The crypto markets are seeing a positive impulse. The Fed announced a 25 basis point rate cut. The interest rate went down to 4% from 4.25%. And this year, analysts expect even more rate cuts.

That is good news for the crypto sector, since it becomes cheaper to borrow money. This means that more liquidity becomes available. Now, some of that liquidity will trickle into crypto.

So, millionaire dreams are about to become reality. Especially if you hold AAVE. Hence, in this video, I will look into how many AAVE will make you a millionaire.

What IS Aave ($AAVE)

Aave ($AAVE) is one of the biggest, if not THE biggest lending protocol in DeFi. It launched in 2017 as ETHLend on Ethereum. In 2020, it was rebranded to Aave. Nowadays, you can find it on 17 different EVM chains. Furthermore, from August 2025 it’s also available on the first non-EVM chain, Aptos.

Aave is live on @aptos. pic.twitter.com/azgKS0JKFc

— Aave (@aave) August 21, 2025

On Ethereum, it ranks second for TVL, after Lido, the liquid ETH staking platform. That’s a rather impressive feat. Its TVL is $36.34 billion. That’s almost twice as much as number 3, EigenLayer and very close to Lido, which has $39.5 billion in TVL.

Aave’s TVL started to grow in early November 2024. It went from $13 billion to its current TVL of $36 billion. That’s almost a solid 3x. With the current bull market around the corner, the TVL is bound to grow even more.

Its founder is Stani Kulechov and so far, Aave has had 3 different versions. The current version is V3. A new version, V4, is on its way. However, more on that in a moment.

Some of its unique features are flash loans. With a flash loan, you don’t need collateral, but you need to repay the loan within the same transaction. Collateral swapping is another unique feature. This allows you to change your supplied collateral asset to another asset. You can do this in a single transaction. So, there’s no need to withdraw and re-supply your funds. There’s also no need to pay back your initial debt.

Ronnie uses Collateral Swaps pic.twitter.com/NQk1wwCo57

— Aave (@aave) March 29, 2023

So, that gives you a bit of an idea what Aave is all about. Now, let’s take a look at what has been happening at Aave recently.

What’s New with Aave?

A big news update for Aave is the launch of V4 in Q4, 2025. Currently, Aave is currently in the final stages of testing the V4 version. Deployment will be next in line. I mentioned V4 already a moment ago, so let’s take a closer look at what V4 brings to the table. This will be among the major DeFi events for this year. So, what’s new?

Aave Labs just published the V4 launch roadmap 👻

It highlights milestones completed so far and the upcoming steps as Aave V4 progresses through its final stages of review, testing, and deployment. pic.twitter.com/N5EOlqNFJt

— Aave (@aave) September 15, 2025

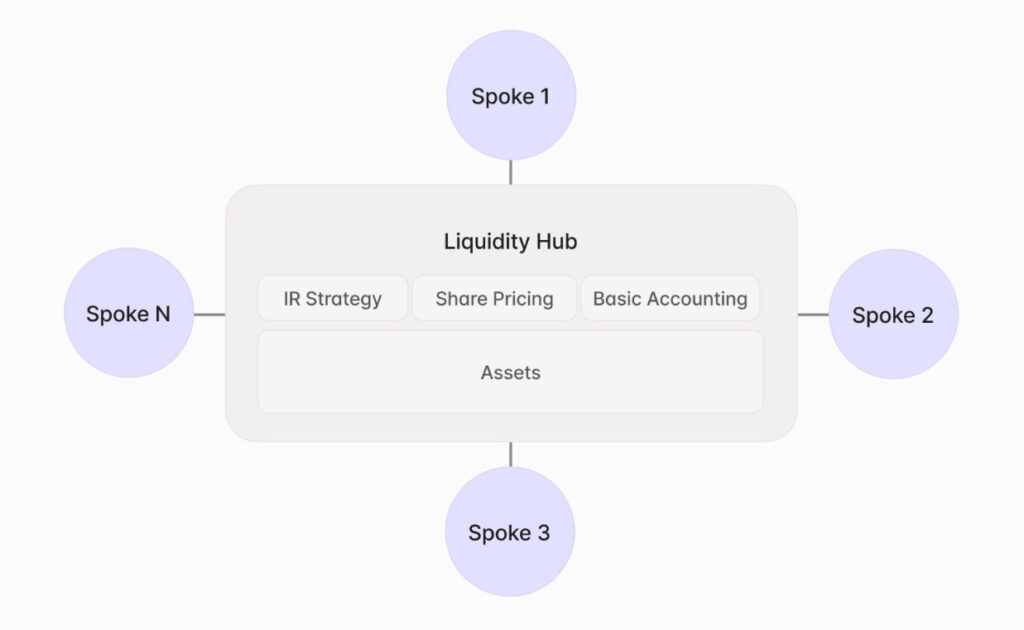

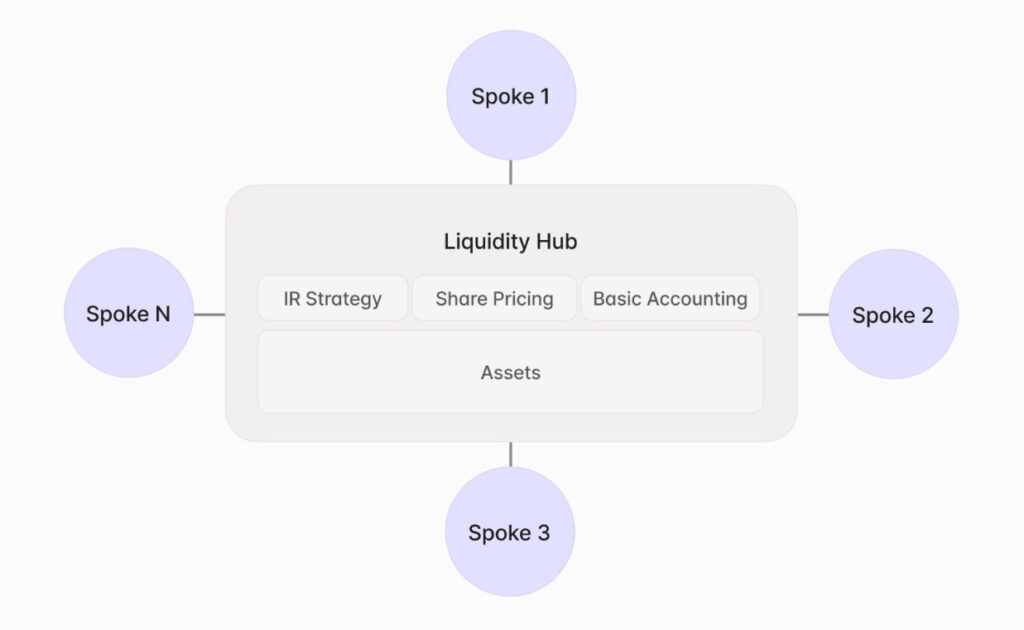

Hub-and-Spoke architecture. This will improve liquidity and reduce gas fees by around 30%. The Liquidity Hub works behind the scenes. We, as users, don’t interact with it directly. When you supply an asset to V4, it’s stored in the Liquidity Hub. However, you interact with various Spokes. These will be your entry point to the protocol. Check the V4 roadmap here.

In our last blog post, we introduced V4’s Hub and Spoke architecture.

Different Spokes can implement their own Risk Premium configurations for specialized risk management.

This allows each Spoke to optimize for its specific use case without sacrificing liquidity.

— Aave (@aave) July 24, 2025

The Spokes connect to the Liquidity Hubs. When you supply or borrow, it will be through a Spoke. Each Spoke has different rules and risk settings. So, the Spokes handle all the interactions and offer various settings. For example, they manage,

- User positions

- Track collateral

- Integrate with price oracles

- And they also include safety controls. It can pause operations if needed.

Source: Aave blog

There’s also a Reinvestment Module. This optimizes idle liquidity, which results in higher LP returns. Furthermore, there’s also a faster and safer liquidation engine.

Aave also entered the realm of RWA with its Horizon RWA market. This market connects institutional tokenized assets with DeFi on Ethereum. It’s an institutional-grade compliance framework that enables overcollateralized lending against RWAs.

The Horizon RWA market by Aave Labs is live. pic.twitter.com/veUi9quMxs

— Aave (@aave) August 27, 2025

So, altogether, this should strengthen Aave’s position as the leader in DeFi lending.

Technical Analysis

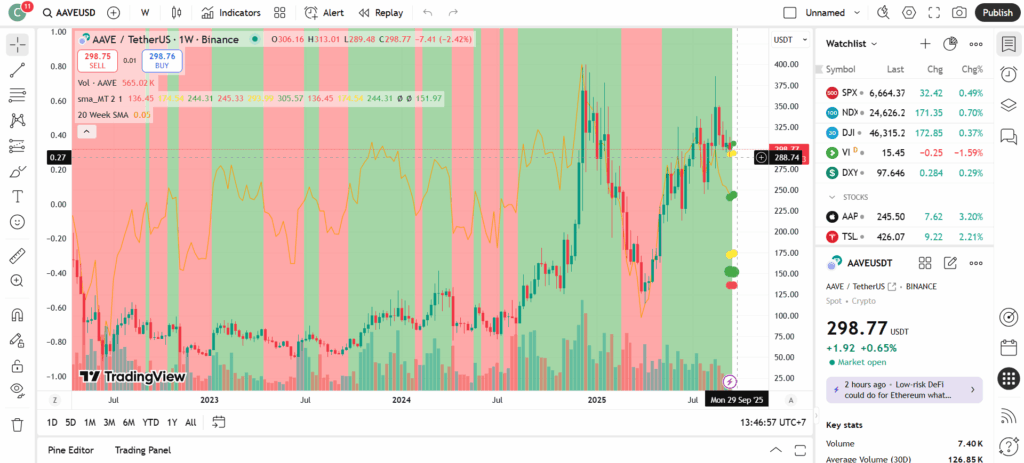

Before we can see where AAVE can go, we need to know where it has been. So, I start with the current $AAVE price of $304. It has a market cap of $4.6 billion, and all tokens circulate, so that’s excellent. Its ATH is $661.69, from May 2021. So, well over 4 years ago. Its current price is 54% below that ATH.

During the last year, AAVE is up by 121%. For a protocol of this size, that impressive. It shows, among others, that DeFi is still a popular choice for investors.

Source: TradingView

AAVE recently tested a critical support level around $249. After that, we saw a strong urge to $357 in August. The RSI is at 63, which is good. It shows positive momentum without being in the overbought zone. The picture below shows the RSi.

Source: Geckoterminal

Current resistance levels are around $330, $340. Breaking through these may open the way to $357. Once this resistance level breaks, it could move to $370. For this year, that may be the max range. However, it’s likely that the bull run continues into 2026, and we may even see more upwards movement.

How Many AAVE to Become a Millionaire?

So, here’s the part that you have been waiting for. How much AAVE does it take to become a millionaire? We saw already that with Aave, you have a DeFi giant. Furthermore, some exciting updates are about to hit the streets, with its V4.

So, it’s time to start the nitty-gritty and get the calculator out. I start, of course, with the current price. At $304 you need 3289.5 AAVE to become a millionaire.

At the $330 support, you will need 3030 AAVE.

Now, let’s move to the August top of $357. Now, 2801 AAVE will make you a millionaire.

I said earlier that $370 could be the top for AAVE in 2025. This means that you need 2702.7 AAVE to get the millionaire tag.

So, if the bull run continues in 2026, how about the following prices for AAVE?

- $400 needs 2500 AAVE.

- $500 needs 2000 AAVE.

- $600 requires 1667 AAVE

- $661, its ATH 1513 AAVE

- After this, it’s price discovery. Let’s go crazy and look at $700, this needs 1428.5 AAVE.

- And $800 needs 1250 AAVE.

Do you think that AAVE can go higher than $800 in this bull cycle? If so, let me know in the comments what your top for AAVE is. Also, do join our social media channels on X and Discord and join our discussions.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post How Many AAVE to Become a Crypto Millionaire? appeared first on Altcoin Buzz.