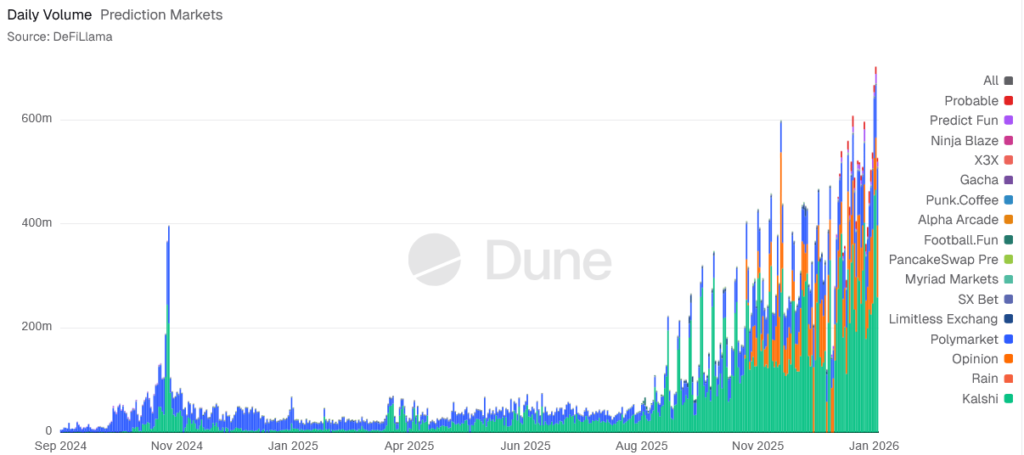

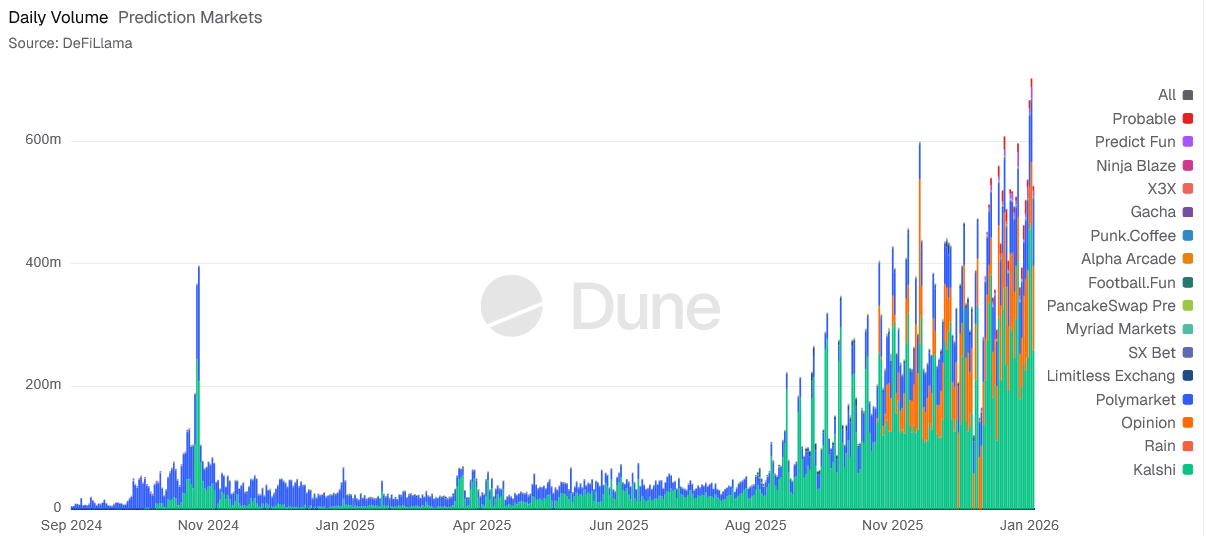

Prediction markets are starting 2026 strong, even as regulators take a closer look. Trading activity across major platforms jumped to about $702M in a single day, setting a new record for the sector.

Data from Dune Analytics shows prediction market volume has been climbing fast since late 2025. Kalshi led the surge, handling roughly two thirds of total trades, while Polymarket and Opinion also saw heavy use. The new record beat the previous day’s high, showing that interest is not slowing down.

Prediction markets let users trade on the outcome of real world events, from elections to economic data. Over the past few months, they have become one of crypto’s fastest growing use cases.

Prediction markets are not slowing down in early 2026.

On Monday, total trading volume reached a new ATH of $700M

Kalshi was the clear leader. It made $460M, Kalshi alone controlled 66.4% of the market, while Polymarket, Opinion, and @trylimitless each held about 14% share.… https://t.co/KB8w4GUbwG pic.twitter.com/zdn51LsbOf

— Jonaso (@Jonasoeth) January 15, 2026

Big crypto companies are paying attention. Platforms like Coinbase and Gemini are exploring integrations, while wallets such as MetaMask are adding access to these markets. This growth has helped push leading prediction market firms into multi billion dollar valuations.

Regulation Raises Questions, Not Volumes

Despite strong numbers, prediction markets are facing more legal pressure. Recent attention followed a high profile trade on Polymarket that raised concerns about possible insider information. Lawmakers in several US states are now reviewing whether certain prediction markets should be restricted, especially those linked to politics, sports, or financial assets.

Some states, including New York and New Jersey, have already tried to limit these platforms. In response, operators have pushed back in court. This week, a federal judge paused action against Kalshi in Tennessee, giving the platform temporary relief.

Outside the US, Ukraine blocked access to Polymarket late last year, calling prediction markets a form of gambling. Even with these challenges, trading data shows users are still active, suggesting demand remains strong for now.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Prediction Market Volume Hits $702M Despite Regulatory Scrutiny appeared first on Altcoin Buzz.