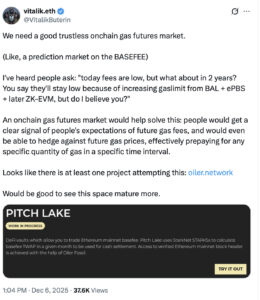

Ethereum co-founder Vitalik Buterin recently called for the development of a trustless on-chain gas futures market. This is a concept designed to help users understand and manage transaction costs over time.

In a recent statement, Buterin explained that while solutions like increasing the gas limit, Balance Adjusted Limits, and future ZK-EVM upgrades aim to keep fees low, users often worry about long-term costs. A dedicated on-chain market could provide transparent signals about future fees. Also, allow users to hedge or prepay for gas in a specific time frame.

Understanding On-Chain Gas Futures

A gas futures market would function similarly to traditional futures in financial markets, where participants can lock in prices for future delivery of an asset. In this case, the asset is network gas. Buterin emphasized that such a market would give users a clear indicator of collective expectations regarding transaction fees. It would also allow developers and traders to manage risk by securing gas at known rates ahead of time.

Projects like Oiler Network are already experimenting with this model, creating platforms where gas prices can be forecasted and traded. This is particularly important for decentralized finance platforms, NFT projects, and other high-volume blockchain users, who rely on predictable transaction costs for budgeting and operational planning.

Recent trends suggest a growing appetite for tools that bring predictability to blockchain operations. According to data from Dune Analytics, Ethereum’s average transaction fees fluctuate widely, with spikes often exceeding $50 during periods of high demand. This volatility can discourage new users and complicate smart contract execution. By introducing a trustless, transparent way to hedge gas costs, on-chain futures markets could improve user experience, reduce risk, and support wider adoption of Ethereum-based applications.

Source: X

A simple example illustrates the potential benefit: a decentralized exchange planning a large liquidity migration could use gas futures to prepay for the expected transaction fees. This would protect the platform from sudden fee spikes and provide financial certainty for planning. As the ecosystem evolves, these tools may become standard for both developers and investors seeking stability in an often volatile environment.

More About Ethereum

Ethereum is currently experiencing a historic moment across multiple fronts. Transaction costs on the network have fallen to all-time lows, making it cheaper than ever for users to interact with decentralized applications. At the same time, liquidity and capital velocity in low-risk DeFi sectors, including lending platforms and stablecoin markets, have reached record highs, reflecting strong user engagement and trust in the ecosystem.

The costs to use Ethereum are at an all-time low.

The liquidity & capital velocity in low-risk DeFi (lending, stablecoins) on Ethereum are at an all-time high.

The Ethereum core dev shipping pace is at an all-time high.

Exciting times. pic.twitter.com/tJPCZvWo7m

— Token Terminal 📊 (@tokenterminal) December 6, 2025

Adding to this momentum, Ethereum core developers are shipping updates and improvements at an unprecedented pace, accelerating network upgrades and innovation. Together, these factors highlight a highly active, efficient, and rapidly evolving Ethereum network.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Ethereum Needs Trustless Gas Futures, Says Vitalik Buterin appeared first on Altcoin Buzz.