Bittensor ($TAO) is about to cross a line that can’t be uncrossed. A halving event always cuts deeper than people expect, but $TAO’s is different. This is not Bitcoin copy-paste. This is a pressure valve on a living network with miners tied to AI demand, not raw hash power.

When supply tightens, systems change. Incentives shift. And price often follows in ways most miss until it is too late. In this video, I’ll show you what this halving really does. Why it matters more than people think, and how it could set Bittensor and $TAO on a path few see coming.

What the Bittensor ($TAO) Halving Actually Is

The Bittensor ($TAO) tokenomics have a lot in common with Bitcoin’s tokenomics. For example, there will ever only be 21 million $TAO tokens. And, what I’m talking about today, it has halvings. However, that’s pretty much where the similarities end. As you can see from the countdown on its tokenomics page, Bittensor’s halving should take place on December 14th.

The current block emission is 1 $TAO per block. That will change to 0.5 $TAO per block in a few days’ time. In other words, currently, each new day sees 7,200 $TAO. That changes to 3,600 $TAO per day.

Bittensor’s first halving is set for December 14, reducing daily TAO emissions from 7,200 to 3,600.

Amid rising network adoption and institutional interest. pic.twitter.com/V5HY13xhmd

— CRYPTO NEWS (@CryptoNewsXBT) December 9, 2025

There‘s also already institutional interest for $TAO. Grayscale, one of the bigger players, wrote a halving report on $TAO.

However, Bittensor’s halving works differently compared to Bitcoin. Bittensor ($TAO) is not a Bitcoin copy. That is important to understand. So, let me explain the differences. First, let’s take a look at what the Bitcoin halving is about.

The Bitcoin Halving

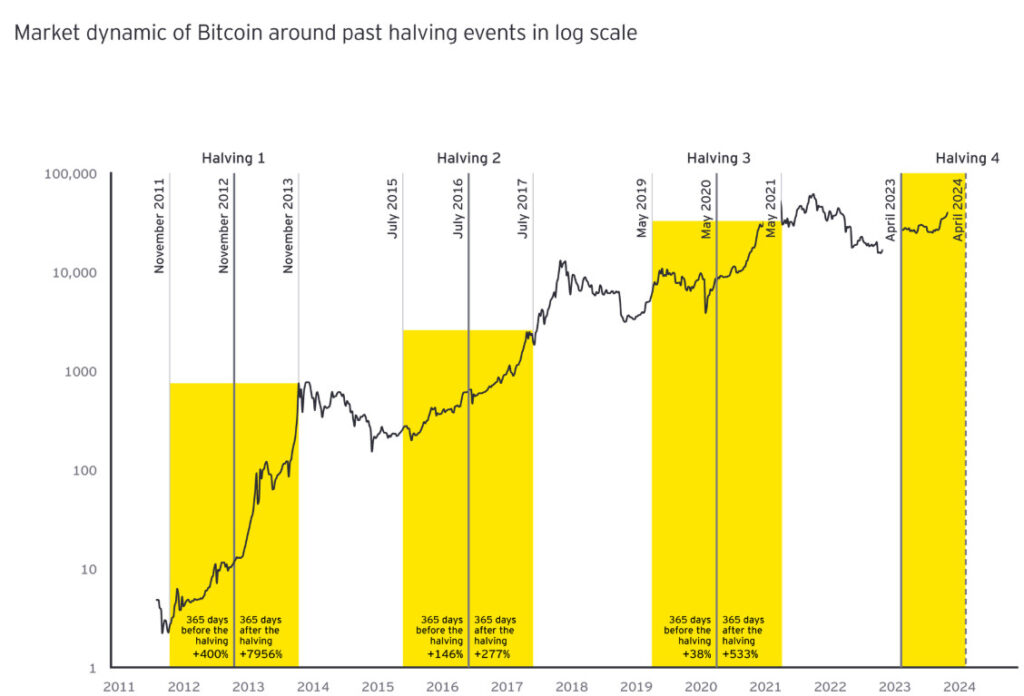

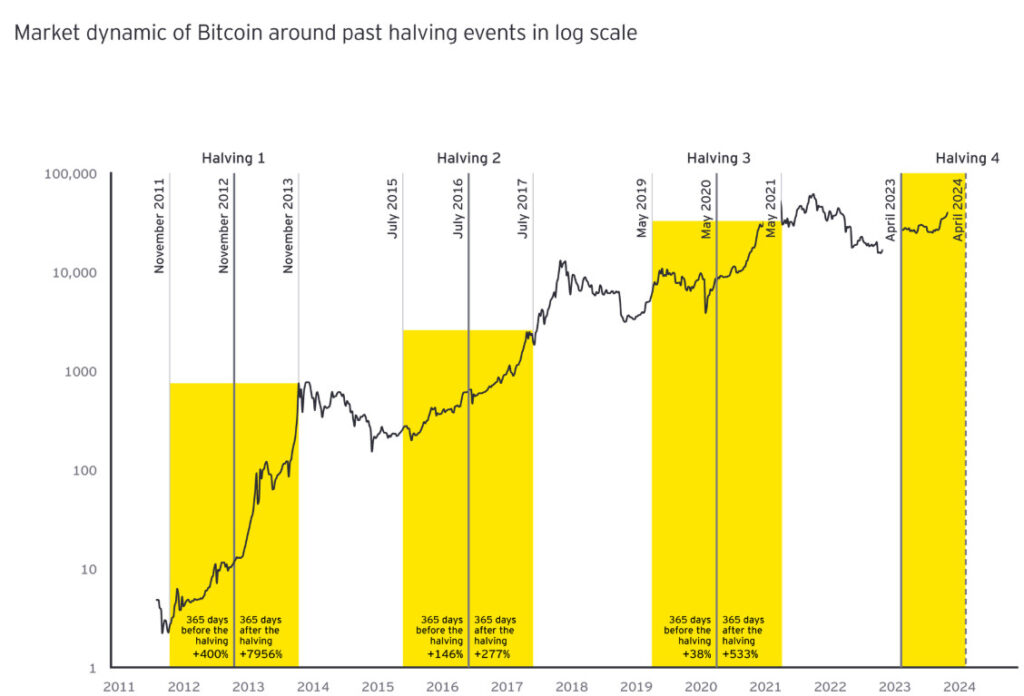

Bitcoin’s halving is simple. It cuts block rewards in half every four years. As a result, fewer $BTC enters the market. Miner incentives shift, but the network’s job stays the same, to secure transactions.

Source: ey.com

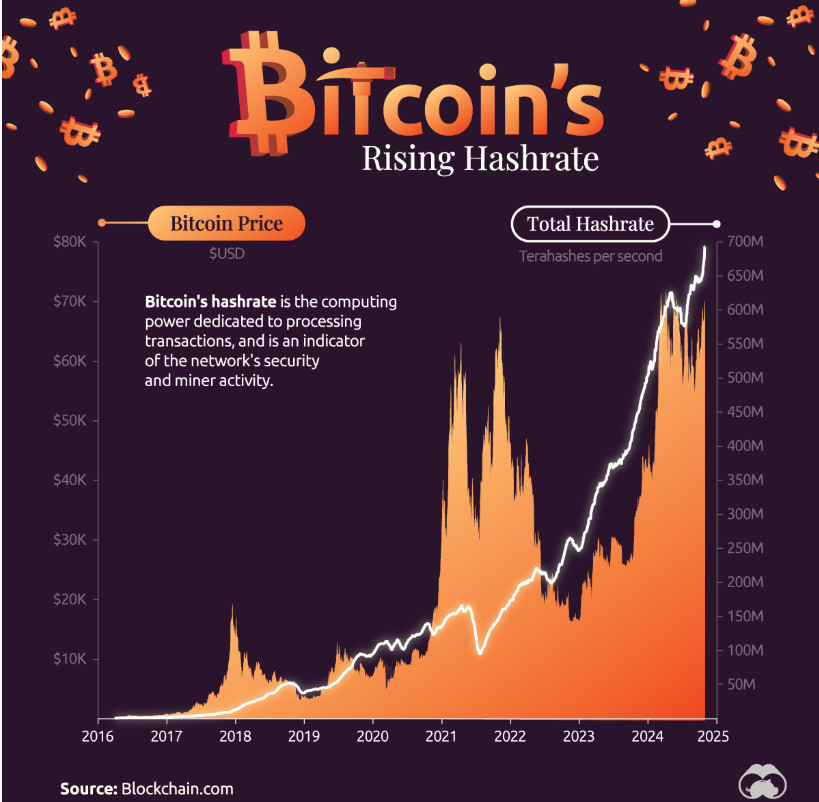

BTC miners only compete on hash power. This is the total computational power of the network. It measures how many calculations miners perform per second to validate transactions and secure the blockchain.

Source: Visualcapitalist

Higher hash power makes the network more secure. That’s because it’s more difficult and costly for attackers to gain control over 50% of the network. So, when rewards drop, weak miners shut down. However, the network keeps running almost unchanged.

So, the $BTC halving is a predictable supply shock and energy-based competition.

The Bittensor halving

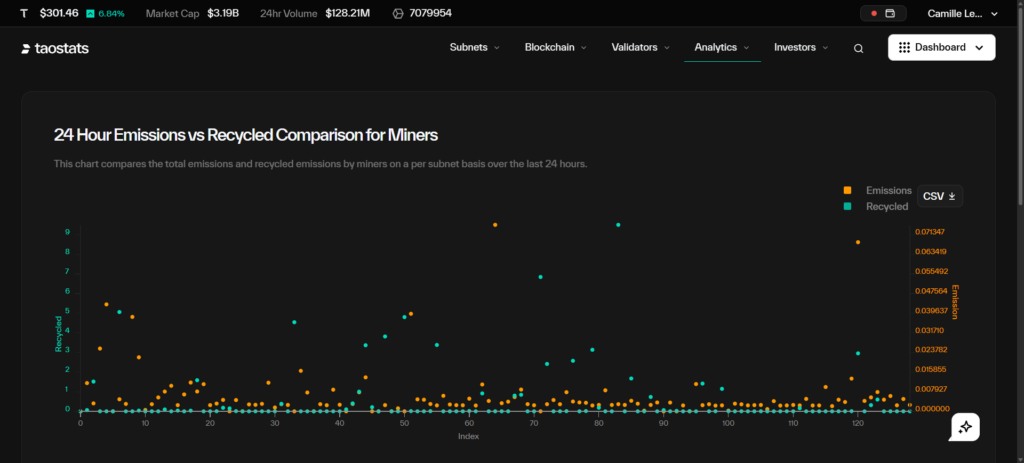

$TAO’s halving hits a different type of economy. Bittensor miners do not secure blocks. Instead, they produce value by performing AI tasks and competing for rankings. Rewards depend on useful output, not energy. So, that’s a very different ball game.

🚨 TAO daily emission are about to get CUT IN HALF!@opentensor is about to undergo its first ever halving event: An event which could galvanise interest in its native token.

Though probably inspired by $BTC‘s famous four-year halvings, $TAO‘s halving is more than a little…

— BSCN (@BSCNews) December 8, 2025

When $TAO emission is cut:

- Miner incentives shift

- Subnets compete harder

- Quality of output must rise

- Weak or low-value miners fall behind

- Demand for $TAO (to use the network) becomes a larger part of the equation

Source: Taostats

$TAO halving is a supply shock inside an active intelligence market. It’s not a passive hashing market. It changes both supply and behavior. That’s why $TAO’s halving has more moving parts than Bitcoin’s.

The halving is the best thing that could happen to Bittensor $TAO right now.

Half emissions means the network stops subsidizing noise and starts rewarding real intelligence.

You now have to PAY IN to use the network’s value, and subnets only earn if they produce demand.

Less… https://t.co/6v2KfFgWim pic.twitter.com/HWWwCHjftU

— Harry (𝜏,𝜏) (@princeharry_za) December 8, 2025

How TAO Mining Works and Why Halvings Hit Hard Here

At the beginning of this video, I called TAO’s halving a pressure valve. Here is what that means.

A. Pressure Building = Network Incentives Tightening

- TAO rewards are limited.

- As the emission drops, miners fight harder for the same pot.

- Competition in subnets grows sharper.

- Quality requirements rise.

- Low-value contributors get pushed out.

This change creates pressure inside the system.

B. Valve Releasing = The Network Reorganizing Itself

When the halving hits, the pressure forces:

- Bad miners to exit

- Good miners to grow

- Subnets to rebalance

- Demand-side users to compete for limited compute

The system does not break. Instead, it adjusts. It becomes leaner and sharper. You can compare this to a valve releasing built-up steam and redirecting flow.

C. Why This Analogy Fits $TAO Better Than Bitcoin

On Bitcoin:

- Halving only reduces supply

- The network function stays the same

- Miner behavior barely changes

On Bittensor:

- Halving reduces supply and reshapes the incentive structure

- Miner behavior changes

- AI output and network quality shift

- The entire ecosystem reacts

$TAO’s halving has both:

- Economic effects, meaning less supply.

- Functional effects. The competition and output quality change.

That is why it feels like a pressure valve. Cutting emissions forces a network-wide adjustment and a new equilibrium. So, that hits different and harder compared to Bitcoin.

The Shockwave: Supply, Miner Pressure, and Network Competition

This is the first Bittensor halving. It’s bound to send a shockwave through the system. The first impact is simple math. Fewer $TAO tokens enter the market each day. However, the deeper shift happens inside the network itself.

Miners do not earn rewards for wasting energy. They earn them for producing useful intelligence. So, when emissions drop, every miner feels the squeeze. The same pool of talent fights for a smaller stream of rewards. That pressure forces change that I mentioned a moment ago.

Weak miners will fall behind. On the other hand, strong miners will sharpen their models. They will upgrade hardware and start pushing for better rankings. Subnets with real demand grow more valuable. Subnets without it face a harder test. As a result, competition becomes more intense. This will raise the quality bar across the board.

And this is where the halving becomes more than only a supply story. It becomes a behavioral story. Reduced emissions force the network to reorganize. Incentives tighten and output improves. This will shift the entire system toward efficiency and real value.

we’re < 2 weeks away from the first $TAO halving.

but this post isn’t about that

this’ll be a short one, about fundamentals

regardless of what happens in the short term, i think Bittensor’s inevitably going to run because the (arguably) most important chain-level metric –… pic.twitter.com/eEsvxTcYHi

— Lucas (@OnchainLu) December 2, 2025

For investors, the key insight is simple. Halvings in Bittensor do not just reduce supply. There’s a lot more at stake. They reshape the internal economy. This shockwave moves through every layer, from miner strategy to user demand. And once the network adapts, it should emerge stronger than before.

The Price Question: What History Suggests vs. TAO’s Reality

In most networks, halvings follow a familiar script. The supply drops and sentiment rises. This results in the price drifting upward as new issuance shrinks. Bitcoin is the classic sample. Its simple design makes halvings easy to model.

But $TAO is not Bitcoin. Its supply curve is only one part of the equation. The real driver is how the network behaves when emissions fall. Check our recent TA video on Bittensor.

$TAO miners compete differently. I have shown you this already. They compete through intelligence, not raw power. When rewards tighten, weak miners drop out. On the other hand, strong miners improve. This results in subnets with real-world use growing more valuable. This creates feedback loops that can push the $TAO price in sharper ways than a normal halving.

There are three clear scenarios.

- If demand stays flat, reduced emissions still support slow upward pressure.

- If demand grows, the price can break higher as supply thins.

- Now assume that Bittensor gains real AI adoption. This means that the market can reprice $TAO far faster than past halving cycles suggest. Like we saw with Bitcoin.

So, either way, the $TAO price is bound to benefit from this halving. In one scenario, it is faster than the other. However, the bottom line seems to be up only. So, at the current $TAO price of $305, you may be looking at an excellent entry point. $TAO’s ATH is $757 from almost two years ago.

So, what do you expect is going to happen to the $TAO price after the halving? Let me know in the comments and make sure to join our X and Discord channels.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post The Bittensor TAO Halving is Here! appeared first on Altcoin Buzz.