Venezuela, one of the world’s most struggling economies, has seen a major decline in the use of its national currency in daily life.

With inflation running at more than 200% a year, people now pay for groceries, rent, and even salaries in stablecoins like Tether’s USDT. Locally, many simply call it the “Binance dollar.”

What began as a tool for crypto-savvy users has turned into the default money for millions. Market stalls, small shops, and even mid-sized businesses accept USDT because it holds value and is easy to transfer. Condo fees, security services, and gardening bills are now quoted in stablecoins instead of bolívars.

Binance Emerges as a Popular Option

Officially, Venezuela’s central bank sets the exchange rate at 151 bolívars per U.S. dollar. But in practice, most people look at Binance or parallel market rates, which are far higher. Vendors and consumers alike prefer the liquidity and consistency of stablecoins. For them, it feels like a more reliable dollar than cash itself.

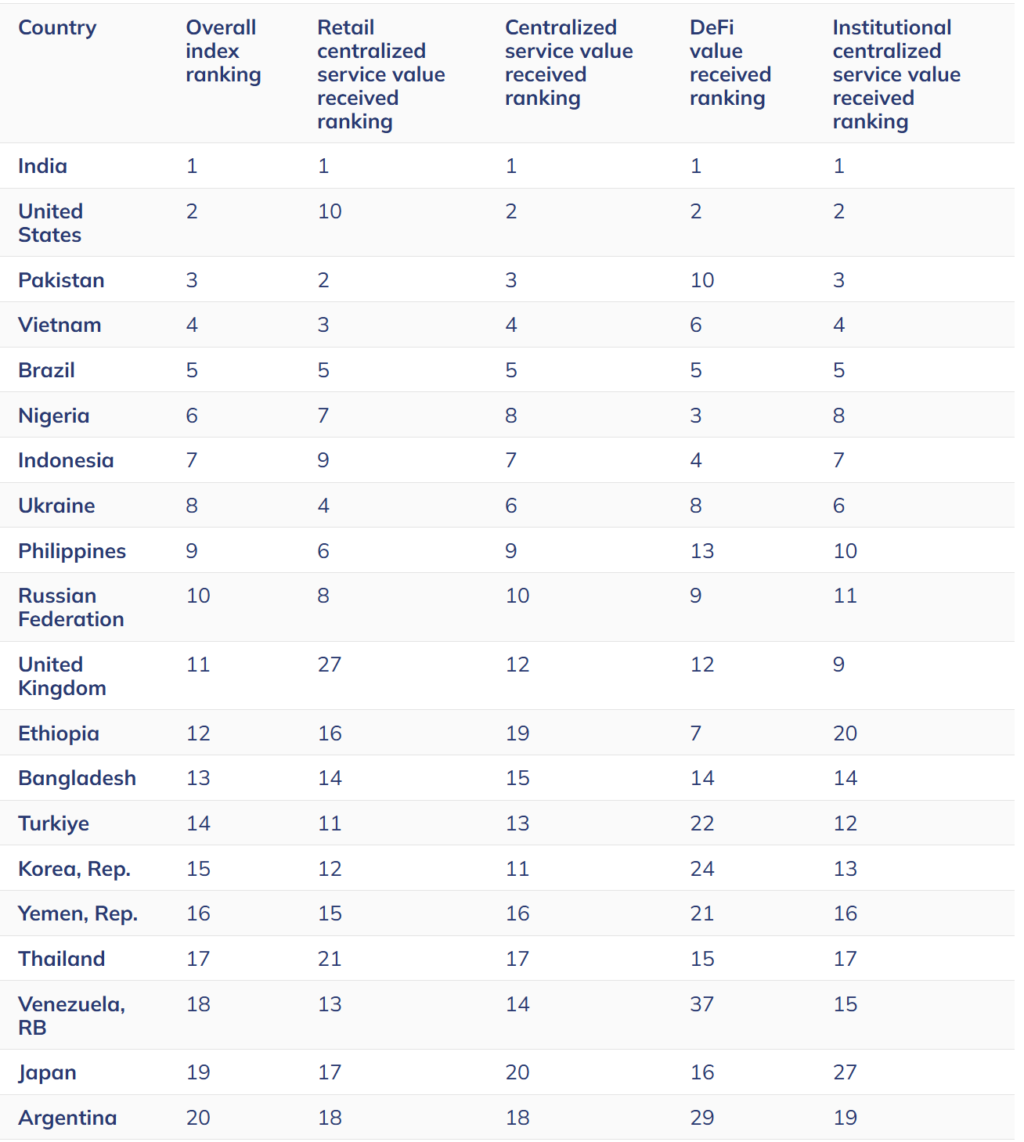

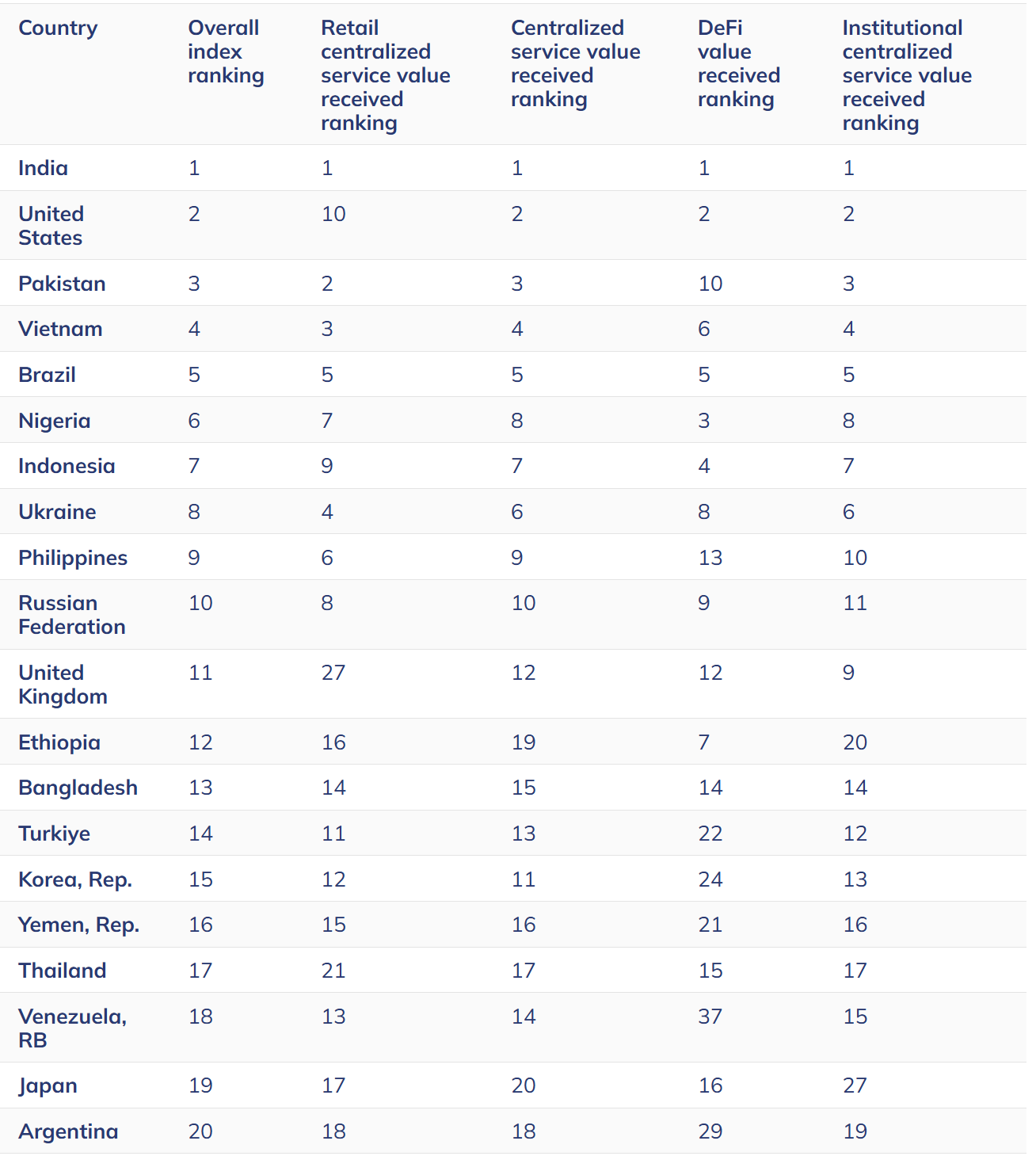

This shift reflects a deeper trend seen in other struggling economies. In Argentina, Turkey, and Nigeria, stablecoins have also become popular as people try to escape inflation and capital controls. Crypto research firm Chainalysis ranks Venezuela among the top 20 countries for crypto adoption, with nearly half of small transactions involving stablecoins.

¡En nuestras tiendas estamos aceptando #Criptomonedas como forma de pago! #Bitcoin #DashCcs #Ethereum #Litecoin #BitcoinCash #Venezuela pic.twitter.com/xS9mFlL2zo

— Traki (@TRAKIenganchate) October 11, 2018

The rise of USDT has even touched larger industries. Oil companies and some local banks reportedly use stablecoins to skirt sanctions and avoid restrictions on foreign currency. Capital controls that once locked people into the collapsing bolívar now push them toward digital dollars.

The Stablecoin Irony

For most people, the situation is ironic. Governments often warn against crypto for being volatile, yet in Venezuela, it has become the most stable option. For many families, holding money in USDT is the only way to plan for the next week, let alone the next month.

As the bolívar fades from use, stablecoins are filling the gap. They may not solve Venezuela’s economic crisis, but for millions, they are keeping commerce alive when traditional money no longer works.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies presented are the thoughts and opinions of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments; therefore, please conduct your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Inflation Soars, Stablecoins Become Venezuela’s Currency appeared first on Altcoin Buzz.