Venezuela’s US dollar stablecoin rush has come to an end, data sources indicate, with USDT prices on peer-to-peer sales platforms returning to levels last seen in December, before the US’ arrest of President Nicolás Maduro.

USDT prices rose by 140% above official US dollar prices on January 7, data from P2P Army reveals.

On January 7, Investing.com data shows the US dollar price stood at 320 bolivars, while P2P traders were paying 769 bolivars per USDT token.

USDT is issued by Tether and is the world’s largest stablecoin. It is primarily backed by US Treasuries.

US special forces took Maduro into custody on January 3, sparking worries about forthcoming military intervention. But as global attention has since shifted to Greenland, feverish USDT buying in Venezuela has subsided.

“As the days go by and the economic path forward becomes clearer, the overreaction of the exchange rate is subsiding,” the economist Asdrúbal Oliveros told the Venezuelan newspaper El Nacional.

While crypto adoption is gaining momentum in Venezuela, citizens no longer appear prepared to pay a premium for stablecoins tied to the US dollar as political tensions in the region subside.

Speculative forces

On peer-to-peer exchanges, USDT prices against the Venezuelan bolivar have tumbled by 40% since the days after Maduro’s capture, P2P Army’s data shows.

Experts say speculation, rather than panic buying, was a key factor driving prices upward in the wake of the US intervention.

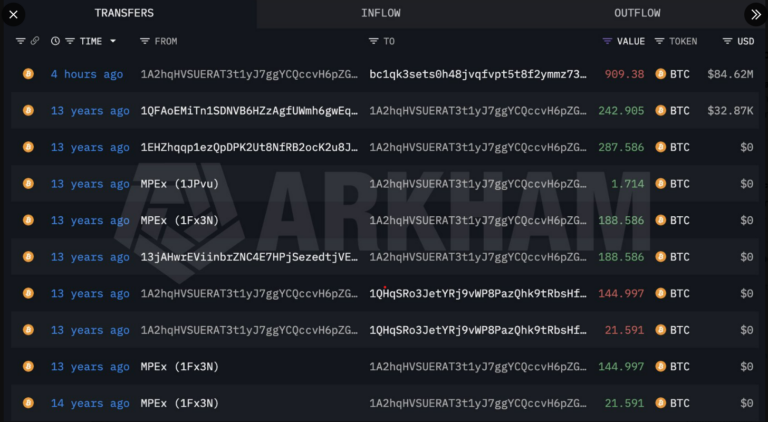

Speculative and mostly low-volume trades on exchanges like Binance “pushed the value of the US dollar-pegged stablecoins” to sky-high levels, the economist Jesús Palacios told El Nacional.

“All the political events that occurred generated volatility,” Palacios said. “Trading on Binance has speculative characteristics. During that week, a shallow market emerged that moved very quickly. Particularly during those days, we observed small trades of $20 or $30, which triggered very high sell rates that are inconsistent with market logic.”

Binance appears to have understood this and acted accordingly.

“We understand that market volatility can cause confusion and concern. Short-term price fluctuations can reflect geopolitical events that increase uncertainty,” Binance wrote on its Spanish-language Telegram channel on January 8.

“To protect our users and the platform, Binance is implementing temporary price limits in P2P markets as a risk control measure during times of extreme market movements.”

Some vendors, however, are still looking to capitalise on recent volatility, experts say.

“We see that some retailers are resisting the downward price movement and are sticking to their high prices,” Aarón Olmos, a Venezuelan economist and university professor, told the Spanish-language media outlet CriptoNoticias. “Some vendors are even brave enough to raise them.”

At the time of writing, USDT is still trading above the USD dollar in Venezuela, but the steep discrepancy has fallen. The official US dollar rate versus the bolivar stands at around 1 to 345. P2P Army says USDT is currently trading at 460 bolivars on Binance’s P2P markets.

Tim Alper is a news correspondent at DL News. Got a tip? Email at tdalper@dlnews.com.