Crypto runs in waves. Some pass. Some rewrite the whole market. The next big wave looks clear now. However, most people miss the early signs. They wait for the headlines. But smart money never waits. So, that next big wave looks like it’s going to be AI.

Now, smart money moves first. This week, Grayscale made a quiet move into AI altcoins like $TAO and $NEAR. It was small in the news, but huge in meaning. Funds study long-term shifts. They do not chase trends. So, when a major player puts real money behind AI, it signals a new phase. It sees the link between AI growth and token value. Grayscale sees where the next cycle may form. If AI keeps rising, these early moves may look obvious in hindsight. So, let’s break down the signs and ahve a look at Bluwhale first.

TradFi and AI

AI already established itself in TradFi. For example, let’s take a look at the S&P 500. It seems that crypto has some catching up to do.

J.P. Morgan, our favorite banker of the week, dug out some interesting numbers. Currently, there are 41 AI-related stocks. This forms 8% of the S&P 500. However, these stocks now account for 47% of the Index’s market cap. That’s a new record. To clarify, the top 40 to 50 stocks in the S&P 500 will always account for around 50% (or more) of the S&P 500 market cap. So, nothing new here.

1/5

JP Morgan has identified 41 AI-related stocks, 8% of the S&P 500. These stocks now account for 47% of the Index’s market capitalization, a new record.

The other 459 stocks, 92% of the S&P 500, are 53% of the Index’s market capitalization. pic.twitter.com/bDEXpqpTrE

— Jim Bianco (@biancoresearch) October 28, 2025

However, one thing is different. 47% of the Index’s capitalization is based on a single theme: AI. That is unique. Add to this the release of ChatGPT in November 2022. Ever since, these 41 stocks have accounted for 74% of the S&P 500’s total increase. This shows that AI already plays a substantial part in TradFi. So, now back to crypto.

Bluwhale

NVIDIA is the top public AI company right now. And they are on the supply side, giving model builders the chips and computing power they need. We have more on the important connections between crypto and AI coming up in just a second. But you don’t need to build models like Claude or ChatGPT to be a top project. That brings us to our first project of the day.

Bluwhale

While a small cap project with a market value of $10 million, Bluwhale plays an important AI infrastructure role.

It operates as 2 sided marketplace that even turns your mobile phone into an AI node. It’s the first we’ve heard of incorporating mobile in this way. On one side, agents are available like apps in an App Store. You can pick whichever agents you need for the tasks you need to get done. And that system works well. We’ve seen it before.

Yet what makes Bluwhale unique is that it’s not only an agent marketplace. It’s also a place for builders to get the tools and infrastructure they need. Tools like decentralized storage and access to NVIDIA-grade compute to help run their models.

So one side is strictly for users. The other strictly for builders. Most AI projects pick one or the other. Bluwhale is doing both.

It’s a big reason we think they are severely undervalued at this stage. Agent marketplaces like Virtuals or Fetch are worth hundreds of millions or billions of dollars. On Virtuals, another agent marketplace we like, many individual, autonomous agents are worth more than Bluwhale is right now. That’s something we expect the market will correct itself on soon.

2 Coins

Since Bluwhale offers 2 markets, it has 2 coins. The native $BLUAI is the agent market coin and the coin for the entire network. Meanwhile, on the developer side, they pay $BLUAI whether they use a dataset for testing, computing power, an LLM model, or anything else. But they also have the $BLUP reward system. It’s community-first. You earn points by sharing your data or computing power, which tracks your contribution to the network.”

With both of these markets, Bluwhale operates like the best of what both AI and DePIN projects have to offer. And if even just one side proves successful long term, its value will skyrocket. Bluwhale is looking to provide the intelligence layer to power all decentralized AI.

The Next Big Thing in Crypto: AI

Back to why crypto and AI need each other….. So, let’s take the bull by its horns. Here are some powerful reasons why AI will be the next big thing in crypto.

Crypto Networks

Most of the crypto networks are full of data. Well, guess what? AI thrives on data. So, what happens if you combine these two? Well, you get a system that can learn and power new markets. For example, networks can track ownership, usage, and payment of data. Now that’s where AI steps in. AI can train this.

Global GDP by 2030

Last year, predictions mentioned an addition of $20 trillion to global GDP by 2030. This number shows the interest institutions have in AI. Right now, the “AI crypto” sector is still small. Currently, the AI sector is worth around $20 billion. The current market cap of crypto is $3 trillion. That’s only 0.67% of crypto’s total market cap. So, there’s plenty of room to grow.

Forget everything you know about DeFi.

The AI sector will become a 15-30 trillion market by 2030.

Knowing this will putt you 10x ahead of everyone 🧵👇 pic.twitter.com/srfuG2Ztuu

— P R U D E N T 📊 🔺( ♟,♟) (@PrudentSammy) August 2, 2024

Regulation

Regulation and trust are big issues for both AI and crypto. Blockchain offers transparency and verifiability to AI systems. Think of data provenance, model audits, or decentralized ownership. That complementary benefit adds structural strength to the pairing. And new AI models need huge amounts of trusted data. Blockchains can prove the source of that data. They also track rights and payments for data owners. This gives builders a way to use real data without breaking trust.

Machine to Machine Payments

AI agents will soon act on-chain. They will buy, sell, vote, and run tasks in crypto networks. This creates a new market for “machine-to-machine” payments, where tokens become fuel. Coinbase recently developed the x402 protocol. This is an open internet-native payment standard. This is one of those huge trends not going away. We will be covering it extensively in the coming weeks and months.

NEW Category: x402

x402 is an open-source HTTP-native payment protocol developed by @coinbase.

We’ve added a new category to help you track all their tokens in one place.

Check it out 👉 https://t.co/Ub1mFuIubS pic.twitter.com/SWTntAPdLz

— CoinGecko (@coingecko) October 25, 2025

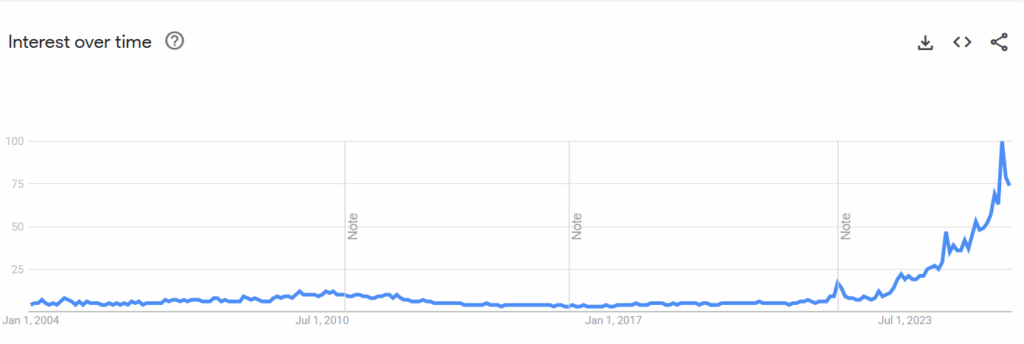

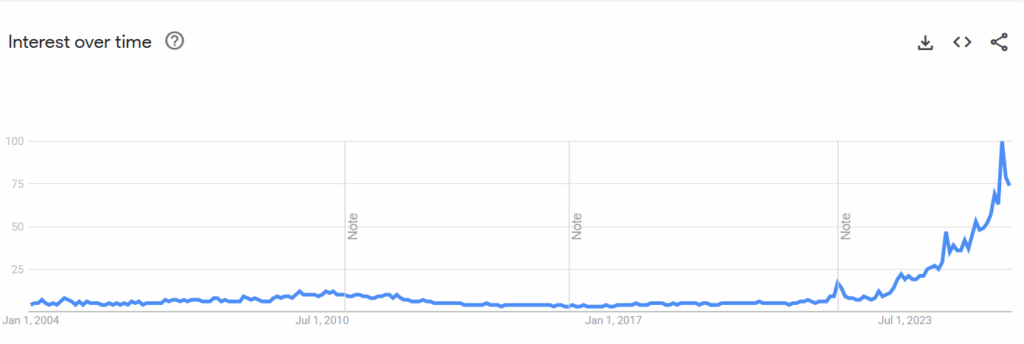

Google Trends

Search and social interest in “AI + crypto” is rising fast. Google Trends shows a sharp climb in “AI crypto” since late 2023, with new peaks during AI model releases. Interest spikes often lead to price cycles.

Source: Google trends

So, now you know some reasons why AI can be the next big thing in crypto. It’s time to take a closer look at 2 more of our favorites, Bittensor ($TAO) and Near Protocol ($NEAR).

Bittensor ($TAO)

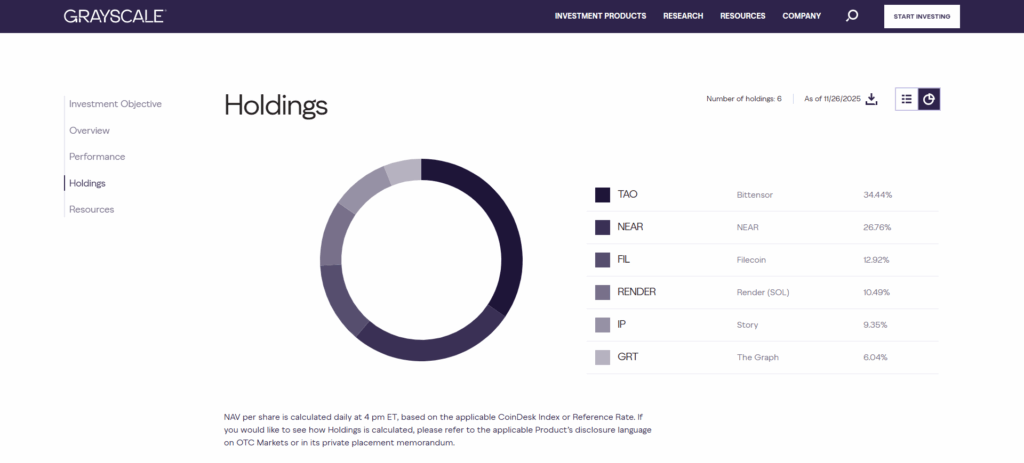

When talking about Bittensor ($TAO), I must mention Grayscale. It has various AI related funds. For example,

- Bittensor ($TAO)

- Livepeer ($LPT)

- Near ($NEAR)

- Render ($RENDER)

- Story ($IP)

Besides these, it also has six more under review. Furthermore, it also has a Decentralized AI Fund. This fund holds 6 altcoins. $TAO is its biggest holding, with 33.38%. This signals big-money confidence in $TAO’s AI narrative. See the picture below.

Source: Grayscale

To emphasize this, Grayscale has also filed a Form 10 for its Bittensor Trust. With such a trust, you don’t have to buy, store, or manage the altcoins themselves. Instead, you buy shares of the trust, which holds the digital asset in custody.

We just filed a Form 10 for Grayscale Bittensor Trust $TAO, the first step toward becoming an SEC Reporting Company, increasing its accessibility, transparency, and regulatory status.

Here are 5 key things to know if the Registration Statement becomes effective 🧵 pic.twitter.com/JDxEVHCT4l

— Grayscale (@Grayscale) October 10, 2025

There’s also Bittensor’s ecosystem growth and its network effects. TAO’s ecosystem uses “subnets”. These are task-specific AI modules. This means that every new subnet or contributor ratchets up collective value. Thus, making the system more than the sum of its parts.

And the crazy part, these subnets seem heavily undervalued. Ridges (SN 62) or Gradients (SN 56) are two worth mentioning. Ridges is up 23% on the day. It trains AI agents and is only worth $45 million right now.

Some #Bittensor subnet valuations..

$93m – @chutes_ai

$57m – @lium_io

$46m – @ridges_ai

$42m – @TargonCompute

$26m – @affine_io

$25m – @gradients_ai

$24m – @tplr_ai

$16m – @webuildscore

$16m – @bitmind

$12m – @hippius_subnet

$11m – @404gen_

$10m – @metanova_labsIt’s…

— DREAD BONGO (@DreadBong0) November 24, 2025

The current $TAO price is $283. Its ATH was $757. Everything under $300 seems like a real bargain.

Near Protocol ($NEAR)

Near Protocol ($NEAR is also one of the 2 leaders in the crypto AI sector. Like Bittensor, Grayscale also has $NEAR in its Decentralized AI Fund. That’s to the tune of 27.49%. Together with $TAO, they make up almost 61% of this fund. Not to mention its $NEAR Trust. So, major capital sees NEAR as part of the AI-crypto narrative.

Near positions itself as the “execution layer for the AI economy”. In other words, Near is built from the ground up to support decentralized AI applications. So, not just generic dApps. It also wants to give AI back to its users. So, decentralized AI and not a centralized version. Decentralized AI is a key theme among all 3 of our projects today.

NEAR is the execution layer for the AI economy.

— NEAR Protocol (@NEARProtocol) September 1, 2025

Near also sees strong ecosystem growth. Its ecosystem has millions of users. It’s actively investing in AI-developer tools, making it ready for AI-crypto adoption.

Near intents are doing really well. A NEAR intent is a simple request you make. Like “send this” or “swap that”. NEAR will now figure out how to do it. You choose the goal. The network handles the steps. It makes crypto feel easy. Last week, intents hit $5 billion in all-time volume. Only a week later, it hit $6 billion.

NEAR Intents = The Universal Liquidity Layer

0 to $1B in volume — 305 days

$1B to $2B in volume — 35 days

$2B to $3B in volume — 20 days

$3B to $4B in volume — 8 days

$4B to $5B in volume — 8 days

$5B to $6B in volume — 6 days pic.twitter.com/zclILd8w5Z— NEAR Protocol (@NEARProtocol) November 22, 2025

The current $NEAR price is $1.86. However, it has an infinite token supply. With a $2.3 billion market cap, this seems undervalued. The growth potential is definitely there.

So, what is your view on crypto and AI growth? Do you have a different fave AI project? Let me know in the comments and make sure to join our discussion on X and Discord.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Bluwhale.

Copyright Altcoin Buzz Pte Ltd.

The post Bluwhale and Why Grayscale is into 2 Specific AI Altcoins appeared first on Altcoin Buzz.