows how even open systems rely on a few trusted sources. When those sources lose confidence, the whole picture of DeFi can shift overnight.

Trust: DeFi’s Weakest Link

Decentralized finance is supposed to remove middlemen. But when platforms like Aster rise and fall based on data disputes, it shows that DeFi still leans on a handful of data providers to define what’s real.

Defillama delisting $ASTER is not a good example of decentralization

Start using Dune for more correct information

Here you can see that $ASTER is killing it’s competition pic.twitter.com/mQ7PBcysWY

— bolivian ($aster) (@_bolivian) October 5, 2025

Trading volume alone no longer tells the full story. Open interest, user behavior, and funding rates matter more. Until the industry finds a fair way to measure true activity, trust will stay fragile.

Aster’s exit isn’t just about one exchange. It’s a reminder that in DeFi, transparency means nothing without truth.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Why Aster’s Exit Could Signal a Trust Problem in DeFi appeared first on Altcoin Buzz.