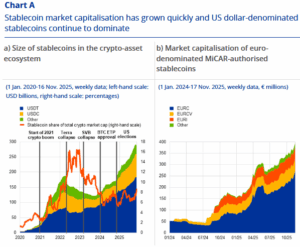

Their market value has climbed to new record highs, crossing 300 billion dollars and capturing around 8% of the entire crypto market. This rapid rise has brought excitement as well as concern.

Investors see stablecoins as useful tools for trading, payments and moving money quickly, but regulators worry that their fast growth and growing links to traditional finance could increase financial risks. As the market expands, the question becomes whether stablecoins can scale safely or whether their own weak spots could lead to trouble.

Why Stablecoins Matter More Than Ever

Stablecoins are tokens designed to keep a steady price, usually tied to a major currency like the US dollar. This simple idea has made them essential to the crypto world. Today, about 80% of trading on major crypto platforms involves stablecoins because traders use them to move in and out of positions without returning to a bank for money every time. Two names dominate this space.

The ECB said stablecoins could destabilize the financial system by drawing retail deposits away from eurozone banks. Stablecoins’ market capitalization has surpassed $280 billion. A run on stablecoins could lead to a fire sale of reserve assets, hitting U.S. Treasury markets and…

— Wu Blockchain (@WuBlockchain) November 24, 2025

Tether holds 184 billion dollars in value, and USD Coin holds 75 billion dollars. Together, they represent almost all stablecoin supply. A big trend pushing growth is new regulatory clarity. The European Union launched its MiCAR rulebook last year, giving issuers clear obligations, while the United States recently passed the GENIUS Act. Hong Kong has put rules in place as well. This wave of regulation has helped investors feel more comfortable, lifting demand around the world.

Source: DeFillama

While people often mention cross-border payments and inflation protection as stablecoin use cases, real data tells a different story. Only a small share of activity comes from everyday users. One study shows that less than 1% of stablecoin volume comes from retail-sized transfers. For now, stablecoins remain tools built mainly for traders rather than the general public.

Source: ecb.europa.eu

Where the Risks Begin to Surface

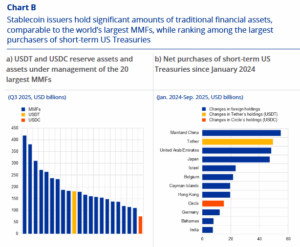

Rapid growth comes with challenges. A stablecoin must always be redeemable at the price it promises. If users lose trust, they may all rush to withdraw at once, leading to a run and breaking the coin’s price. This has happened before in crypto and can shake markets quickly. The biggest risk comes from the fact that leading stablecoins hold huge piles of assets in traditional financial markets.

Tether and USDC together rank among the largest buyers of US Treasury bills. If either one faced a run, they might need to sell these assets quickly, which could hurt wider markets. Some analysts even project that stablecoins could reach two trillion dollars in size by 2028, which would increase the stakes.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post ECB Flags Rising Stablecoin Risks Amid Surging Market Growth appeared first on Altcoin Buzz.