JPMorgan has done the unthinkable! They entered the blockchain sector yesterday. Their CEO, Jamie Dimon, was a critic. Not necessarily on blockchain technology, but more towards crypto. So, what is the unthinkable? Well, in cooperation with Chainlink and Ondo Finance, Kinexys by JPMorgan went onchain. It completed a novel cross-chain, atomic settlement of tokenized treasuries. Kynexys is JPMorgan’s blockchain-based financial infrastructure unit.

This exploded heavily on X yesterday. It still fills my timeline today. Everybody and his dog is talking about it. That’s how big this is. And it is. It shows that RWA is real and is ready to take off. This brings bank payment rails to tokenized asset markets. So, let’s take a closer look at what this means for these two altcoins, Chainlink ($LINK) and $ONDO.

Chainlink ($LINK)

Chainlink ($LINK) is an oracle. But not just any oracle, it’s the absolute market leader. If we look at the second place oracle, measured by market cap, Pyth, it’s 9.5x behind Chainlink. To clarify, that’s measured by market cap.

We’re excited to announce the successful completion of a cross-chain Delivery versus Payment (DvP) transaction in collaboration with Kinexys by J.P. Morgan (@jpmorgan) and @OndoFinance.https://t.co/W2IC8NeO18

This milestone marks the first-of-its-kind cross-chain, atomic… pic.twitter.com/0J1tA3AYWk

— Chainlink (@chainlink) May 14, 2025

Oracles are essential for blockchain. The reason is simple, and I have explained this a lot of times. A blockchain can’t communicate with the outside, or the real world. That’s where oracles give a helping hand. They find real world data, verify the data and pass it on to the blockchain. This can be anything. For example, weather reports, sports results, or prices for financial assets. Like stocks or crypto.

Chainlink has the biggest adoption in this sector. Its ecosystem is massive. As of April, this year, there were 2367 projects listed that use Chainlink. However, if we look at the $LINK price, it doesn’t really reflect that. Its current price is $16.50 with a $10.8 billion market cap. $LINK’s ATH was at $52.70, already 4 years ago. It’s up by 30% over the last 30 days, so that’s good.

But, will this JPMorgan news be a catalyst for $LINK’s price action? Chainlink provided the infrastructure for the JPMorgan transaction. We are big fans of Chainlink at Altcoin Buzz. So, yes, we won’t mind if it does.

Ondo Finance ($ONDO)

Ondo Finance ($ONDO) is all about RWAs or tokenized assets. Once again, with Ondo, we have the market leader in the RWA sector on our hands. JPMorgan sure knows who to work with. We covered Ondo quite a bit recently. So, you may want to catch up with some recent videos about Ondo. For example, this one about how many $ONDO will make you a millionaire. Or this one where I look a bit deeper into Ondo.

Ondo currently keeps breaking almost daily new TVL ATHs. It’s now at $1.186 billion. That means that institutions are putting their money into Ondo products. For example, their $USDY and $OUSG stablecoins. For the recent transaction, the three projects used $OUSG. Short-term US Treasuries back this stablecoin.

$Ondo TVL is putting in new all time highs every single day

Something big is cooking

https://t.co/EnAxngkwNL pic.twitter.com/W5X1H9RJbw

— Not Telling (@nottellingyou73) May 10, 2025

Ondo combines various factors. On one side, the openness of public blockchains. And on the other side, the compliance and security standards required by institutions. The current $ONDO price is around $1. However, new ATHs of over $2.14 seem not too far away.

1/ Kinexys by J.P. Morgan (@jpmorgan), Ondo Finance, and @chainlink are teaming up to connect bank settlement infrastructure to Ondo Chain.

Today, we are excited to announce the debut transaction on Ondo Chain testnet — a cross-chain, atomic DvP settlement of OUSG. pic.twitter.com/AIiOntgUMz

— Ondo Finance (@OndoFinance) May 14, 2025

Chainlink and Ondo Finance Working Together

Chainlink and Ondo Finance now working together is a big deal. They’re both leaders in their respective sectors. As already mentioned, for oracles and RWA. Chainlink is a big provider of RWA infrastructure. It’s even listed on CoinGecko as the leader in one of their RWA lists.

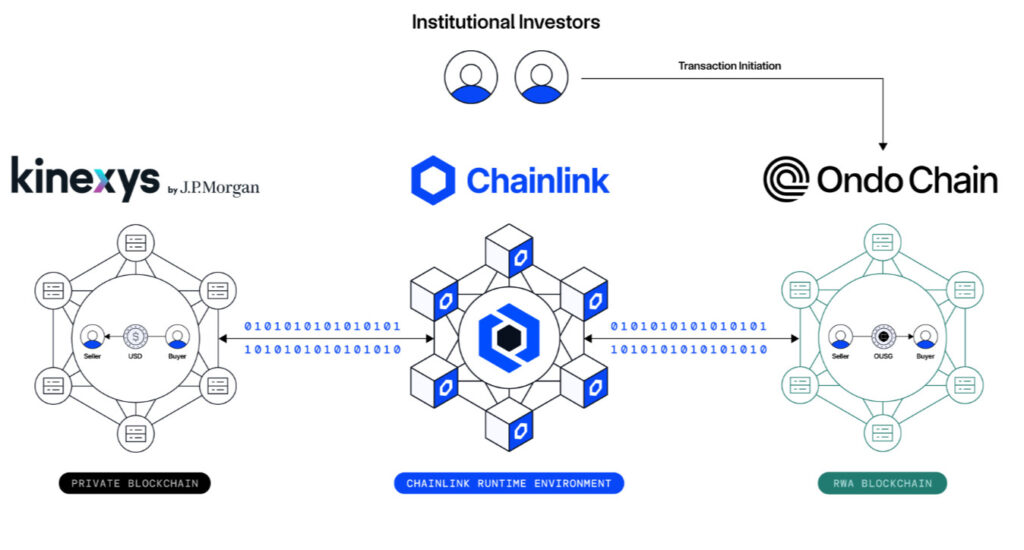

Like, as in this transaction, Chainlink offered the cross-chain infrastructure. It has two features for this,

- CRE — This is their Chainlink Runtime Environment. That’s a secure off-chain computing environment. It coordinates activity across blockchains and existing systems. Chainlink used CRE for this transaction.

- CCIP — This is their cross-chain interoperability platform. This connects various chains and allows for token or message transfers.

Source: X

Ondo Finance used its testnet for this cross-chain, atomic DvP settlement of $OUSG. Kinexys has a permissioned chain. Ondo’s chain is part public and part permissioned. The permissioned part is to accommodate compliance. It will now start to look into more advanced DvP transactions and use cases. DvP is a Delivery Versus Payment mechanism, used for this transaction. It makes sure that both parties fulfill their obligations concurrently or payment goes first before delivery of the assets. That’s similar to what we do in crypto, since transactions can’t be reversed, so fiat payments must go first.

Combining both their knowledge and their tech opens up new possibilities. This surely connected TradFi with DeFi.

Will Chainlink Be Able to Challenge $XRPs Place?

Chainlink has a lot going for itself. This co-op with JPMorgan and Ondo Finance may be positive in the longer term. Its $LINK price development may benefit from this. However, it will be hard to challenge $XRP. $XRP’s current market cap is $145.6 billion. This week, it even managed to get into 3rd spot by market cap for a day. It overtook Tether’s $USDT. That’s a massive achievement.

JUST IN: $XRP surpasses $USDT in market cap, securing the #3 position in the rankings pic.twitter.com/pNi5XCg08K

— Crypto Briefing (@Crypto_Briefing) May 12, 2025

On the other hand, $LINK’s current market cap is $10.8 billion. That’s 13.5x away from the $XRP market cap. That’s a massive gap to overcome. So, maybe that’s possible in a far far away future, but it’s not imminent. Because, even if $LINK manages to pull off a 14x, $XRP will also grow. In other words, the gap may become smaller, but there will still be a gap.

So, what do you think of this RWA transaction? Is it as big as it was made out to be? Let me know in the comments. Also, do join our conversation on our X and Discord channels.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post JPMorgan Releases Crypto Bulls by Integrating Chainlink & ONDO appeared first on Altcoin Buzz.