Jack Mallers, CEO of Strike, has launched a new Bitcoin-focused firm aimed at competing with MicroStrategy’s Bitcoin playbook.

The new company, Twenty One Capital, enters the market with backing from major players including Tether, SoftBank, Bitfinex, and Cantor Fitzgerald. The firm plans to go public under the ticker XXI and will initially hold 42,000 Bitcoin, valued at approximately $3.9 billion.

So it begins…@Tether_to + @SoftBank + @bitfinex + @Official_Cantor + @jackmallers announced Twenty One, a Bitcoin-native Company, expected to launch with over 42,000 Bitcoin and a mission to maximize Bitcoin Ownership Per Share.

At Tether and Bitfinex, we have always… pic.twitter.com/Da8nD85mVE

— Paolo Ardoino

(@paoloardoino) April 24, 2025

A Direct Challenge to MicroStrategy

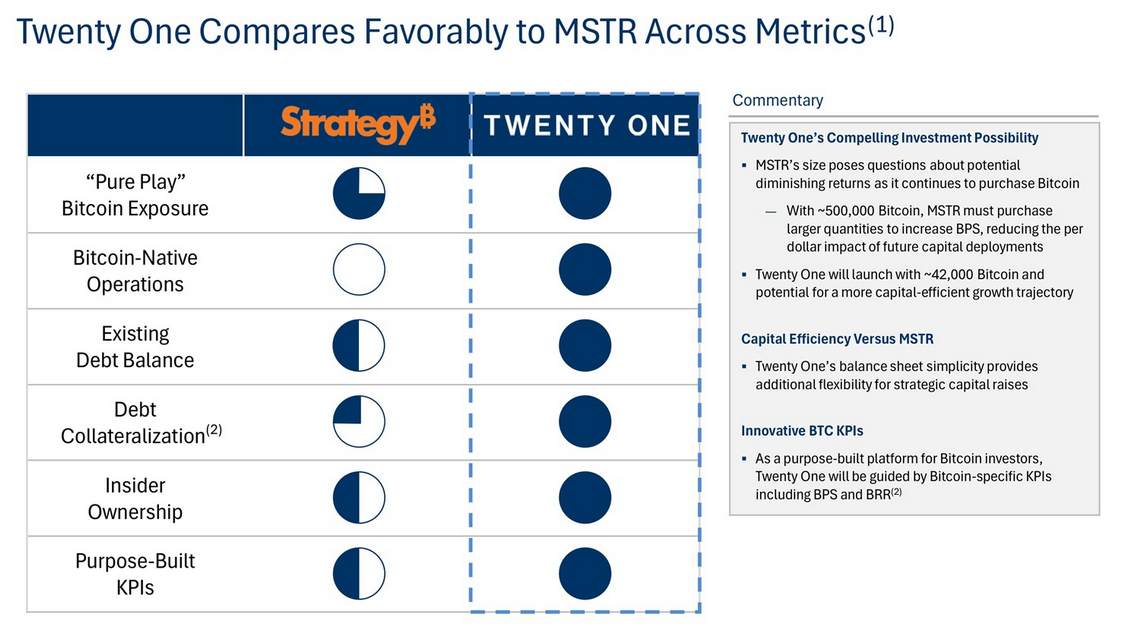

Mallers is positioning Twenty One Capital as a more flexible and capital-efficient Bitcoin investment vehicle than MicroStrategy. The firm has publicly drawn comparisons to Michael Saylor’s strategy, stating that MicroStrategy’s model may face diminishing returns due to the scale of its existing holdings (over 534,000 BTC.)

Announcing Twenty One: https://t.co/zg4PVHidw2

Twenty One is a #Bitcoin-native company and the ultimate vehicle for capital markets to access #Bitcoin

We intend to leverage capital markets to maximize #Bitcoin ownership per share (BPS) & pioneer #Bitcoin-native financial tools pic.twitter.com/RixWzvcL1y

— Jack Mallers (@jackmallers) April 24, 2025

Twenty One argues that its structure allows for greater impact per share when acquiring Bitcoin and offers more room for future strategic growth.

Explaining the vision of the firm, Mallers said, “Our mission is simple: to become the most successful company in Bitcoin, the most valuable financial opportunity of our time. We’re not here to beat the market, we’re here to build a new one.”

#Bitcoin is the most accessible smoke alarm for fiat liquidity. It smells blood first.

They told you it was just a tech stock. That couldn’t be further from the truth.

Let’s watch what happens when a truly free market with a fixed supply starts leading the way. pic.twitter.com/ksvF2OXDiR

— Jack Mallers (@jackmallers) April 22, 2025

Major Investors Commit Bitcoin for Equity

The company will convert its initial Bitcoin holdings into equity. Tether contributes nearly 24,000 BTC, SoftBank adds 10,500 BTC, and Bitfinex provides another 7,000 BTC. All three contributions will be exchanged at a rate of $10 per share.

Twenty One Capital’s public listing will be executed through a SPAC merger with Cantor Equity Partners. To complete the process, the firm is raising $585 million through a combination of convertible bonds and equity financing.

To be clear, I am the CEO of @Strike. I will lead both companies.

At Strike, we will continue building #Bitcoin financial services for the world, making Bitcoin more accessible for all.

Today, we’re sharing some of our financials for the first time:

2024 Volume: $6B+

YOY… pic.twitter.com/xxjDc3SzJv— Jack Mallers (@jackmallers) April 24, 2025

Ownership of Twenty One will be divided among its backers, with Tether and Bitfinex holding a majority stake, while SoftBank retains a significant minority position.

Expanding Beyond a Treasury Model

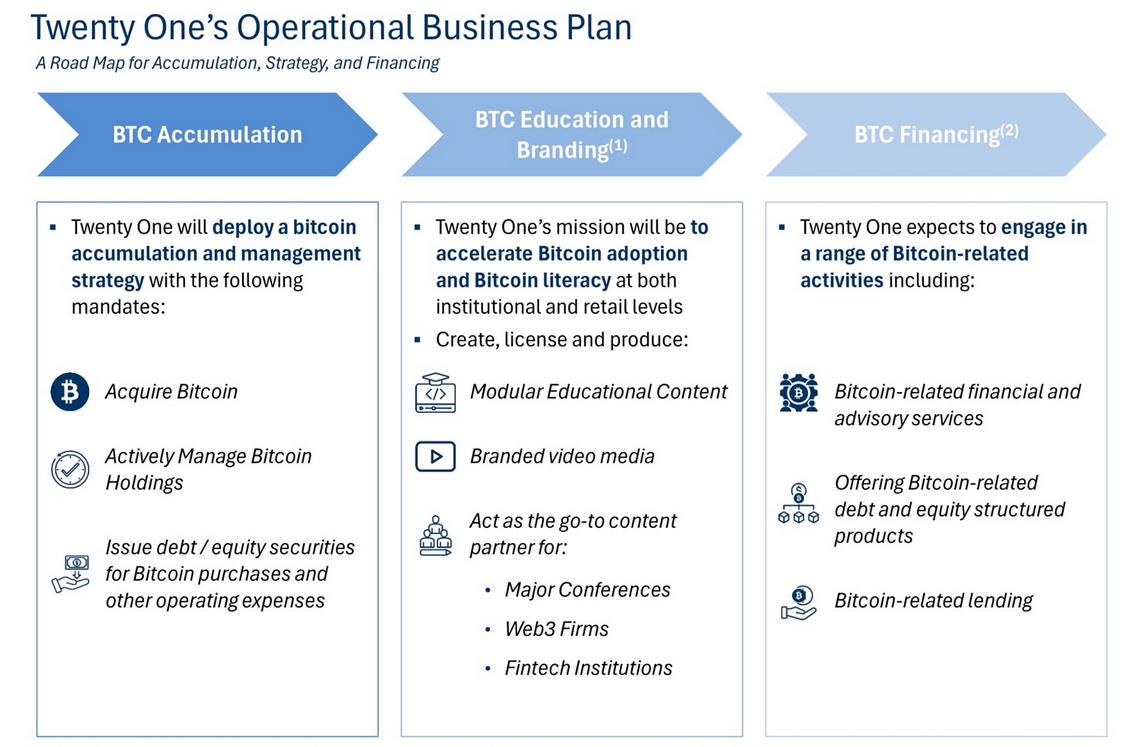

Unlike MicroStrategy, which focuses primarily on Bitcoin acquisition, Twenty One Capital has broader ambitions. The firm plans to roll out Bitcoin-based financial products, including debt and equity offerings, a lending service, and educational initiatives.

According to the company, these services are designed to support both institutional and retail adoption of Bitcoin.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Mallers Joins Bid to Outshine Saylor’s Bitcoin Strategy appeared first on Altcoin Buzz.