Bitcoin is dumping again. It has lost the $108k support. The next support is at $105.2k and $102.2k.

It might be the retest to $102k, but we can never be sure. Let’s discover more about how the crypto market is doing this week.

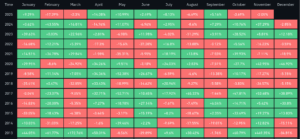

If it looks like November will be another October, then it won’t be. This means the sentiment and macro factors will determine the course of November. The historical price action does not matter anymore.

Currently, the sentiment is hovering around the Fear and Neutral area. This is expected as the sentiment has been in the Greed zone for too long. This is exactly what happened during March-April 2025.

Even though the historical price action might not make sense in November, it is imperative that we take a look at it. It is rare to see a bearish October. But 2025 has been full of surprises. 2025 has seen a:

- Bullish September.

- Bearish October.

Notably, there has never been a bullish September and bearish October.

What does it mean?

We can not consider monthly performances as the base for the upcoming price action. Usually, a slightly bearish October can lead to a highly bearish November and a strong bullish December.

Nevertheless, we need to stick to reality. We also need to be pretty clear about one thing — will the dip continue or, more precisely, when will the market bounce? By market, we mean altcoins. There were early signs:

- TAO pumped well in October.

- ZEC performed exceptionally in October.

- ZK pumped over 70% in a day.

Why ZEC and ZK? The crypto community (whales) is realizing that they are not holding power anymore. Bitcoin miners realized it in early 2025. Even Ethereum OGs know that this cycle is different. This cycle can not sustain big movements indefinitely. So, the best bet would be a more privacy-oriented version of Bitcoin — which is ZEC, and another privacy-oriented version of Ethereum — which is ZK.

But privacy is not the narrative. Privacy has never been a solid narrative in this bull run, either. The early moves of ZEC and ZK are whales making their mark that they are here, and they want to control the market, again.

Ever since the flush of October 10, liquidity, especially perpetual market volume, has been on the decline. Perpetual markets often trigger altcoin rallies. So, for a steady uptrend, we need to see:

- Rising perpetual market volume.

- Increase in funding rate for popular alts.

Crypto Market Shows Weakness as Bubble Starts to Burst

But overall, the market does not look healthy. Kadena shut down its operation recently. Soon, many other L1s and L2s will follow Kadena. This is one of the reasons behind CZ’s tweet about buying ASTER.

Full disclosure. I just bought some Aster today, using my own money, on @Binance.

I am not a trader. I buy and hold. pic.twitter.com/wvmBwaXbKD

— CZ 🔶 BNB (@cz_binance) November 2, 2025

CZ knows that the market is struggling. Though Hyperliquid and other DeFi protocols generate substantial revenue, many other projects are losing money. This is unsustainable, and the crypto bubble is bursting. So, let’s wait for the confirmation.

The pullback should close above $110k for the market to turn bullish. Any price under can force BTC to retest $102.2k. Altcoins as a whole will follow BTC. There will be exceptions like ZEC. For now, there is no immediate threat of a bear market.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Crypto Market Report – November Week 1 appeared first on Altcoin Buzz.