Memecoins put Solana in the spotlight in 2024, and it rallied to a new all-time high. However, something major is happening with Solana today that you need to pay attention to. At some stage, pump fun accounted for 70% of all new token launches. It also handled 56% of all transactions on Solana. However, pump fun seems to be dead. Memecoins are on the way out. Something we don’t regret at Altcoin Buzz. We are strong believers in utility.

But where does that leave Solana and its $SOL token? How is the network faring right now, and what does the future bring for Solana? So, let’s take a closer look at the current state of Solana.

The Decline of Pump Fun

As already mentioned, last year, pump fun accounted for 70% of all new token launches on Solana. Add to this 56% of all transactions. That’s a massive influence. It really dominated Solana’s rise last year. It catapulted into the top 10, measured by market cap.

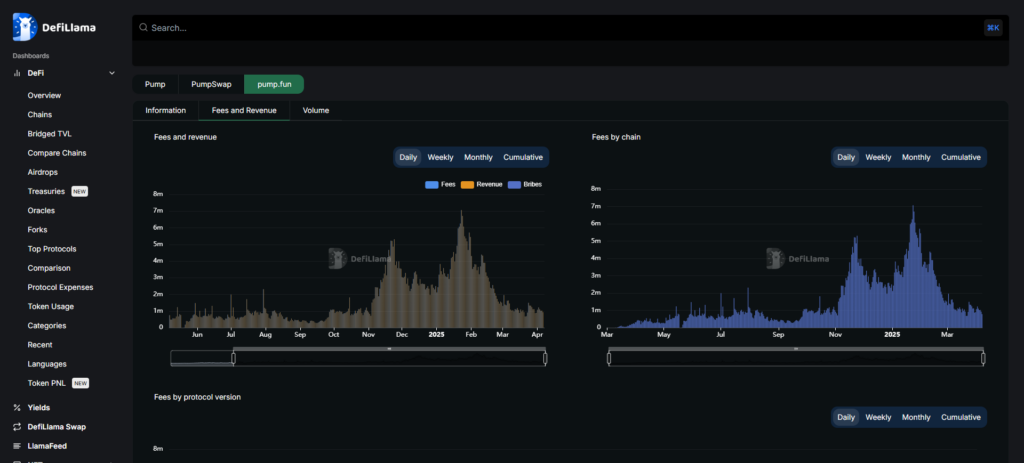

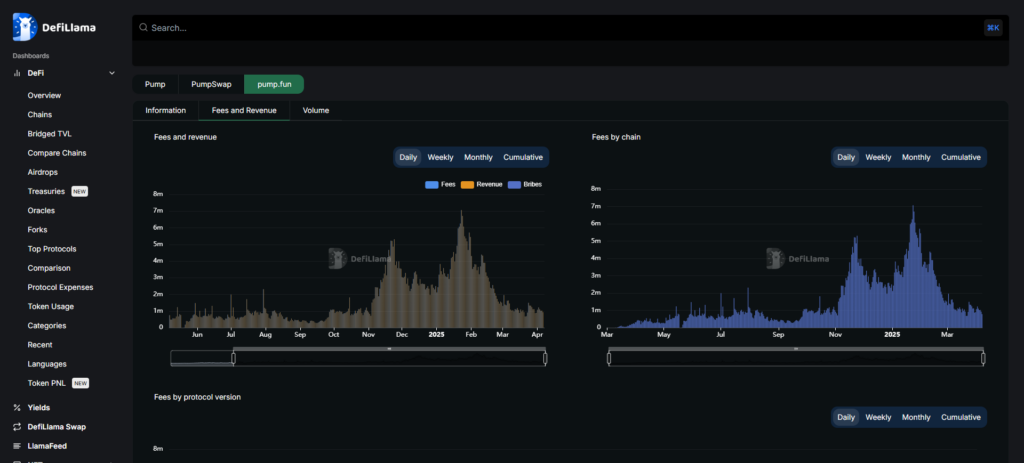

However, all good things come to an end. Well, good is relative here. Nonetheless, pump fun tanked heavily in revenue since the start of this year. On the 25th of January, there was still $15.38 million revenue. During February, this tanked by 92%. See the picture below.

Source: DeFiLlama

The main culprit was the Libra memecoin by Argentine President Javier Milei. Some would add the $TRUMP and $MELANIA memecoins here as well. Furthermore, besides revenue, token launches are also down. So, the sentiment shifted. What generated $400 million in revenue last year, is no longer.

So, what is going to replace this and what other trends can we expect during this year for Solana?

What Else is Happening at Solana?

At the forefront are the Solana ETFs. The SEC acknowledged Fidelity’s Solana ETF application today. This is a positive sign.

ETF News: #SEC acknowledges @Fidelity @solana ETF application under Rule 14.11 (e)(f) Commodity Based Trust Shares.https://t.co/52nd2dKHnx pic.twitter.com/d0R0VxaxpR

— MartyParty (@martypartymusic) April 3, 2025

It shows a shift in policy in the SEC, with Paul Atkins becoming the new chair. It’s expected that the SEC will approve the Solana ETFs. Among others, Frank Templeton, Grayscale, and VanEck also filed for $SOL ETFs.

This doesn’t mean that the ETF gets approved. However, it starts a countdown, during which the SEC needs to approve or decline the filing.

SEC OFFICIALLY ACKNOWLEDGES FIDELITY’S SOLANA ETF FILING

The U.S. SEC has formally acknowledged Fidelity’s application for a spot Solana ETF, marking a key step in the review process.

This move doesn’t guarantee approval, but it does start the countdown on the SEC’s official… pic.twitter.com/VtwfPJxJy5

— Crypto Town Hall (@Crypto_TownHall) April 4, 2025

The Bitcoin ETFs are going strong. However, the Ethereum ETFs are underperforming. I’m curious to see how other crypto ETFs will fare. In a general sense, it’s great to see crypto ETFs. However, I have my doubts on how effectful they will be, besides the Bitcoins ETFs.

There’s also the Firedancer new consensus mechanism in the making. This should launch later this year, but there’s no fixed date yet. This should make Solana more decentralized. It also reduces the chances of major outages. This used to be a weak point of Solana. However, the last outage was in February 2024. Firedancer should improve scalability and stability. It’s currently undergoing extensive testing on its Frankendancer testnet. This managed 1 million TPS!

Live demo of the Frankendancer Solana validator client running 1m TPS at Right Curve pic.twitter.com/7DgRGLuFR3

— Solana Accelerate

NYC May 19-23 (@SolanaConf) September 21, 2024

More positive news is that many devs and projects are moving from Ethereum and its L2s to Solana. The Ethereum L2s problem is TPS, or transactions per second. Ethereum L2s can reach around 100 TPS. Chains like Solana and Sui are much better to provide higher and faster throughput.

Everyone is moving from Ethereum and its L2’s to #Solana. The execution layer is #Solana not #Ethereum. Read for yourself.

Base cant handle more than 100 tps. It is just Optimism forked. All L2s will hit the brick wall. Stop the fantasy. You can sequence 1m transactions but… https://t.co/KwEWnNBrLZ

— MartyParty (@martypartymusic) April 3, 2025

Solana’s TPS is currently around 4,000. Sui’s TPS should be infinite. During the $LIBRA memecoin launch, Solana got battle tested. It creaked, but didn’t crack and managed to handle all transactions.

The Downside for Solana

There’s also a downside for Solana. First thing that comes to mind is a massive token unlock. Yesterday, the $SOL price was still $130. Today’s around $117. It even touched $112. The reason is that $200 million worth of $SOL unlocks today.

$200M OF SOL UNLOCKING TOMORROW

Tomorrow (4th April) marks the largest single-day unlock of staked SOL until 2028.

These 4 accounts staked a total of $37.7M of SOL in April 2021, and are up 5.5x at current prices. pic.twitter.com/qvKFWxygh9

— Arkham (@arkham) April 3, 2025

There are 4 accounts that staked a total of $37.7M of SOL in April 2021. However, they’re up 5.5x as of today. So, it’s likely that there will be some imminent profit taking. As a result, many whales sold their $SOL after they unstaked. Here are 4 accounts that sold for around $46 million.

Many whales unstaked and dumped $SOL today!

HUJBzd dumped 258,646 $SOL($30.3M).

BnwZvG dumped 80,000 $SOL($9.47M).

8rWuQ5 dumped 30,000 $SOL($3.53M).

2UhUo1 dumped 25,501 $SOL($3M).

Address:https://t.co/mCaB45W6pVhttps://t.co/wjhEwyZgFHhttps://t.co/Waqe4cxvbP… pic.twitter.com/kc1Q5GEKIX

— Lookonchain (@lookonchain) April 4, 2025

On the other hand, Marty Party reasons that there is a daily $6 billion trading volume for $SOL on Binance. Hence, he thinks that this unlocking won’t make a difference.

We also have Ali on X. He’s a renowned trader. He seems to indicate that $SOL might take a plunge. According to him, Solana’s trend line is getting tested too much and too often. This weakens the trendline and leads to a break.

The more times a trendline gets tested, the weaker it becomes. Eventually, it breaks. #Solana $SOL pic.twitter.com/sSCbU0AgUw

— Ali (@ali_charts) April 2, 2025

Another dark horse could be Cardano’s Midnight. This is all about privacy and could lure developers and projects to Cardano. It’s currently in testnet phase.

There’s also Sui, sometimes referred to as Ethereum and/or Solana killer. Although I’m not a big fan of the ‘killer’ narrative, Sui is a strong player. It could claim ground from both Ethereum and Solana. However, I believe more in cooperation. We see this for example by the integration of $SUI in the Phantom wallet.

So, what do you make of Solana? Is it at a breaking point, or will it lead the leg up again? Let me know in the comments. Also, join us in our Discord and X discussions.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post MASSIVE SOLANA SOL UPDATE! Cardano ADA BREAKOUT? appeared first on Altcoin Buzz.