RWAs are traditional, real-life assets—invoices, dollars, oil, or property—brought onto the blockchain. Like digital assets, you can now use them to trade and engage in DeFi activities.

With RWAs playing a significant role in different projects, it’s worth understanding the four types and how to pick the right one for your needs.

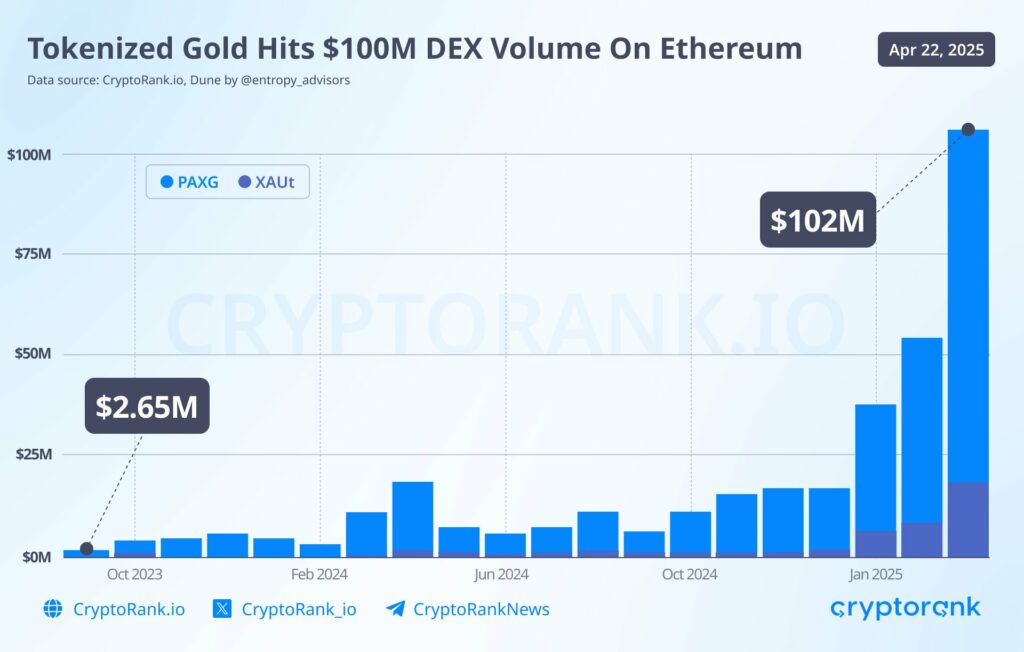

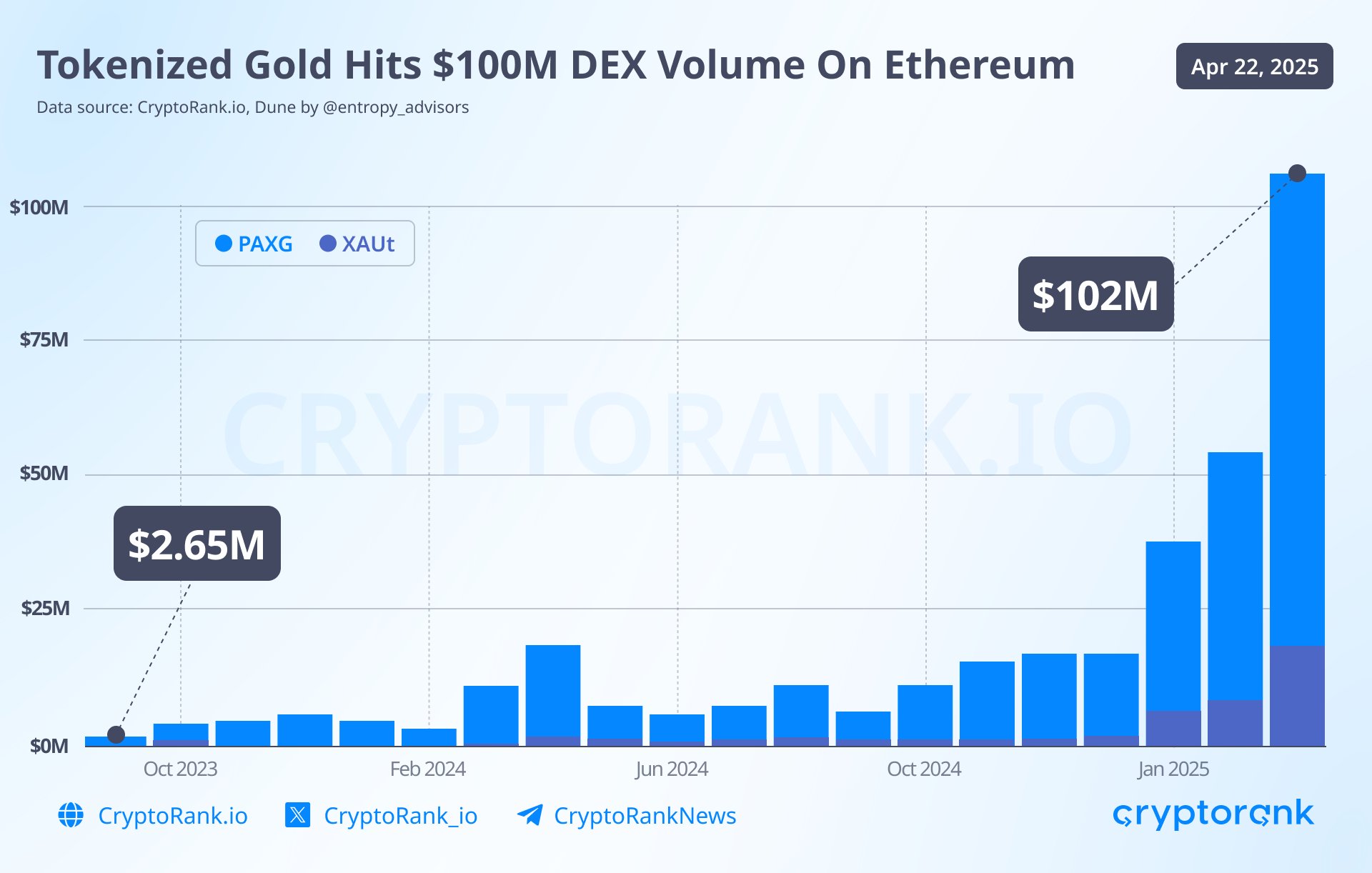

1. Tokenized Gold ($PAXG, $XAUT)

Gold is a haven during economic downturns. It is now digital and more efficient for traders and everyone involved with market activities. Here is a very interesting chart about this asset:

Source: X

- Inflation hedge: Gold holds its value when paper money loses purchasing power.

- Store of value: Holding Gold is a good way to keep your money for the long term.

- Audited and backed: Every token is supported by real, physical gold stored in safe custody and audited by third-party accountants.

- Global access: No need to visit a gold dealer or store physical bars—you can buy or trade gold 24/7 from anywhere.

Best for: long-term holders, wealth preservers, and conservative investors. If you want something solid and time-tested, tokenized gold is like digital gold bars in your pocket—with none of the hassle.

Do you hold tokenized gold coins?

The two largest players, PAXG and XAUT, exceeded $1.5 billion in combined TVL, increasing 31% year to date. pic.twitter.com/OZfMo7eBWq

— Crypto.com (@cryptocom) April 19, 2025

2. Stablecoins ($USDL, $USDe, $USD0)

Stablecoins are the backbone of crypto transactions. Digital tokens are pegged to the U.S. dollar, making them useful for daily use.

The Next Generation of Stablecoins: Solving The Free Float Dilemma

Any “stablecoin” pegged to $1 is NOT stable

Your stablecoins (like $USDC and $USDT) are INFLATING in price AND supply, anon.

But the next generation of stablecoins can solve for this:

[1/25] pic.twitter.com/RSWsS64XFa

— Ishan B (@Ishanb22) September 20, 2022

- Pegged to USD: They maintain a stable value, 1:1 with the U.S. dollar.

- Used everywhere: You can trade with them, make payments, or park your funds in DeFi apps.

- Backed by real assets: Some issuers back them with cash in the bank, while others support them using U.S. Treasury bills or credit.

- High liquidity: You can use or move them anytime, making them perfect for fast decision-making and transactions.

Best for: Daily users, active traders, and DAO treasuries. If you’re constantly moving funds around or need stability in a volatile market, stablecoins are your go-to RWA.

Conclusion

RWAs bring the fantastic features of blockchain to the real world. Now that you know these categories of RWAs, the choice is simply a matter of your goal. Whatever your need, a real-world asset is waiting to let you do it better. This is only the first part of the article; there is a second part.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This post is sponsored by Movement Labs.

Copyright Altcoin Buzz Pte Ltd.

The post 4 Types of RWAs and How to Choose the Right One – Part 1 appeared first on Altcoin Buzz.