Bitcoin has lost momentum, liquidity is retreating, and altcoins are bleeding volume. In such times, attention shifts from sectors to narrative.

Why is ZEC pumping? Because it is privacy-oriented Bitcoin. Why ZK pumped? Because it is a privacy-oriented Ethereum. You get the idea. Aave and Morpho are two solid DeFi protocols. Aave is a battle-tested, OG protocol, while Morpho is a ‘new kid’ in the block. Let’s discover more about Aave and Morpho in this article.

By the way, here is a cool article on Aave featuring its latest features on Arbitrum.

Tokenomics and market data

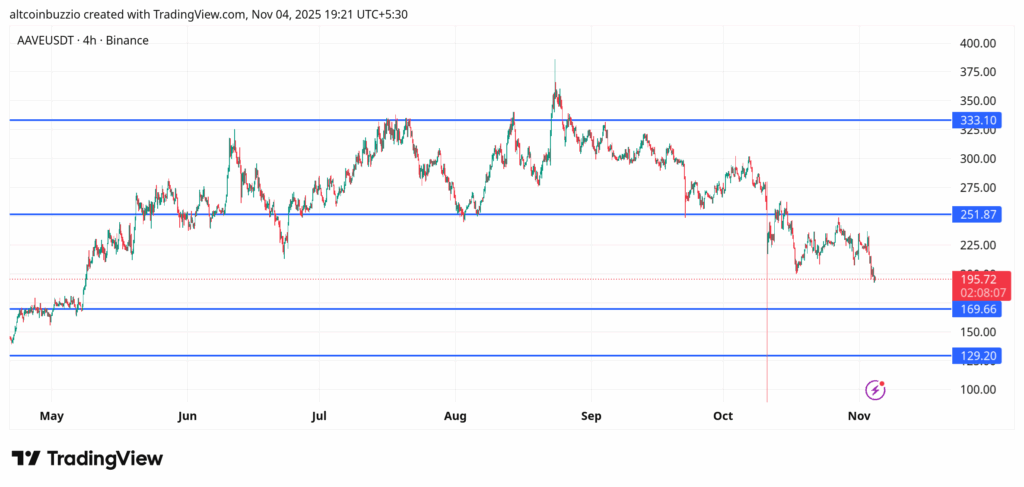

Aave is trading at $195, above the critical support of $169. Both $169 and $129 could be good entries. $251 and $333 are the closest resistances.

Marketcap: $3 billion.

FDV: $3.1 billion.

TVL: $35.2 billion.

You can earn 3.6% for supplying USDT on AAVE, while Morpho offers 3.8% APY for USDC.

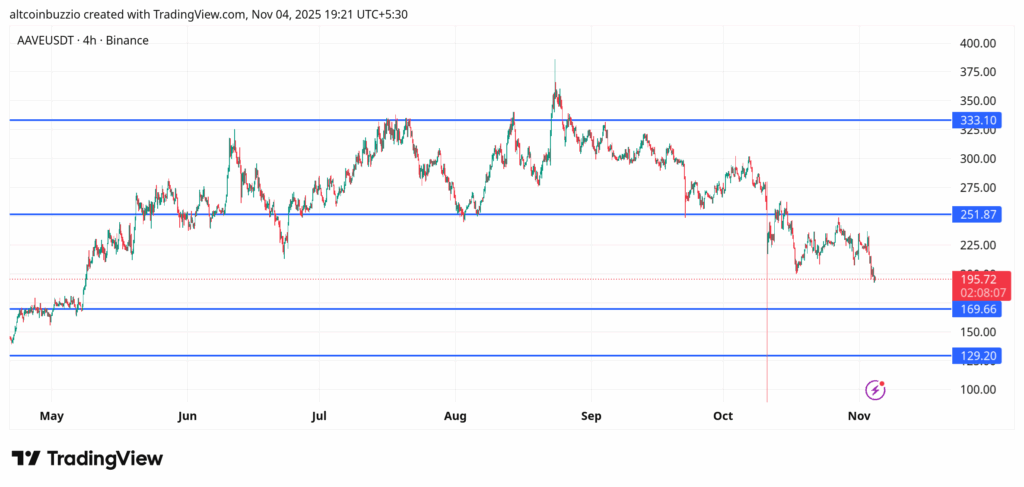

Morpho is trading at $1.66. It is still in range. The next support is at $1.27.

Marketcap: $575 million.

FDV: $840 million.

TVL: $12.5 billion.

This means Aave and Morpho are on opposite sides of the same equation. Both solve lending, but they do it with different philosophies.

Aave is built around pooled liquidity, the other around isolation and precision.

How Aave and Morpho Work?

Aave runs the pools. You deposit, someone borrows, and the smart contract handles the rest. It’s simple, stable, and dependable. Aave has over $35 billion in TVL across 12 chains.

Aave is what made DeFi lending usable. The protocol has liquidity aggregation and variable interest rates. AAVE has a permissionless money market with pooled risk and transparent collateralization. But Aave has its own set of problems. When the utilization of funds drops, the liquidity sits idle.

Utilization is simply the ratio of borrowed funds and TVL as a percentage. This means Aave automatically lowers interest rates when the utilization is low. The interest rates go up when the utilization is high.

The upcoming Aave V4 wants to change that. V4 helps Aave move to a hub-and-spoke model. It means there will be a central liquidity hub with modular “spokes” for specialized markets. This system will help Aave to become even more efficient.

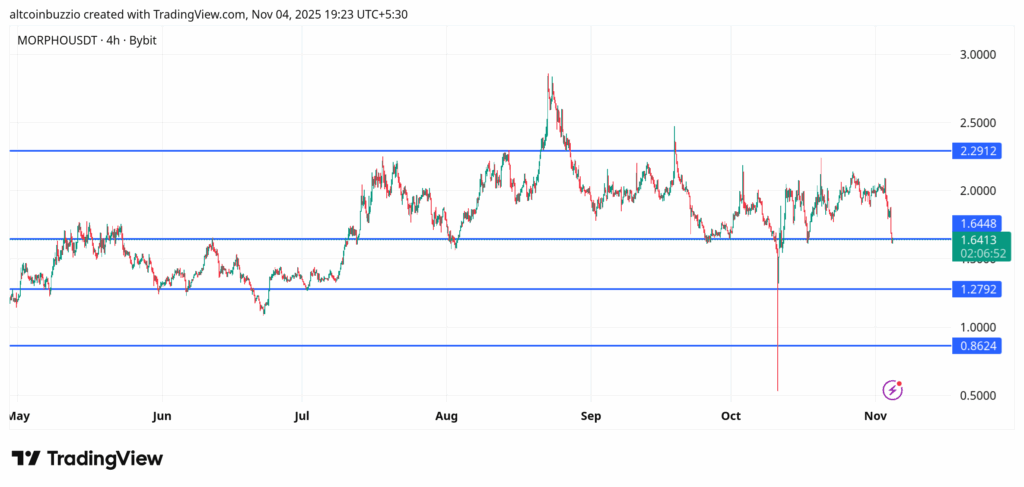

Morpho has an extremely decentralized lending model. There is no concept of a single, centralized, and shared pool. As you can see from the TVL screenshot above, Morpho has many specialized pools with varying risk.

In Morpho, a borrower and a lender connect directly. If there are no lenders or borrowers, Morpho routes through Aave or Compound pools. This ensures the yield in Morpho stays high and there is no idle capital. The utilization ratio can hit 100% without any risk. While Aave limits utilization to around 80 to 90%.

What about the risks?

Aave spreads risk. This is because all borrowers and lenders share the same liquidity pools. A sharp drop in collateral can trigger liquidations across the board. This means Aave’s risk mechanism is robust but systemic.

At the same time, Morpho isolates risk. Each market is a separate instance. This implies that a collapse in one market doesn’t affect the rest. That’s cleaner, safer, and easier to audit.

Morpho has several components:

- Morpho Blue lets anyone create isolated lending markets with immutable parameters. Each market is its own risk container.

- Morpho Vaults offers curated strategies for passive yield. These components further isolate risks.

It comes with a trade-off — liquidity fragmentation. Isolated markets mean liquidity scatter, unless vaults aggregate liquidity in a central pool.

Tokens and Governance

AAVE is both a utility and the governance token for the Aave protocol. MORPHO is also the utility and governance protocol for the Morpho protocol.

Aave has also launched GHO, its over-collateralized stablecoin. In the first year of its launch (in 2024), GHO experienced volatility. However, in 2025, GHO has been extremely stable.

Aave governance is active, complex, and heavy. Each upgrade passes through AIPs or Aave Improvement Proposals.

Morpho governance is lean. Immutable markets mean fewer decisions. Vaults and Borrowers operate independently.

Have there been security incidents with AAVE and MORPHO?

Aave has been hacked once. Aave’s core protocol has never been hacked. There were multiple failed attempts in the past.

A periphery contract of Aave was exploited for about $56,000. No user fund was affected.

At the same time, Morpho had two security incidents.

First was a white-hat MEV operator (c0ffeebabe.eth) who intercepted ~$2.6 million in assets. The funds were recovered.

Conclusion

Aave and Morpho are two crucial players in the DeFi space. Aave is an OG protocol that has stood the test of time. While Morpho is new, it has strong roots in the Base ecosystem.

Both are DeFi gems with different approaches to scalability.

The FDV/TVL ratio of both protocols is similar. Aave has a higher number at 0.088, and Morpho is at 0.067. It also means Morpho might be far more undervalued than Aave.

If you are a supplier, it makes more sense to go with Morpho as it offers better APY. If you are a borrower, Aave is the better choice as you get higher liquidity.

For long-term holds, Aave is the sensible choice. Since OG protocols have started performing, Aave could be next.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Why Are Aave and Morpho Redefining DeFi? appeared first on Altcoin Buzz.