But Ethereum, thanks to its recent switch to proof-of-stake (PoS), is far tougher to attack. Experts say it is stronger than Bitcoin’s proof-of-work (PoW) network.

Justin Drake, a key Ethereum researcher and architect of the Ethereum Merge, said that launching such an attack on Bitcoin would be “much cheaper” than on Ethereum, estimating the cost at around $10 billion.

What Makes Ethereum Harder to Attack?

Ethereum’s shift to PoS means validators, not miners, secure the network by staking Ether (ETH) instead of using energy-intensive mining rigs. This change introduced a new layer of defense: social and economic penalties for bad behavior.

Drake explained that if someone attempts a 51% attack on Ethereum, the community can identify the attacker through the “social layer” — basically, the human consensus deciding which version of the network to support. This social layer allows Ethereum to “slash” (penalize) the attacker by confiscating their staked ETH. It’s a powerful deterrent not available in Bitcoin’s PoW system.

1. Respectfully, BTC is completely screwed because of its security budget. It would only cost $8B to 51% attack BTC today. When this gets down to $2B (AKA, BTC’s security market cap becomes 0.1% of its asset market cap), a 51% attack is virtually certain to happen. This will…

— gphummer.eth

(@gphummer) May 14, 2025

Adding to this, Atan Sitbon, CEO of Lightblocks, said that Ethereum’s security relies not just on cryptography or protocols but also on “the community’s powerful social and economic coordination mechanisms.” This human factor gives Ethereum a dynamic way to respond to attacks beyond pure code.

How Does Bitcoin Compare?

Bitcoin’s PoW consensus relies on mining hardware and massive energy consumption to secure the network. While it has a longer track record of reliability, Bitcoin doesn’t have Ethereum’s social slashing power.

Grant Hummer, co-founder of Etherealize, estimated it would cost about $8 billion to launch a 51% attack on Bitcoin, and warned such an attack would become “virtually certain” if the price drops to $2 billion. This cost reflects the immense computing power needed to control the majority of Bitcoin’s network.

Still, experts like Hassan Khan, CEO of Bitcoin liquidity protocol Ordeez, stress that while a 51% attack is theoretically possible on either chain, the practical barriers are enormous. For Bitcoin, the sheer energy and equipment costs make a sustained attack highly unlikely. For Ethereum, the PoS system adds economic and governance hurdles that discourage such attempts.

Why This Matters for Investors and the Crypto Market

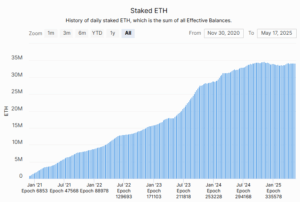

With nearly 34 million ETH staked — worth about $90 billion — the economic stake in Ethereum’s security is massive. Attempting to control that much staked ETH would likely cause its price to rise, further increasing the cost of an attack.

Source: beaconcha.in

This ongoing debate highlights how Ethereum’s design aims for a balance between security, decentralization, and innovation, offering a promising model for the future of blockchain.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Ethereum More Secure Than Bitcoin Against 51% Attacks? appeared first on Altcoin Buzz.