Yes, Bitcoin hit an all-time high above $110,000 last month. And yes, Bitcoin has roughly doubled in value since September. But for some, this rally is different.

“This cycle has been a very weird one,” Bitcoin analyst James Check said in his newsletter Checkonchain.

“It has certainly not conformed to the expectations of a large majority of investors.”

That’s because Bitcoin appears to have broken from its traditional four-year price cycle.

Every four years, the reward to mine Bitcoin gets cut in half. The last halving took place last year in April when Bitcoin’s rewards were slashed to 3.125 Bitcoin per block from 6.25 Bitcoin.

Manic rally

Bitcoin halvings tend to spark a manic rally, with the price going vertical within a year and sizzling out within 12 to 18 months.

After the 2016 halving, Bitcoin spiked to around $20,000 from $650 — a near 3,000% return.

Last cycle, which kicked off in May 2020, Bitcoin soared to $69,000 from $8,600 at the time of the halving. That’s a 700% increase.

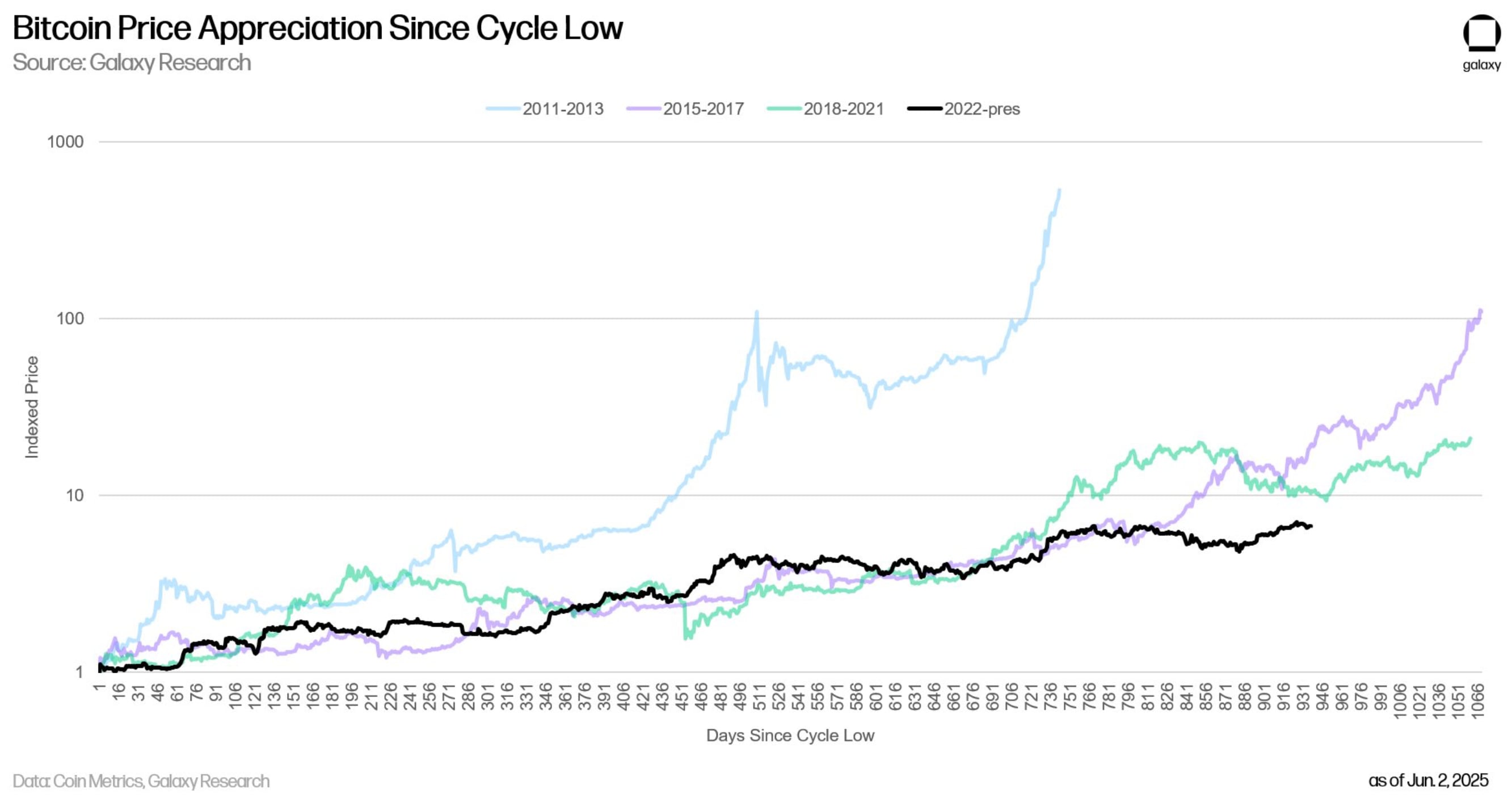

This time? Bitcoin is up just 70%.

Typical Bitcoin cycle

A typical Bitcoin cycle unfolds like this: investors buy up Bitcoin in the run up to the halving. That and the subsequent supply shock set off a euphoric rally that sends the cryptocurrency to new all-time highs.

Later, Bitcoin suffers a steep crash and a prolonged bear market.

The 2013, 2017, and 2021 cycles followed this script. Not this time.

“If there was ever a time for the four-year Bitcoin cycle to end, this is probably it,” said Check.

Bitcoin ETFs

What’s different this time around? Bitcoin exchange-traded funds, and Bitcoin treasury companies.

Since their approval in January 2024, Bitcoin ETFs have soaked up over 1.1 million Bitcoin — roughly 5% of the total supply that will ever exist. BlackRock dominates the market, with over half of all Bitcoin in spot ETFs held in its fund, IBIT.

That flood of institutional demand — sticky, steady, and largely unsold, according to Eric Balchunas, Bloomberg Intelligence ETF analyst — has smoothed out the wild swings that usually define a Bitcoin bull market.

Moreover, Bitcoin treasury companies like MicroStrategy and its imitators have also been gobbling up Bitcoin, propping up the asset’s price.

“This is looking like a longer and more measured bitcoin cycle than priors,” Alex Thorn, head of research at Digital Galaxy, said on X.

Influential macro analyst Noelle Acheson agreed.

“Pretty much all of us who have been through a few of these now seem to agree that this one ‘feels’ different,” Acheson said on X.

“More sober so far.”

Shaky ground

But not everyone is convinced of a tamer Bitcoin.

Saifedean Ammous, author of The Bitcoin Standard, warned investors that Bitcoin remains vulnerable to its classic drawdowns, in no small part because of an “alarming” trend underway — Bitcoin treasury companies.

These are firms that raise capital by offering convertible debt and plowing that money into Bitcoin to beef up their balance sheets.

Michael Saylor popularised the strategy with his company Strategy, which has inspired a plethora of copycats.

If the price of Bitcoin crashes, overexposed companies might be forced to dump their Bitcoin to stay afloat — triggering a wave of selloffs that could spiral into a deeper collapse, according to Ammous.

“If your business model can’t survive an 80% drop in Bitcoin, it’s not sustainable,” he said during the Bitcoin 2025 conference.

“We’re getting toward the very shaky ground of the top and the fall from it.”

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.