The New York Stock Exchange (NYSE), powerhouse of global markets, just revealed plans for a blockchain-powered platform to trade tokenized securities, digital versions of stocks settled instantly on-chain.

Owned by Intercontinental Exchange (ICE), NYSE seeks U.S. regulatory nods for 24/7 trading, dollar-sized orders, and stablecoin funding.

Instant Settlement Meets Wall Street Muscle

Tokenized shares would match traditional ones, granting full dividends and voting rights to holders. NYSE President Lynn Martin called it a leap “toward fully on-chain solutions” blending trust with tech.

NYSE’s platform fuses its Pillar matching engine—handling billions daily—with blockchain for post-trade magic. Multiple chains support settlement and custody, enabling anytime trades. Qualified brokers get equal access, preserving fair markets. This fits ICE’s digital push: partnering BNY Mellon and Citi for tokenized deposits in clearinghouses, easing 24/7 margin calls across time zones.

New York Stock Exchange said it is developing a tokenized securities trading and on-chain settlement platform, pending regulatory approval, to enable 24/7 trading, fractional shares, and near-instant settlement, as part of Intercontinental Exchange’s broader push toward…

— Wu Blockchain (@WuBlockchain) January 19, 2026

Tokenization turns assets into blockchain tokens for speed and programmability. Real-world win: BlackRock’s BUIDL fund tokenized $500 million in treasuries on Ethereum, settling in seconds versus days. NYSE aims higher, blending fungible tokens with legacy shares.

Trends Signal Mainstream Shift

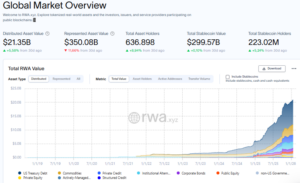

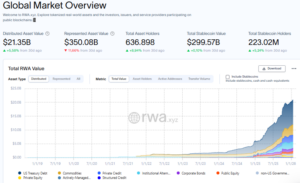

Wall Street embraces blockchain. Tokenized assets hit $10 billion TVL in 2025, up 300% yearly, per RWA.xyz. Europe leads with MiCA rules; U.S. lags but warms via pilots. ICE, clearing $1 quadrillion yearly in swaps and energy, positions NYSE as the compliant gateway. Stablecoins fuel it: $200 billion market cap powers funding without banks.

Risks remain, regulatory hurdles, custody tech, but NYSE’s pedigree builds confidence. Michael Blaugrund, ICE’s strategy VP, sees it fueling “capital formation in global finance.”

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post NYSE Unveils Tokenized Securities Trading Platform appeared first on Altcoin Buzz.