This is the second part of the report on Crypto trends; here is the first part.

Coingecko’s Q1 2025 report highlights major crypto trends—from dips in spot trading volume to DeFi shake-ups and struggles with on-chain dominance. Even though the market cooled off after 2024’s highs, there were plenty of storylines worth watching. Let’s break down the top crypto trends that will shape the industry in early 2025.

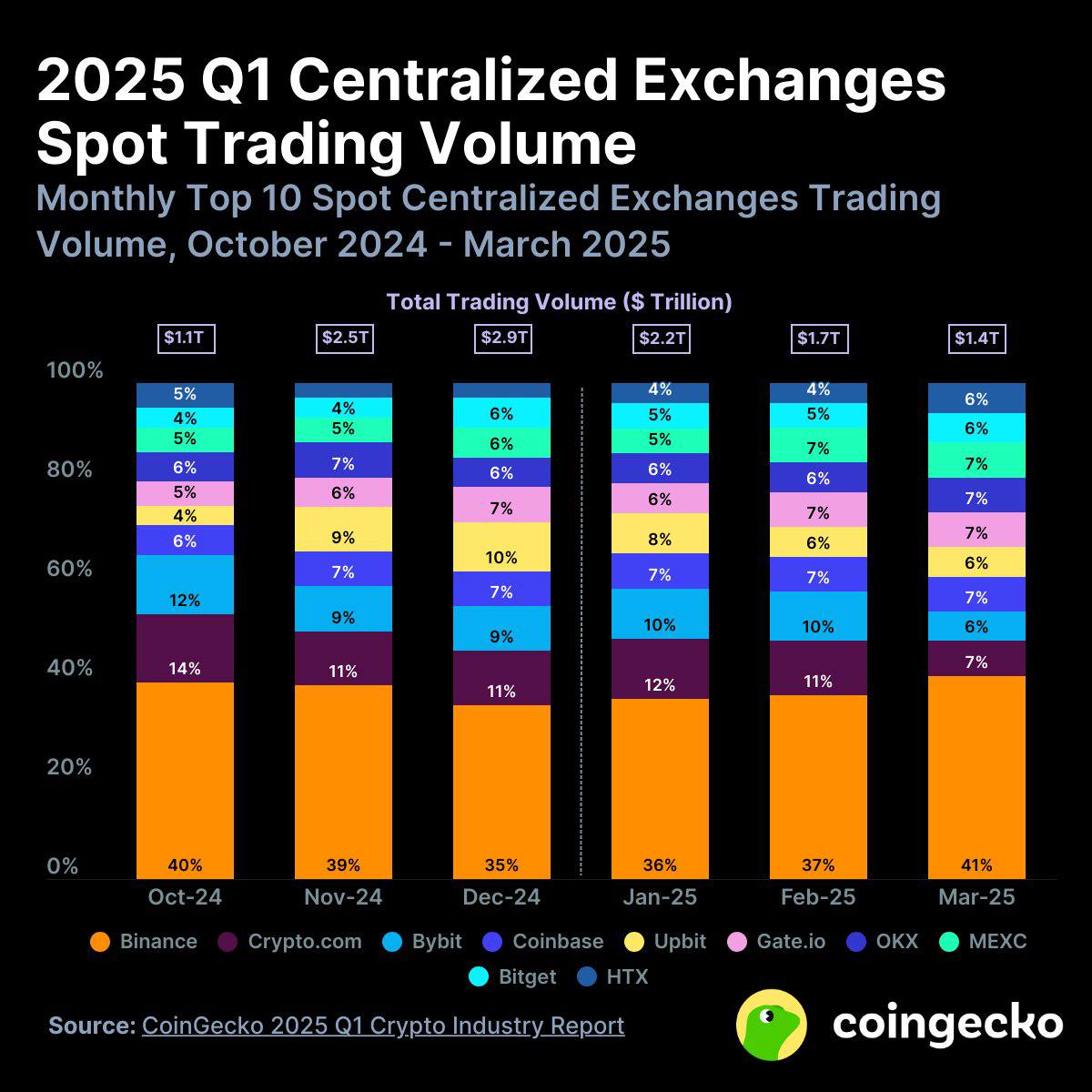

6) Centralized Exchange Spot Trading Dropped to $5.4T

Trading operations on CEXs fell beneath the $5.4 trillion threshold. Among the top 10 CEXs, trading activities for spot trading declined by 16.3% to a total of $5.4 trillion. In Q1 of 2025, Binance continued as the leader but lost ground regarding market share when its performance dropped to 40.7%.

The exchange lost $413 billion worth of trade volume from December to March. The results astonished the market because HTX emerged as the only major exchange to achieve positive growth, with an 11.4% increase in volume. The trading activity at Bybit plummeted by 52.4% after the security breach affected its operations in February. Upbit lost one-third of its total spot trading volume during this period.

Source: X

7) Solana Led DEX Trading, but Ethereum Made a Comeback

DEX dominance emerged as a key trend in the cryptocurrency market during this period. Solana marked 39.6% of all decentralized exchange market transactions. During January, $TRUMP and other political meme coins achieved a 52% popularity, generating the highest reported figure for that month.

In March, memecoins remained popular, which led Solana to reach its maximum DEX trading value of $184.8 billion. Ethereum regained a 30.1% market share in March, while Solana settled for a 23.4% share. New players, such as Sonic and Berachain, also debuted, pushing chains like Optimism and Polygon out of the top 10 in March.

REPORT: Solana led all chains in Q1 2025 DEX trading with 39.6% market share and $293.7B volume, fueled by January’s $TRUMP memecoin frenzy, per CoinGecko. pic.twitter.com/5KQRpzZc9s

— Cointelegraph (@Cointelegraph) April 17, 2025

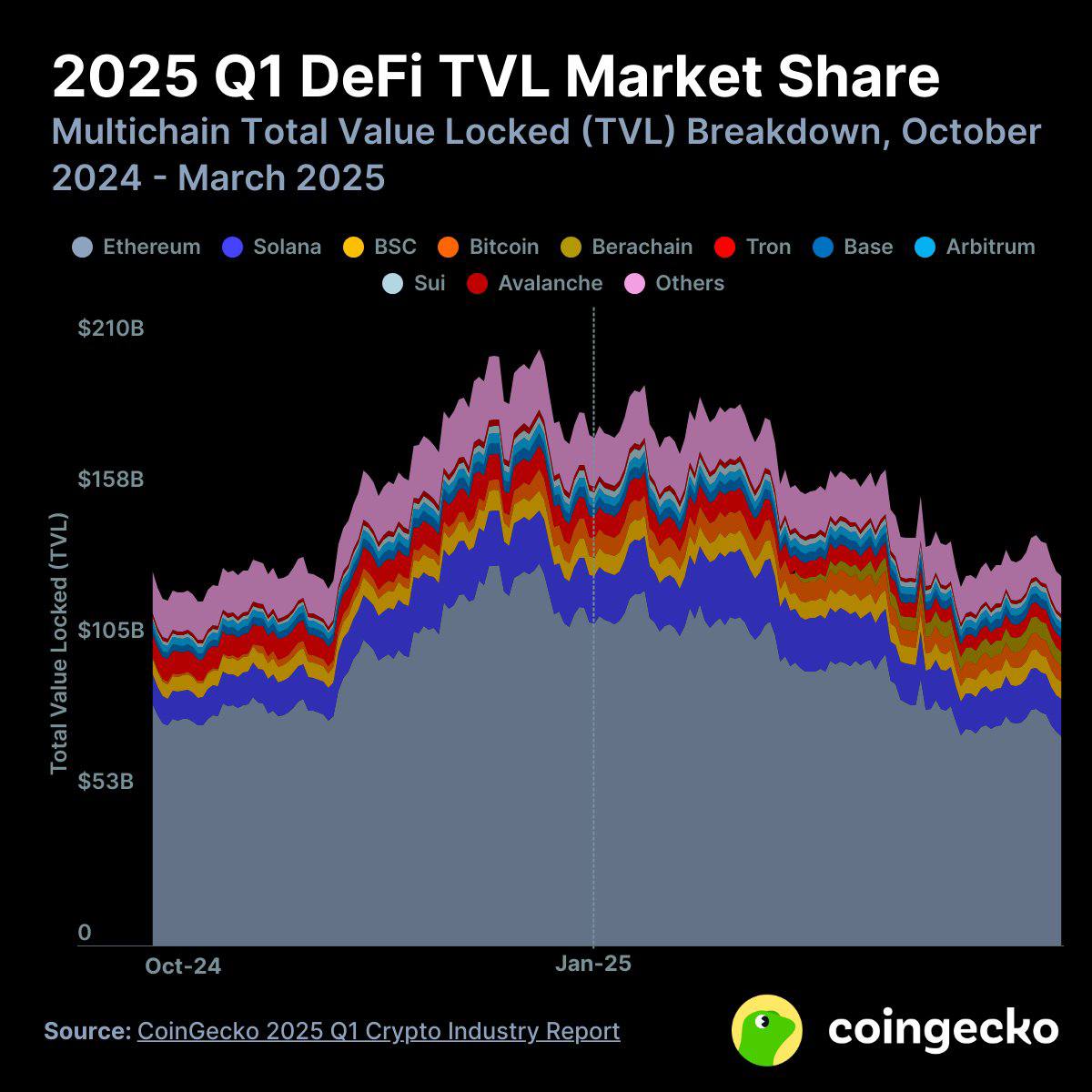

8) DeFi TVL Took a $48.9B Hit

The total value locked (TVL) in DeFi governance decreased by 27.5% throughout the first quarter, falling from $177.4 billion to $128.6 billion. Altcoin prices fell hard.

Ethereum’s total value locked (TVL) decreased by more than $40 billion from its initial 63.5% to reach 56.6% by the end of the quarter. Solana and Base TVL decreased by 23.5% and 15.3%, respectively.

Berachain established its reputation during the red market movement. Berachain, launched in February, achieved $5.2 billion in TVL, securing the sixth position among all other projects. The pre-deposit vaults operated by Boyco accumulated $2.3 billion, indicating better launch results.

Source: X

Conclusion

The Q1-2025 report from Coingecko paints a clear picture—crypto trends this year are shifting. DeFi experienced a decline while CEX slowed down, but Solana brought disruptive changes to DEXs before ETH returned to maintain its position. To overcome an uncertain market period, Berachain launched new blockchain operations as a strategic move toward innovation. As we move into Q2-2025, the market shows signs of cooling down, but strategic competition maintains its full force without slowing down.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This post is sponsored by Sui.

Copyright Altcoin Buzz Pte Ltd.

The post Coingecko’s Q1 2025 Report Reveals Crypto Trends- Part 2 appeared first on Altcoin Buzz.