Arthur Hayes, the co-founder of BitMEX, says Bitcoin is likely to fall in the short term before bouncing back toward the end of the year. His latest market note warns that the crypto rally has lost key support as dollar liquidity tightens across the financial system.

Hayes believes Bitcoin is reacting to the same forces that shape global money supply. He describes the asset as a “free market signal” for future liquidity. When liquidity expands, risk assets rise. When it contracts, Bitcoin tends to drop.

According to him, the recent 25% pullback from early October highs reflects a shift in liquidity rather than any change in political messaging from the White House. He says the market is now giving more weight to hard data than political promises.

Declining Liquidity Hits Bitcoin

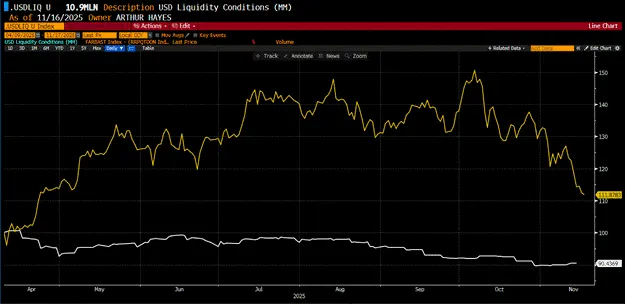

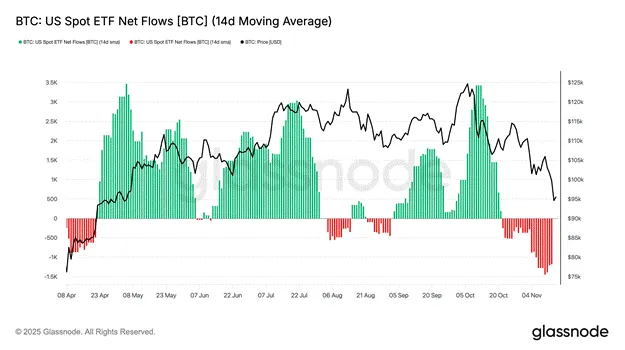

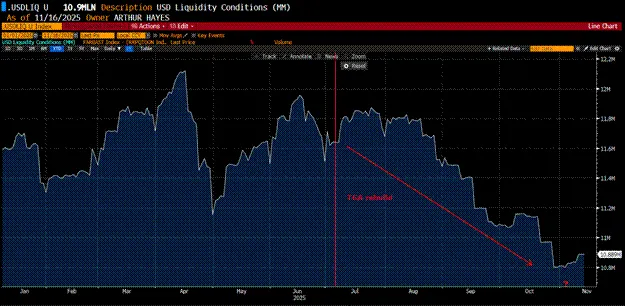

Hayes cites his USD Liquidity Index, which fell about 10% since April. During that same period, Bitcoin had moved higher due to strong inflows into ETFs and digital asset treasury firms. Those inflows have now slowed.

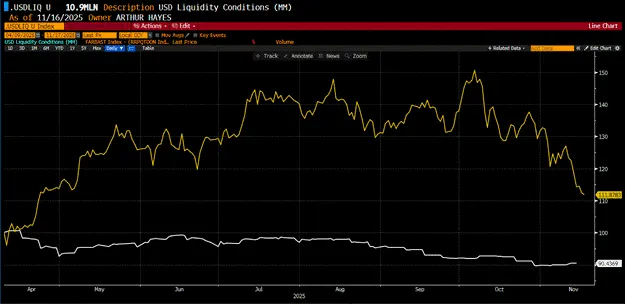

He explains that most ETF buying this year did not come from long-term believers. Instead, hedge funds used ETFs to run a basis trade. They bought spot exposure through ETFs and hedged with CME futures. This trade worked only because the spread between futures and spot sat above interest rates.

As the spread narrowed, funds exited. This caused outflows from major ETFs, creating the impression that institutions suddenly lost interest in Bitcoin. Hayes says the shift triggered fear among retail investors, amplifying the sell pressure.

Digital Asset Treasury companies, such as MicroStrategy, also slowed their Bitcoin purchases. Their stocks moved from trading at a premium to trading at a discount, making it harder for them to acquire cheap Bitcoin through equity issuance.

Hayes Says Political Pressure Will Reverse the Trend

The former BitMEX CEO believes the current downturn is temporary. He argues that US political forces will eventually push the government to inject more liquidity into the system.

Hayes points to the ongoing struggle between the White House, the Treasury, and the Federal Reserve. He says politicians want to appear tough on inflation, especially as voters continue to complain about high living costs. At the same time, they need markets to stay strong ahead of the 2026 midterm elections.

He predicts that once the pain in stocks, bonds, and risk assets becomes too visible, policymakers will shift back to aggressive liquidity support. This would mirror earlier periods where tightening was followed quickly by stimulus.

A Set-Up for a Year-End Rebound

Hayes compares the current environment to past cycles. He notes that when the Treasury rebuilds its cash balance after debt ceiling resolutions, liquidity falls. This happened in 2023 and again in 2025.

He expects a similar outcome: a short period of stress, followed by renewed money printing as leaders attempt to stabilize markets and regain public support.

In his view, these dynamics set the stage for Bitcoin to recover strongly before the year closes. He remains confident that political and market pressure will force a return to expansionary policy.

Hayes warns the price could slip toward $80,000–$85,000 before recovering. He projects that a rebound in U.S. liquidity later in the year could lift Bitcoin into the $200,000–$250,000 range.

For long-term investors, Hayes says the short-term drop does not change the overall trajectory. But in the near term, he warns that the market needs to flush out excess optimism before the next leg higher.

Hayes join other Bitcoin experts to share their views on BTC in recent times. Michael Saylor of Strategy believes BTC will stand strong amidst crisis. Others like Robert Kiyosaki believes now is the best time to get Bitcoin.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Arthur Hayes Predicts Bitcoin Slide and Year-End Rebound appeared first on Altcoin Buzz.