Ethereum may be preparing for a long-term breakout simil (opens in a new taar to Bitcoin’s explosive run over the past eight years, according to Tom Lee, cofounder of Fundstrat and executive chair of BitMine. Lee said on Sunday that Ether is “embarking on the same Supercycle” that pushed Bitcoin from $1k in 2017 to over one hundred times that value today.

Lee shared the view in a post on X, where he reflected on his original Bitcoin call. He recommended BTC to Fundstrat clients in 2017 with a small one to two percent allocation. Bitcoin was about one thousand dollars at the time.

Since then, the asset has survived six drops of more than 50% and three deep declines of over 75%. Yet it still delivered a hundred-fold gain from his first recommendation.

Bitcoin is a volatile asset.

We first recommended Bitcoin to Fundstrat clients in 2017 (1%-2% allocation)

– Bitcoin 2017 ~$1,000Since then (past 8.5 years), $BTC:

– 6 declines > -50%

– 3 declines > – 75%2025, Bitcoin 100x from our first recommendation

TAKEAWAY:

To have… pic.twitter.com/xtIRGLdnWM— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 16, 2025

Lee said these gains did not come without severe stress moments. “To have gained from that 100x Supercycle, one had to stomach existential moments to HODL,” he wrote. In his view, the reason for this volatility is simple. Crypto prices “discount a massive future,” and doubt always creates sharp swings.

He believes Ether is entering the same type of long-term cycle now.

Ether Trails Bitcoin, but Accumulation Is Rising

Ether has been slower than Bitcoin for most of 2025. Bitcoin pushed to a new peak above $126k in October. Ether reached its own high of $4,946 in August but has not kept pace since then. As of Monday, Bitcoin is down about 25% from its record. Ether has fallen more than 35%from its high.

Lee said the volatility does not change the long-term picture. To him, the pullback is part of a broader cycle where doubt clears the way for future growth.

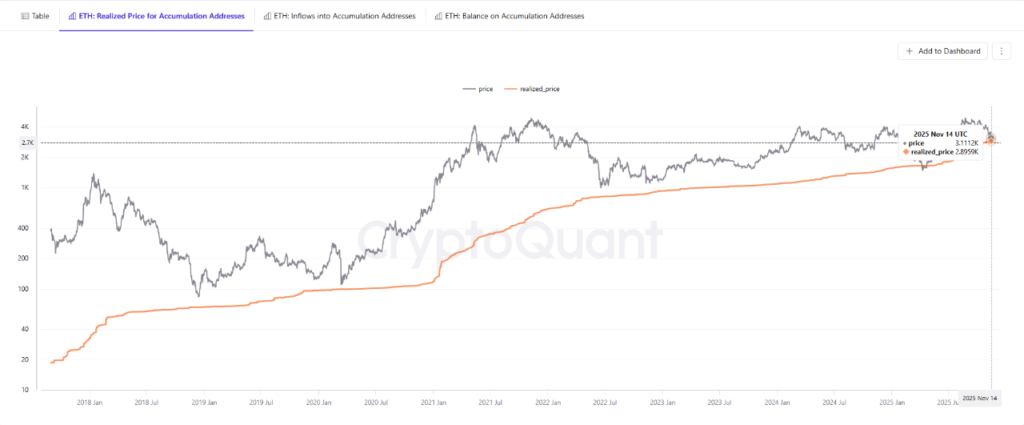

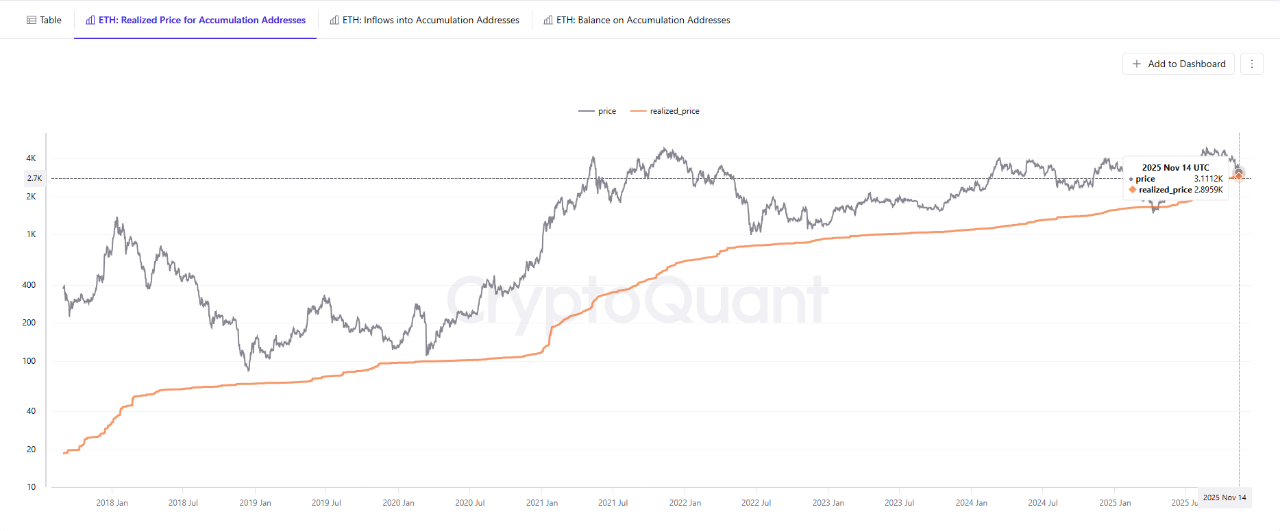

On-chain data supports that view. According to CryptoQuant analyst Burak Kesmeci, Ether is now close to the average cost basis of long-term holders.

With ETH trading around $3185, it is only about $200 above the price where long-term accumulators last bought in. Ether has dipped below that level only once this year, in April, during uncertainty related to global tariff announcements by the Trump administration.

Kesmeci said this zone is one of the strongest long-term accumulation ranges for Ether. More than 17 million ETH has moved into accumulation wallets in 2025. The total balance held by these long-term addresses has grown from $10 million ETH at the start of the year to 27 million ETH today. If the price drops below $2,900, he expects it will not stay there for long.

Ether briefly fell to a low of $3023 on Sunday but has since stabilized.

What Lee’s Call Means for the Market

Lee’s comment adds a notable shift in tone. Much of the market conversation this year has centered on Bitcoin’s strength. Ethereum has taken a back seat. But Lee’s view suggests Ether may be at the early stage of a larger cycle, similar to Bitcoin during its 2017 to 2025 climb.

The message is simple. The path will not be smooth. But the long-term direction, in his view, is higher. Or as he put it, “The path higher is not a straight line. HODL.”

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Tom Lee Says Ethereum Starting a Bitcoin-Like Supercycle appeared first on Altcoin Buzz.