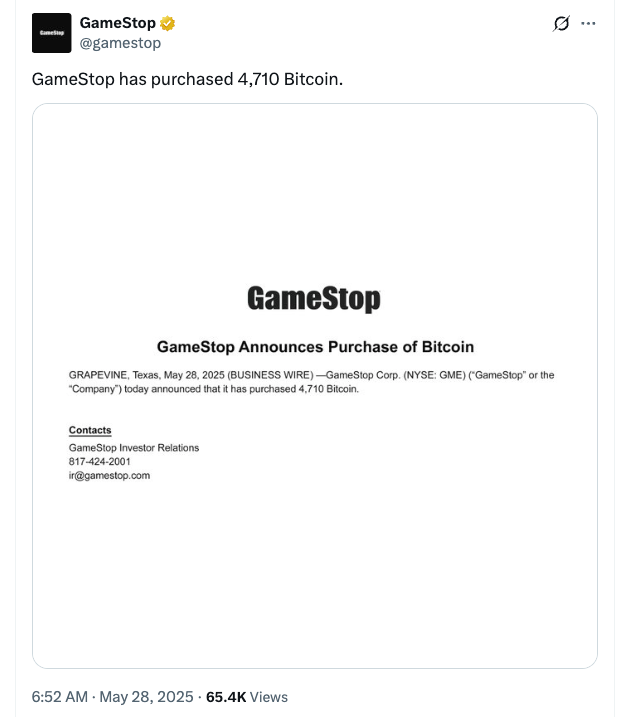

Video game company GameStop has confirmed its entrance into the Bitcoin market, purchasing around 4,710 Bitcoins. While it did not disclose details on the acquisition’s cost, the batch purchase is estimated to have cost $513 million.

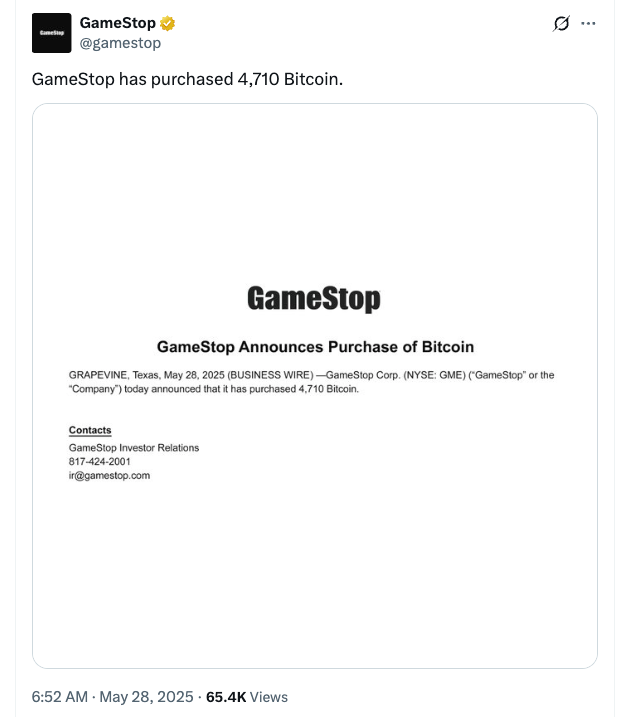

GameStop disclosed the purchase in a recent Securities and Exchange Commission (SEC) filing. Notably, the purchase comes weeks after the consumer electronics retailer said its retail board had approved adding Bitcoin as a treasury reserve asset. At the time, GameStop announced a $1.3 billion convertible notes offering, revealing plans to fund its BTC purchase using debt financing.

Interestingly, GameStop’s recent Bitcoin purchase isn’t its first attempt at entering the digital market. In 2022, the electronics company launched crypto wallets to help users easily manage their cryptos and NFTs. However, the program was shut down in 2023 due to regulatory concerns.

GameStop’s shares decline.

While the news of GameStop’s Bitcoin acquisition was widely received in the crypto community, the company’s stocks appeared to have taken a hit. Following the announcement on Wednesday, GameStop’s shares declined by 4%. However, the company’s year-to-year gain currently stands around 10%.

GameStop has been exploring investing in new assets since March to expand its business. This aligns more with a broader trend of corporate giants embracing digital assets, such as Bitcoin. Companies such as Strategy (formerly MicroStrategy) have increased their Bitcoin holdings recently.

Similarly, Trump Media and Technology Group recently announced plans to raise $2.5 billion to buy Bitcoin. The company will reportedly sell $1 million in convertible bonds and $1.5 million in shares to raise the capital.

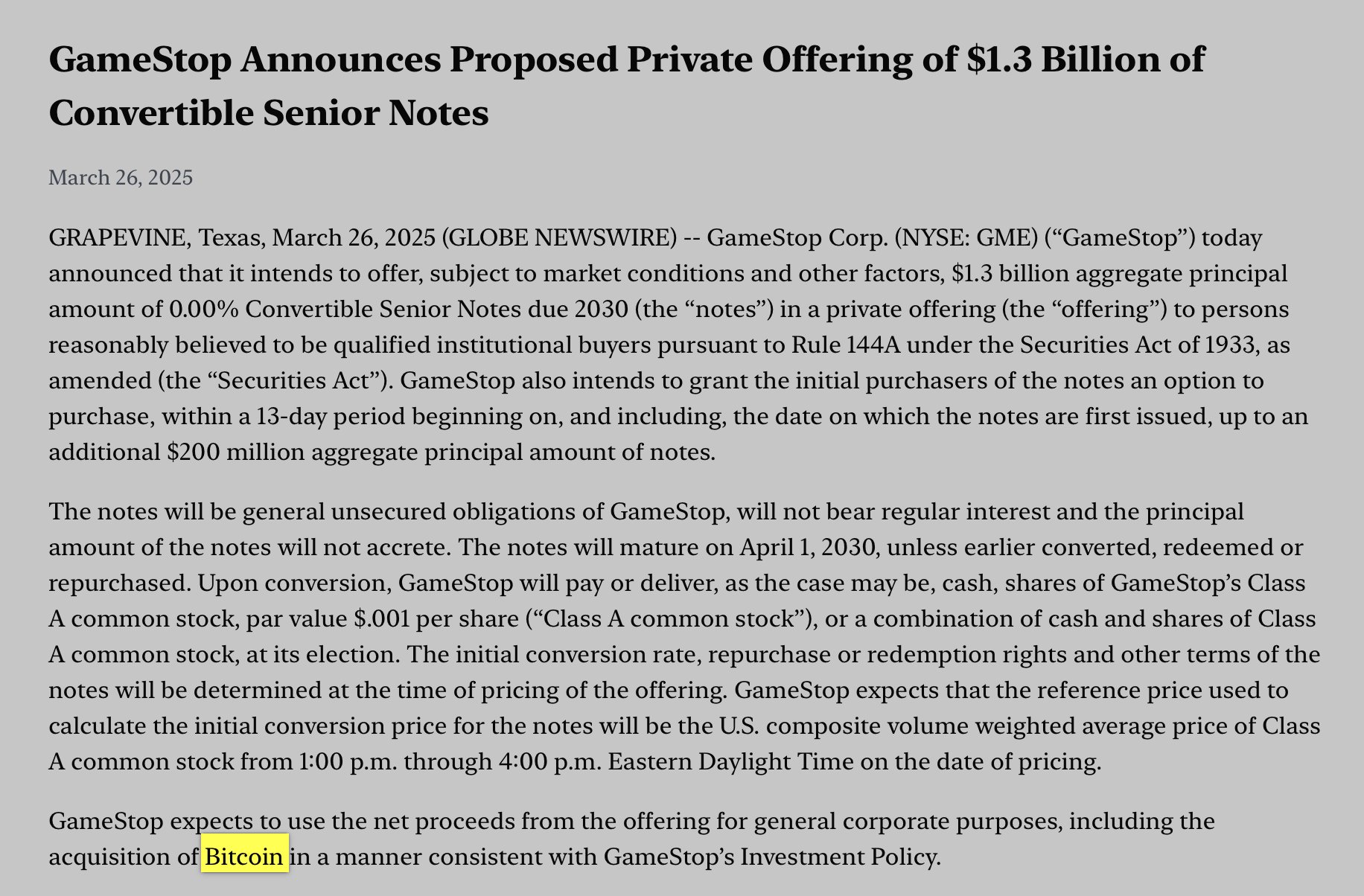

Metaplanet Doubles Down on Bitcoin with Zero-Interest Bonds

Japanese investment firm Metaplanet is making bold moves to increase its Bitcoin holdings. Just after raising $50 million, the company issued another $21 million in zero-interest bonds to Evo Fund, allowing it to borrow without paying interest.

These funds are part of Metaplanet’s larger strategy to accumulate 10,000 BTC by the end of 2025. So far, it has raised $135.2 million this year alone and holds about 7,800 BTC. With a newly launched U.S. subsidiary aiming to raise $250 million, Metaplanet is positioning itself as one of the most aggressive Bitcoin-focused companies in the world.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post GameStop Buys 4,710 Bitcoin in First Crypto Move appeared first on Altcoin Buzz.