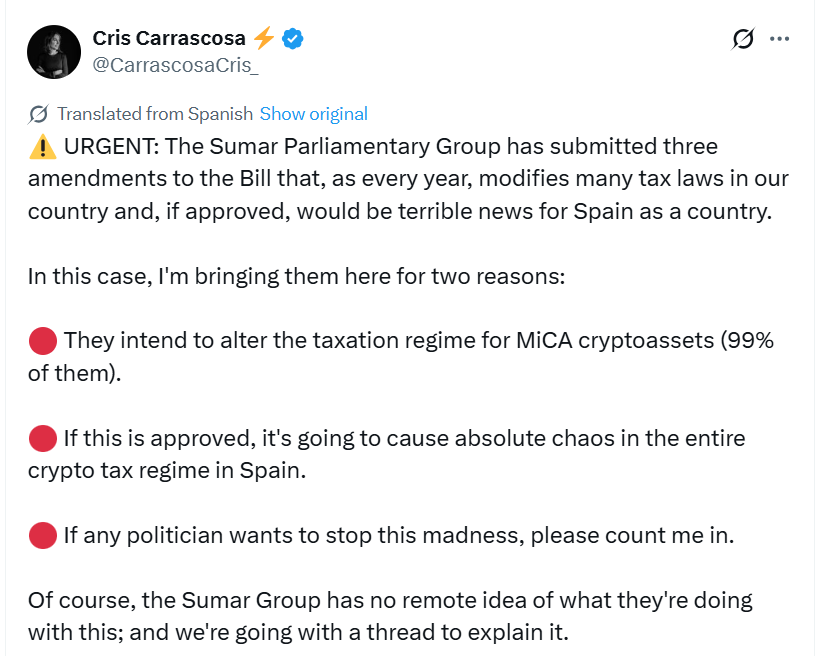

Spain’s Sumar party has proposed major changes to how the country taxes and regulates cryptocurrencies. The plan includes raising the top tax rate on crypto profits to 47%. It also classifies digital assets as seizable property. Additionally, it advocates for establishing a warning system for investors.

The proposal aims to update three key tax laws. These include rules on income tax, inheritance and gift tax, and the general tax code. Local media reports that the changes would shift crypto earnings into the same category as regular income. Today, most crypto gains fall under the savings bracket, which carries a lower rate.

A Call for Tougher Rules on Digital Assets

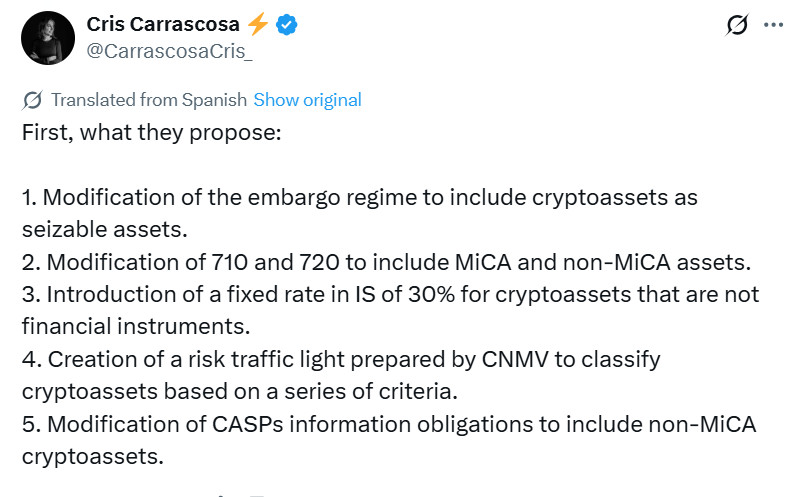

If passed, the new rules would raise the top tax rate on individual crypto gains to 47%. Companies holding crypto would face a flat 30% rate. The plan also directs Spain’s securities regulator to create a “risk traffic light” that labels crypto assets by risk level. Platforms would have to show these labels to users.

Sumar also wants all digital assets to be treated as attachable property. This means they could be taken by authorities in certain legal situations. Some legal experts doubt this part of the plan. They say many crypto assets cannot be held or controlled by regulated custodians, which makes seizure difficult or impossible.

Critics Say the Plan Misunderstands Bitcoin

The proposal has drawn strong criticism from tax specialists. Some argue that the plan misreads how decentralized assets work. Bitcoin, for example, can be stored in private wallets without a custodian. These wallets cannot be monitored or seized in the same way as bank accounts.

Economists warn that harsh tax rules may push crypto users to move their activity outside Spain. They say the plan may raise legal concern without improving oversight.

A Debate as Crypto Use Grows

The proposal comes as Spain increases its focus on crypto compliance. The tax agency sent more than 600,000 notices to crypto holders last year, double the number from the year before.

The debate over Sumar’s tax plan shows how European governments are trying to balance consumer protection with innovation. The final decision could shape how crypto users in Spain report gains, store assets, and follow new rules in the years ahead.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Bluwhale.

Copyright Altcoin Buzz Pte Ltd.

The post Spain’s Sumar Proposes 47% Crypto Tax Targeting Bitcoin appeared first on Altcoin Buzz.