Hi! Trista here.

There aren’t many places left to hide. In times of strife, investors for decades could rely on good old US haven assets to protect and hedge.

No longer.

US Treasury prices and the dollar are falling along with US equities. Only gold is behaving like it’s expected to, consistently hitting record after record. Now is supposed to be Bitcoin’s moment. And in some ways, it is.

That’s because Bitcoin has usually tended to move like a volatile tech stock, with roller coaster swings that defy backers who claim again and again that it’s digital gold.

Bitcoin is, for once, not swinging by double-digit percentage points on a daily basis.

In fact, it’s the world’s biggest stock market, the mighty S&P 500 Index, that’s been acting super volatile lately.

As Bloomberg market whiz Joe Weisenthal noted, the benchmark stock index has posted six straight days of moves with a range bigger than 5%. The other times that’s happened? 1987, 2008, and 2020.

Yikes.

The S&P 500 is as volatile as bitcoin now pic.twitter.com/OrO68Z0HiS

— Eric Balchunas (@EricBalchunas) April 10, 2025

And some of the charts show sharp moves in the dollar and US Treasury yields are making the fiscal stability of the US government look more like a rocky emerging market, and not the world’s largest economic superpower.

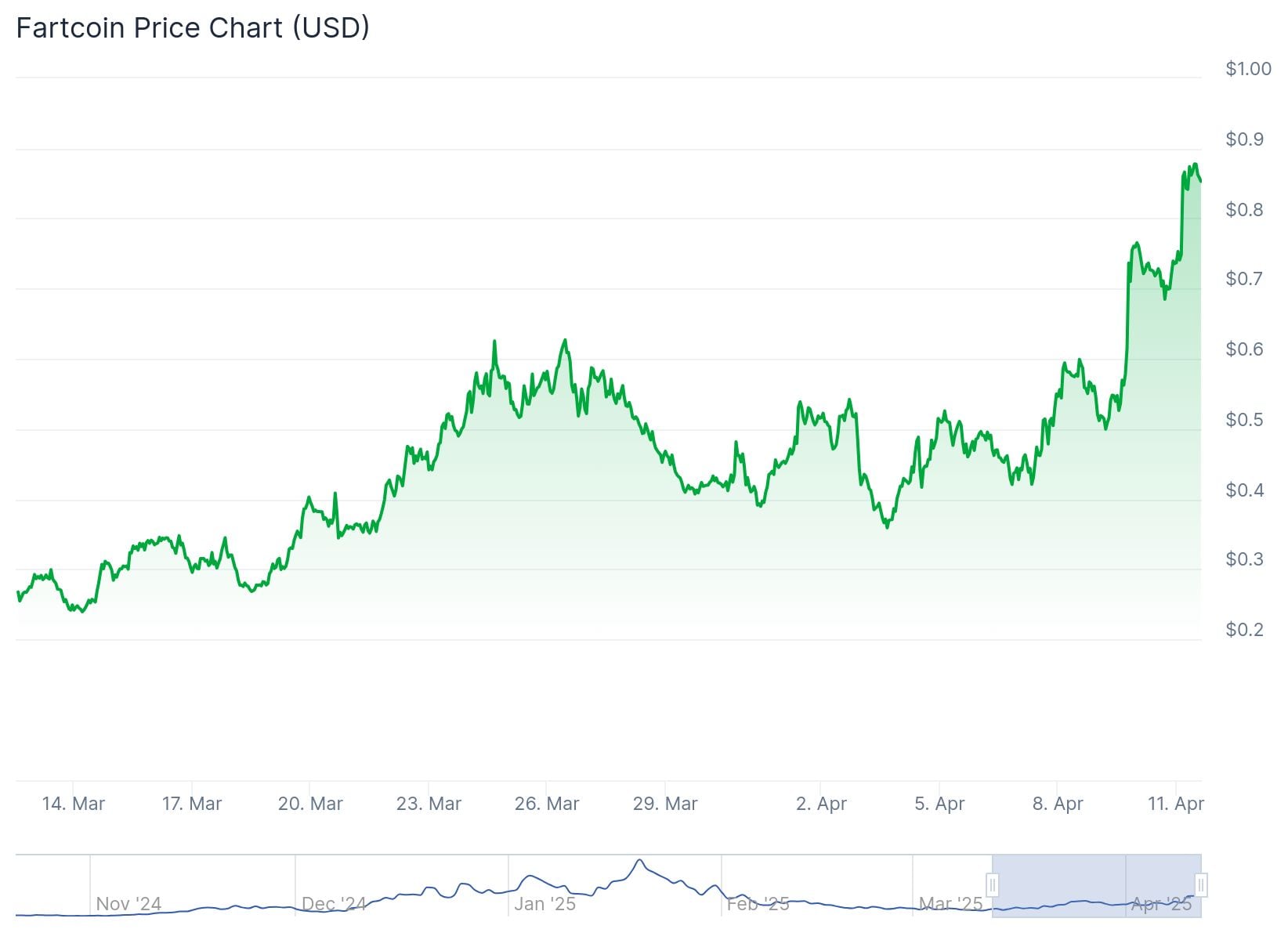

Meanwhile, in an odd twist, Fartcoin is ripping.

Deutsche Bank economist George Saravelos isn’t mincing words, saying in a note to investors:

“Given the centrality of the dollar to the global financial system, there are likely to be many unpredictable consequences to the epochal shifts in capital flow allocation that have been unleashed.”How to parse the tea leaves of a new economic world order?

Poor macro traders have whiplash trying to figure that one out.

By comparison, Bitcoin traders look positively boring. That’s impressive, in these markets.

How Trump tariffs left investors reeling and crypto execs searching for new answers: ‘It’s chaos’

Crypto industry bigwigs are going through some things. That’s the takeaway at Paris Blockchain Week, where Liam Kelly detailed the impact of the market chaos.

China is now the biggest driver of Bitcoin — why some say that’s great news for the price

Want to understand how monetary policy will impact Bitcoin’s price? Look to China, reports Aleks Gilbert.

Jittery Bitcoin traders pile into bearish bets — here’s when they see the price rebounding

Traders are rushing into Bitcoin hedges that see the price as low as $70,000 in the near term. But in the longer term, prepare for a rally above $100,000. Osato Avan-Nomayo has more.

Post of the Week

Another week, another opportunity for US President Donald Trump to wreak havoc on global markets. And the meme makers of the internet responded in kind.

Morning routine pic.twitter.com/J5wmuBKSjA

— Not Jerome Powell (@alifarhat79) April 11, 2025