Passive Income is a hot topic right now as market conditions are uncertain to say the least. And CoinEx has some fantastic passive income options for you that you might not be aware of. CoinEx is one of the best exchanges you haven’t heard of. Like Gate.io or MEXC, they offer a lot of coins. More importantly, they offer the high-quality coins you want.

CoinEx offers 1020 coins in over 1500 different markets. So that’s A LOT of access. And many are eligible for these income programs too. So today, we are taking a look at some lower risk strategies by looking at the passive income options on CoinEx.

CoinEx Financial

CoinEx has a unique feature that lots of other exchanges don’t offer. Now, CoinEx Financial is an AMM or automated market maker. We usually see this with DEXes. But the reason CoinEx has it is very strategic. It’s to be sure there is good liquidity across many markets and not just the biggest markets like Bitcoin, Ethereum, and Solana.

So starting from your login onto CoinEx, you go to Finance and CoinEx Financial to start things off. And you can see in the video below an explainer of what the CoinEx Financial account does.

You are helping CoinEx as well as traders that want to trade on margin by giving them the liquidity to do so. And they are paying you for it. And that’s with CoinEx to reinforce the margin requirements for safety.

It’s important to note that to take advantage of the deals here, which include 3.68% on USDT and 14% on Monero, you need to move your funds from the Spot Account Wallet to the Financial Wallet. That means you can’t trade them again until you move them back.

And that’s OK because you are putting the funds to work without trading. It’s passive income for you while you wait for the right thing to trade. In these uncertain market conditions, it’s a great option.

CoinEx Is Different

The few exchanges that do offer similar services for USDT pay you MUCH less than 3.68% to park your USDT. Most pay in the 1-2% range.

You also have to lock your tokens up with them most of the time. Not so with CoinEx. Here everyone earns the same APY no matter how much money you put in OR how long you keep it there. So keep it for a week or a month or a year. It’s all the same APY.

We like this deal, so we are going to buy it for USDT. And it’s so smooth and fast, we are going to show you in real time how you can save USDT at 3+% on CoinEx. We go right to Financial from the Wallet and you see we have $50 in there to trade in the Financial Wallet.

You can see how easy it is to move funds from the Spot Wallet to the Financial Wallet. And then if that asset is eligible for the program, you automatically start earning. It shows we earned a penny worth of USDT yesterday for our one day’s interest.

It’s important to note that once you move it into the Financial Wallet, this happens automatically. You don’t need to do anything. You click on the Earn More under Operations if you want to add more money to earn even more interest. But you see, under a minute and the money is in there and earning.

CoinEx AMM Liquidity Pools

In the same section, the Finance section, you see another offering that says AMM. Here again, it’s all about liquidity. You can play this passive income option conservatively or as aggressively as you want.

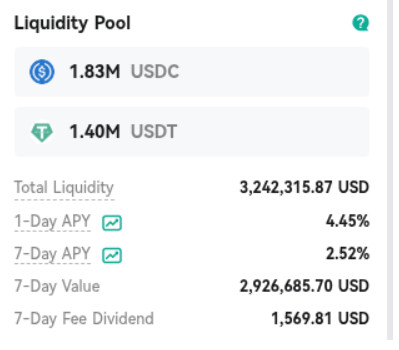

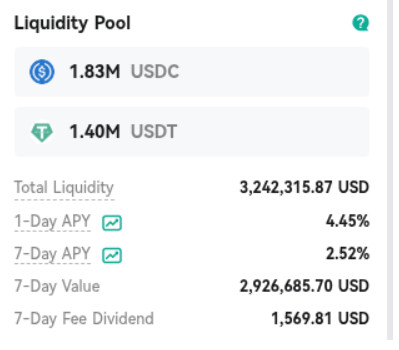

For example, with the USDC-USDT pair, you have almost no risk of impermanent loss. Plus, it pays 2.5%. Or you can get VERY aggressive. The average APY in this program is 30% on almost 1400 markets.

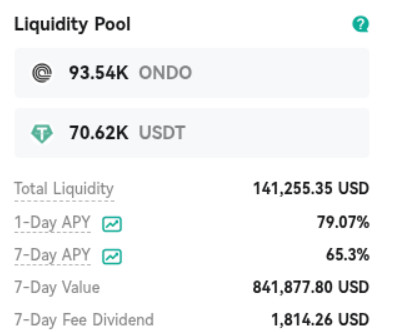

Then some of the APYs are sky-high. For example, on some memecoins paired with USDT, you can earn upwards of 2000%. But the impermanent loss risks are very real given memecoin volatility.

Ondo is a token in high demand on CoinEx right now. Paired with USDT, you can earn 65% APY if you keep your coins there for at least 7 days. That’s a big ROI for a coin you likely hold anyway and have no intention of selling in the next week. There’s IL risk here too, but that’s more due to how fast Ondo is growing.

The point is, you can go as low or high on the risk curve that you want. With the crazy external factors affecting markets right now, the stablecoin pair seems like a good deal to us.

Conclusion

Today, we looked at a couple of great passive income programs CoinEx offers. With CoinEx Financial, you just earn while you wait. Maybe you are going to wait out the Trump tariff story for things to stabilize. Then just earn on your stablecoins while you wait.

Then we looked at the AMM options. Here you can do similarly, including with stablecoin pairs. Or you can get more aggressive if you want.

Either way, CoinEx is presenting some great passive income options right now while market conditions are so strange. It pays to take a look.

And if you don’t have an account on CoinEx yet, use this link here to get started on your passive income journey today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by CoinEx.

Copyright Altcoin Buzz Pte Ltd.

The post The BEST Passive Income Strategies in Crypto With CoinEx! appeared first on Altcoin Buzz.