Many say Bittensor ($TAO) is the next Bitcoin. It follows similar tokenomics and emissions structure.

Now, TAO has given us a huge opportunity to invest in Microcaps without losing money!

- Bittensor is a standout performer among altcoins, along with BNB.

- The charts for Bittensor have been very bullish. Despite the market downturn, Bittensor appears to be a safer long-term alternative.

- Many say Bittensor ($TAO) is the next Bitcoin due to similar tokenomics and emissions.

What New Investment Opportunity Does TAO Offer?

- Previously, staking $TAO gave emissions in $TAO (only).

- TAO allows investing in Subnet Microcaps without losing money. This is only an option, and you can still choose to get TAO as a reward.

- This is safer than risking money by purchasing more volatile subnet tokens.

The Incentive Layer – A bittensor documentary 🎥

Watch now on https://t.co/FSlGQN3uat

Explore how a global network is reshaping the production of intelligence through open collaboration, aligned incentives, and permissionless innovation. Taking the lessons from bitcoin and… pic.twitter.com/RcIGu5x3ho

— Everτ τ, τ (@evert_scott) October 29, 2025

So, How Is Bittensor $TAO Changing Its AI Economy?

Previously:

- New liquidity emissions (TAO) flow into each subnet’s liquidity pools based on subnet price.

- This meant that subnets where the ALPHA price was higher got more TAO emissions.

- This process had drawbacks and bore the risk of gaming the economy (Net inflows is a better model, as with the previous model. Subnets with high ALPHA prices and higher liquidity were able to easily absorb negative net inflows).

How does the Bittensor Token Economy Work now?

- Under the new flow-based model, subnets that have negative net TAO flows (TAO that has flowed into the subnet minus TAO that has flowed out, from staking/unstaking activity) for sufficiently long will receive zero TAO emissions and consequently zero alpha injection. This means:

- No liquidity growth for the subnet pool.

- Higher slippage for users staking.

- Difficulty attracting new participants.

.@opentensor $TAO helps leverage economic incentives and decentralized networks for open and accessible #AI development.

Grayscale Bittensor Trust is open for private placement for eligible accredited investors.

Learn more and see important disclosures: https://t.co/GN66eNEdSt pic.twitter.com/qkv9WofILk

— Grayscale (@Grayscale) October 19, 2025

Do TAO Alpha Token Emissions Work?

- ALPHA emissions are given to subnet participants for their work.

- Each subnet receives ALPHA emissions independently of TAO emissions.

- ALPHA emitted equals full block emission every block.

How Are TAO Alpha Emissions Distributed?

- At the end of each tempo (~360 blocks/ 72 minutes), ALPHA collected is shared as:

- 18% to the subnet owner.

- 41% to miners (determined by Yuma Consensus).

- 41% to validators and their stakers (based on validator holdings).

Definitive doc on how the new Net $TAO Flow emissions will work just dropped.

All questions answered. 🙂 https://t.co/vucEV7L8fC pic.twitter.com/RjcLTlcig7

— Mark Jeffrey (@markjeffrey) November 4, 2025

Can Bittensor $TAO Subnet Owners Maintain Positive Emissions?

- Build genuine utility attracting long-term stakers.

- Create sustainable value, encouraging TAO inflows.

Do Bittensor TAO Validators and Stakers Get Emissions?

- Validators get an allocation from the emissions pool.

- Then, TAO and ALPHA are emitted to stakers based on validators’ holdings.

- TAO emissions come from swapping part of ALPHA through subnet liquidity pools.

Why Is This Emissions Model Important?

- Real demand wins: utility, users, and revenue drive TAO inflows.

- Darwinian design: weak subnets are pruned, strong ones grow.

- Ecosystem boost: more TAO locked in productive places, reducing sell pressure.

After months of ranging, $TAO finally broke out

But the real story isn’t about price — it’s the ecosystem underneath

A Darwinian AI ecosystem where subnets compete, miners earn, and founders fight for survival every day

In “Beginner’s Guide to Bittensor (TAO)”, I cover:

-… pic.twitter.com/Z3kJJiXr8m— 0xJeff (@Defi0xJeff) October 15, 2025

Get a Higher APY Than Usual

- Usual staking APY is around 4-5%.

- You can now choose between TAO or ALPHA tokens as rewards.

- Using the TAO Stats platform lets you choose one validator for staking.

How to Stake TAO and Claim Alpha Tokens?

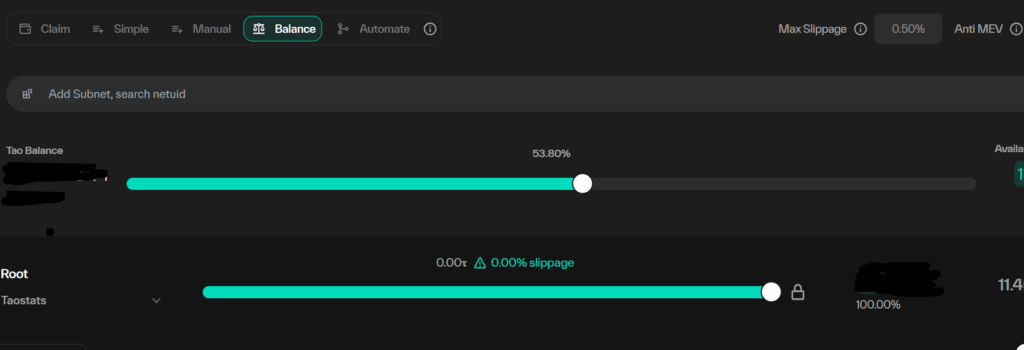

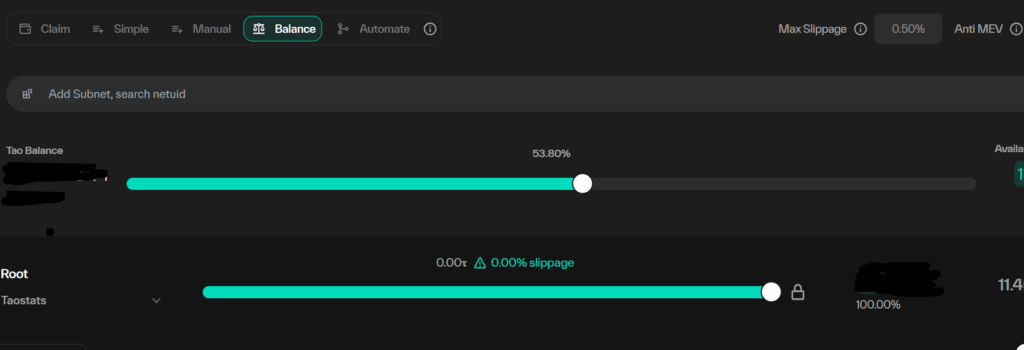

- Go to https://dash.taostats.io/stake/auto-balance.

- Connect your Substrate wallet (Subwallet or Talisman).

- Go to your Balance and choose an amount to stake using the slider.

- Complete the staking process.

Claim Alpha Tokens Instead of TAO

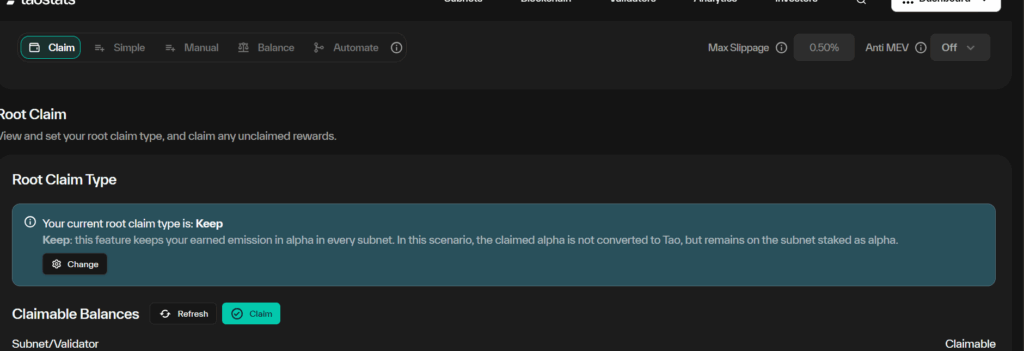

- Go to the “Claim” tab.

- Change Root Claim Type to “Keep” to get ALPHA tokens.

- This choice can give you a higher APY, which you can manually convert to TAO.

- If the claim type is “Swap,” you get TAO emissions, which are safer long-term.

For detailed choices, visit this guide:

https://update-emissions-flow-docs-t.developer-docs-6uq.pages.dev/staking-and-delegation/delegation

Final advice

Play well and choose staking rewards that fit your risk tolerance and goals!

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Earn 80%+ APY Staking Bittensor TAO Today appeared first on Altcoin Buzz.