Most people build their 2026 portfolio based on hope or old narratives. But the market we face now is not the one we survived in past cycles. So, I set out to build the strongest possible portfolio for 2026. Not based on hype. Not based on wishful thinking. Only data. And the results changed my view of the market.

The same altcoins kept rising to the top, and the list is nothing like what most investors expect. Some are obvious. Others will surprise you. All these altcoins have key catalysts ahead that could reshape their value. In this video, I walk through each pick. The numbers behind them, and why this mix may outperform the typical 2026 portfolio. If you’re willing to challenge assumptions, this is where you start.

Bitcoin ($BTC)

My first pick, in this list of altcoins, isn’t an altcoin at all. That’s right, it’s the crypto OG himself, Bitcoin ($BTC). It’s your hedge against a crumbling dollar value.

We can also see that institutional adoption is speeding up. Big institutional investors are increasingly embracing Bitcoin. They are diversifying their portfolios. There are plenty of DATs (Digital Asset Treasuries) out there. These are companies that strategically hold cryptocurrencies on their balance sheet for investment.

This way, Bitcoin receives legitimacy beyond speculation. Michael Saylor and his Strategy are the perfect example for such a DAT. But we also start to see this with other cryptos. Like, Tom Lee’s Bitmine with Ethereum.

Major forecasts still point to strong long-term gains. For instance, J.P. Morgan projects that Bitcoin could reach as high as $170,000 by 2026. This underscores continued confidence in $BTC’s growth potential relative to traditional assets. So, even with short-term dips, many analysts see further gains. They credit this to increased demand, shrinking supply, and cycle dynamics.

The #Bitcoin Power Curve Cycle Cloud predicts a peak of around $250,000-$300,000 in 2026. pic.twitter.com/dwt67rMvnX

— Trending Bitcoin (@TrendingBitcoin) December 8, 2025

Given this rising institutional interest, my portfolio will for 30% consist of $BTC. The current $BTC price is around $87k. However, keep in mind, once $BTC hits $170k, or higher, it doesn’t matter whether you bought it at $85k or $92k. Make sure to buy it!

Ethereum ($ETH)

Ethereum ($ETH) is my next pick of this list for altcoins in 2026. And believe me, for a long time I was not a big Ethereum fan. However, it seems that Buterin is turning things around. The recent Fusaka upgrade can well put Ethereum back on my radar. Yes, I know, it always had that first mover advantage. However, it was too slow and too expensive to do anything on it. At least for my liking.

This Fusaka upgrade changed a few things. Ethereum became scalable. Transactions are becoming cheaper and faster. To be honest, it’s about time! So, check out my recent video about this Fusaka upgrade. It has been a massive move for Ethereum. And if we look at the $ETH price, it’s up by almost 8% over the last 14 days. My portfolio will consist of 20% $ETH. Like Bitcoin, institutional interest is also big for Ethereum. Both have plenty of ETFs, with more to come.

Sui Network ($SUI)

Sui Network ($SUI) is one of my fave projects. The Mysten Labs team doesn’t seem to know how to stop building. Which is good on them. We have already seen various institutions showing interest in the Sui Network. 21Shares is now offering 2x leveraged SUI ETF (TXXS) on the Nasdaq. Leveraged ETFs are a first for Sui.

The SEC has approved the first-ever 2x leveraged SUI ETF (TXXS), live on Nasdaq via @21shares_us.

A first for Sui in public markets – offering amplified, regulated exposure to SUI.

A new chapter for Sui investing begins. pic.twitter.com/y6h4gqMlnP

— Sui (@SuiNetwork) December 4, 2025

We also know that Sui already offers a wide variety of stablecoins. In June 2026, 3 more European stablecoins will join. These are the MICA-regulated stablecoins $EURXM, $USDXM, and $RONXM. Sui is working hard on the payments front to get the industry on similar functional payment standards with the Blockchain Payments Consortium. It’s another sign of how important payments and stablecoins are for Sui’s long term growth.

EURXM, USDXM, and RONXM are coming – three MiCA-regulated stablecoins launching in June 2026, built for real payments. https://t.co/jLzZJg2hvf

— Sui (@SuiNetwork) December 12, 2025

RWAs are also the talk of crypto town. Sagint now picked Sui as its Layer 1 chain partner. Sagint brings tokenized, traceable digital assets for critical minerals to Sui. Sui will allow for tracking the supply chain of these minerals.

Today, in a step forward for real world asset tokenization on Sui,@SagintInc announces it has selected Sui as its Layer 1 blockchain partner. pic.twitter.com/ZTnnUpg3cr

— Sui (@SuiNetwork) December 11, 2025

Here’s an interesting story about Bhutan. You may know that Bhutan already mined around 13,000 $BTC. That’s worth around $1.3 billion. However, it’s located in the remote Himalayas. So, Sui successfully tested how blockchain can function without internet.

In Bhutan’s remote valleys, our team tested how blockchain can function when the internet disappears.

We explored offline signing, physical data movement, and onchain verification using Sui.

Read the full story 👇https://t.co/twwVamUbDj pic.twitter.com/uuoMrS1vZS

— Sui (@SuiNetwork) December 10, 2025

With the current $SUI price at $1.48. I will reserve the last 20% of my portfolio in 2026 for $SUI.

Bittensor ($TAO)

Bittensor ($TAO) is next up on my altcoins for my 2026 portfolio. The $TAO halving just happened. So, check out my recent video on this event. This is a big event for Bittensor. But, as I explain in that video, Bittensor took inspiration from $BTC, but it’s certainly not a copy. The tokenomics are similar, with a 21 million max $TAO cap and halvings. However, mining couldn’t be more different.

Bitcoin mining uses hash power. In contrast, in Bittensor you produce value by performing AI tasks. Miners compete for rankings. Bittensor has subnets. So, the better the output is, the better the subnet’s ranking is. This translates to the amount of $TAO they receive. A very different game compared to Bitcoin.

The current $TAO price is around $254. However, after the halving, I can see the price going up again. And don’t underestimate the current AI boom we see. Bittensor is the leading crypto AI project. Chainlink on this list takes care of the infrastructure. However, Bittensor is where it really happens. This is our big AI favorite at Altcoin Buzz. That’s why I make sure that 15% of my portfolio is in $TAO.

Ondo Finance ($ONDO)

With Ondo Finance ($ONDO) we’re in the RWA sector and last on today’s list of altcoins. Now, I’ve been talking about Ondo and RWA for a long time. RWAs have all the ingredients to become massive. All the big financial players are betting heavily on this. Think of BlackRock and other big players. However, we can add another massive development.

Tokenization is shaping the next evolution of global markets. In @TheEconomist, Larry Fink and Rob Goldstein discuss how tokenization can modernize market infrastructure, enhancing efficiency, transparency, and access by connecting traditional and digital finance. Read more: pic.twitter.com/Hf1Q7HbxaZ

— BlackRock (@BlackRock) December 1, 2025

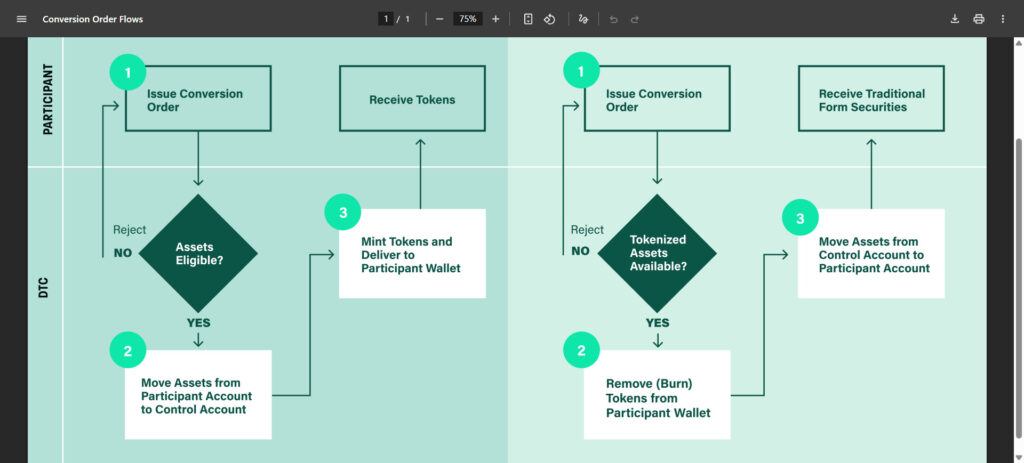

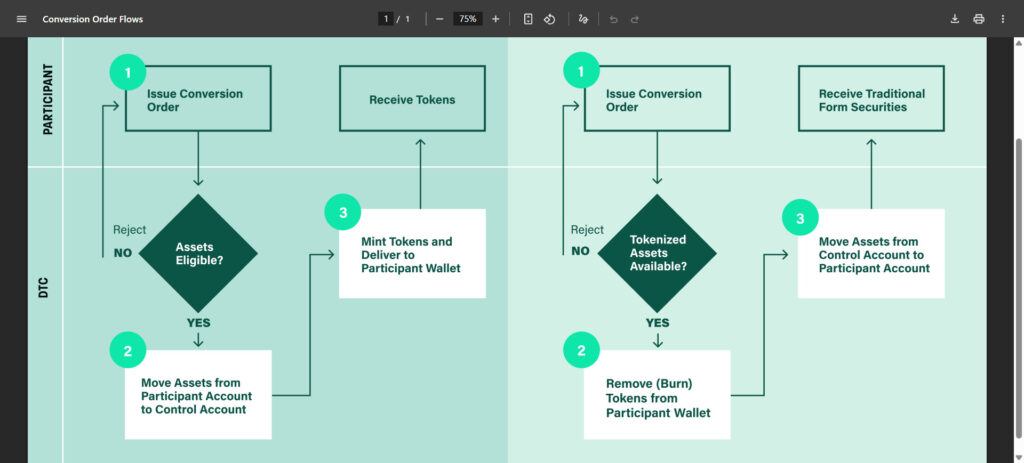

The DTCC got the go ahead from the SEC to tokenize real world, DTC-custodied assets on blockchain. The DTC is the Depository Trust Company. It acts as a central securities’ depository. It holds stocks and bonds electronically on behalf of financial institutions. This is a subsidiary of the DTCC. The DTCC is the Depository Trust & Clearing Corporation. To see how that process works, see the picture below.

Source: DTCC

The DTCC settles about 3.7 quadrillion dollars every year. It is the core settlement engine in the US behind nearly every,

- Stock trade.

- ETF movement.

- Treasury transfer.

Tokenization will start for real right now.

The current $ONDO price is around 41 cents. So, in my book, $ONDO is holding all the right cards to grow in 2026. That’s worth 15% of my 2026 portfolio. Check my recent video on how much $ONDO you need to become a millionaire.

So, which altcoins would you have in your 2026 portfolio? Let me know in the comments and make sure to follow our X and Discord accounts.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Sui.

Copyright Altcoin Buzz Pte Ltd.

The post Real Talk: High Conviction Altcoins for a Safe 2026 Crypto Portfolio appeared first on Altcoin Buzz.