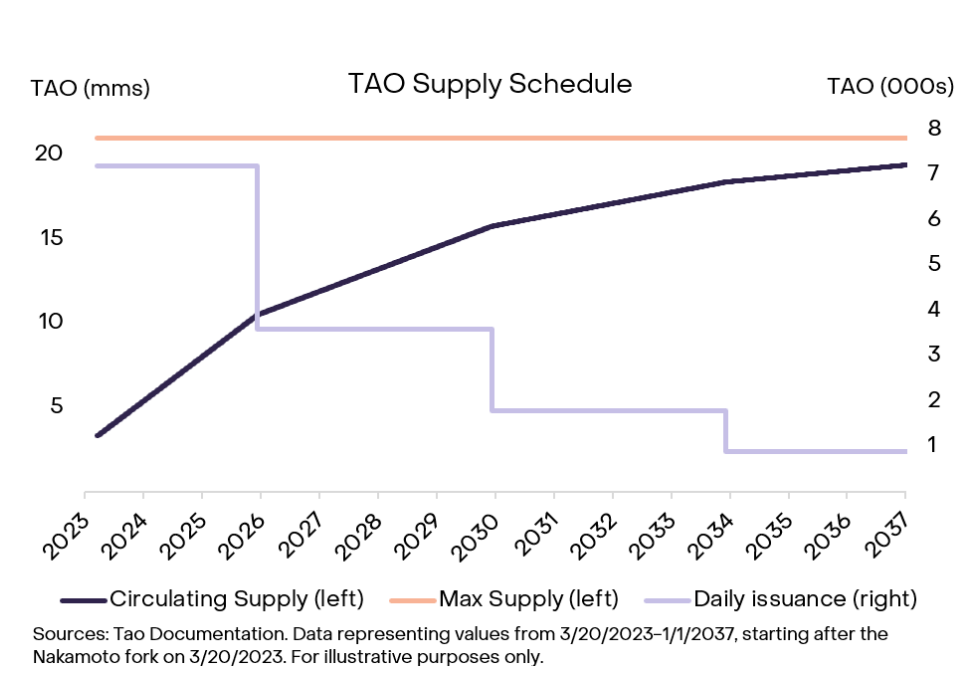

Bittensor is getting ready for its first halving. The event is expected to take place around December 14. When it happens, daily TAO issuance will fall from 7,200 to 3,600. The network launched in 2021 and follows a fixed-supply model similar to Bitcoin. Its total cap is 21 million tokens.

Grayscale Research analyst William Ogden Moore stated that the halving marks a significant step in the project’s growth. He called it a milestone that shows the network is moving into a more mature phase.

Bittensor’s first halving is approaching soon, reducing $TAO emissions from 7,200 to 3,600 per day. With growing institutional interest and expanding AI subnets, this could be a key moment for the network’s evolution.

Read @TheBlock__ article: https://t.co/JuRplyTwHM

— Grayscale (@Grayscale) December 10, 2025

Why a Halving Matters

A supply cut often draws attention in crypto. Many investors see fixed-issuance tokens as more attractive than assets that can expand forever. If demand rises and supply tightens, scarcity can support value. TAO’s design mirrors Bitcoin’s approach. It uses a predictable release schedule. No pre-mine. No sudden expansion.

A Growing Ecosystem of AI Subnets

Bittensor runs on “subnets”, a small, specialized networks that act like startup teams inside the ecosystem. Each subnet focuses on a unique AI service such as compute, agent development, or inference tools.

Data from CoinGecko shows more than 100 active subnets today. Their combined values exceed hundreds of millions of dollars. Taostats tracks 129 subnets and places their total valuation closer to $3 billion. Either way, the expansion signals growing interest in decentralized AI systems.

Major subnets include Chutes, which offers serverless compute for AI models, and Ridges, which focuses on building and improving AI agents.

Developers and VCs Are Taking Notice

Investors are pouring in. Inference Labs recently closed a $6.3 million funding round to support Subnet 2, which verifies AI inference. xTao, a major infrastructure developer in the Bittensor ecosystem, also went public this year through the TSX Venture Exchange.

AI-focused funds are leaning in as well. Chris Miglino of DNA Fund has described the Bittensor ecosystem as one of the most active spaces in decentralized AI today.

What Comes Next?

The halving arrives at a time when TAO’s price has faced pressure. Still, the event could shift sentiment. If network activity keeps rising and AI demand grows, the reduced issuance may strengthen the token’s long-term outlook.

For now, all eyes are on December 14 as Bittensor enters its first major supply cut, and a new chapter in the race to build decentralized AI infrastructure.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Bittensor Prepares for First Halving as TAO Drops appeared first on Altcoin Buzz.