The proposal aims to optimise revenue generation and reduce operational overhead across its V3 deployments.

By adjusting reserve factors on underperforming chains and winding down low-revenue instances, Aave is signalling a more disciplined approach. It is also setting a revenue threshold for future deployments.

Reserve Factor Adjustments and Instance Offboarding

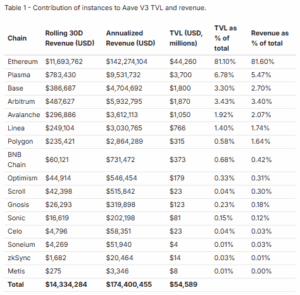

Under the proposed strategy, Aave plans to increase the reserve factor on instances generating less than $3 million in annualised revenue, including Polygon, Gnosis, BNB Chain, Optimism, Scroll, Sonic, and Celo. Reserve factors determine how much interest is set aside from lending activity to protect the protocol and can impact profitability for depositors. Aave hopes this adjustment will boost revenue and make underperforming instances more sustainable.

For chains that show minimal improvement after 12 months, Aave will consider offboarding them entirely. This approach reflects a focus on efficiency and risk management, ensuring that resources are concentrated on high-performing deployments rather than spreading operational attention too thin.

The proposal also targets three Aave V3 instances—zkSync, Metis, and Soneium—which each generate between $3,000 and $50,000 annually. These instances have struggled to achieve product-market fit and require significant engineering effort for asset onboarding. Closing these markets will allow Aave to redirect engineering and governance resources toward more promising opportunities.

More About Aave

Aave is preparing to launch on Mantle, marking a major step in bringing decentralised finance to a wider global audience. With Bybit serving as the liquidity bridge, the world’s most trusted DeFi lending protocol will gain direct access to more than 70 million users while tapping into Mantle’s fast and efficient distribution layer.

.@aave is coming to Mantle.

With @Bybit_Official as our global liquidity bridge, we’re bringing the world’s trusted DeFi lending protocol to 70M+ users, connecting proven liquidity with Mantle’s high-performance distribution layer.

Making DeFi mainstream, making DeFi win. pic.twitter.com/1ATukC9RRu

— Mantle (@Mantle_Official) December 2, 2025

This pairing connects deep, proven liquidity with a network built for high performance, creating a path for borrowing and lending tools that feel both simple and scalable. It also signals a broader shift in the industry, where leading platforms are joining forces to make DeFi easier to use and more available to everyday people. The goal is clear: push decentralised finance into the mainstream and set it up to win long term.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments based on the information provided. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Aave Proposes New Multichain Strategy to Focus on Revenue appeared first on Altcoin Buzz.