Bitcoin’s price movement has kept the entire ecosystem restless. One week it shows strength. The next week it slips just as quickly. Investors are watching every candle. Traders are hunting clues. Everyone is asking the same question. What do we expect as we enter the final stretch of the year?

This week delivered a bit of clarity. Three major voices stepped forward with strong opinions. Robert Kiyosaki. Michael Saylor. Eric Trump. Their comments created a wave of conversation and gave a clearer picture of how influential players view Bitcoin heading into Q4. Beyond the noise, their positions carry weight. And for the ecosystem, their tone matters more than ever.

Why These Voices Matter Now

The market is sitting at a sensitive point. Bitcoin is consolidating in a tight range. Liquidity is thin. Sentiment is fragile but hopeful. When long-term thinkers speak, they influence both institutions and everyday holders. Their perspective often shapes the narrative that money follows. So their comments this week are not just reactions to price. They are signals for what comes next.

Kiyosaki. Bitcoin as Protection

Robert Kiyosaki stayed true to his long-held stance. He believes a major crash is coming, not just in markets but in the broader financial system. Instead of selling, he is buying more.

His argument is simple. He trusts what he calls the “laws of money.” Gresham’s Law. Metcalfe’s Law. In his view, the Federal Reserve and US Treasury break these laws by printing what he calls “fake money.” And when that happens, as he puts it, real assets move into hiding.

CRASH COMING: Why I am buying not selling.

My target price for Gold is $27k. I got this price from friend Jim Rickards….and I own two goldmines.

I began buying gold in 1971….the year Nixon took gold from the US Dollar.

Nixon violated Greshams Law, which states “When fake…

— Robert Kiyosaki (@theRealKiyosaki) November 9, 2025

Kiyosaki’s targets remain bold. He sees Bitcoin hitting $250k in 2026. Gold at $27k. Silver at $100k. Ethereum at $60k. These predictions come from his circle of macro thinkers and analysts, and he backs them with personal conviction.

Kiyosaki is protecting himself with Bitcoin. And even when the market crashes, he continues to accumulate. His message to the ecosystem is a familiar one. The financial system is fragile. Savers lose in inflationary economies. True wealth, in his view, comes from holding assets that cannot be printed. Bitcoin sits at the center of that thesis.

Saylor. Bitcoin as Digital Capital

Michael Saylor remains the philosopher of the ecosystem. For him, Bitcoin is not just money. It is digital capital for the next hundred years. His conviction is unchanged. MicroStrategy continues to accumulate.

He expects Bitcoin to push into new all-time highs this quarter. Saylor’s message is aimed at institutions and governments. He speaks to people who think in decades, not months. His tone reinforces the idea that Bitcoin is becoming a formal treasury asset rather than a speculative trade.

JUST IN: Michael Saylor predicts Bitcoin will reach $150,000 by end of this year. pic.twitter.com/ovPz5fMFLW

— Watcher.Guru (@WatcherGuru) October 29, 2025

Eric Trump. The Extreme Bull

Eric Trump took an even bolder stance. He believes a rotation from gold into Bitcoin is no longer a theory but an inevitable shift. He points to scarcity, adoption, and institutional pressure as the drivers.

🇺🇸 ERIC TRUMP SAID #BITCOIN IS ABOUT TO GO PARABOLIC IN THE NEXT 2 MONTHS

IT’S COMING 🚀 pic.twitter.com/8w5fsI71El

— Vivek Sen (@Vivek4real_) November 2, 2025

His long-term projection is the most aggressive. He sees $1M per Bitcoin in the future. Whether or not that number proves accurate, it shows how deeply Bitcoin has moved into mainstream high-net-worth circles. The asset is no longer niche. It is part of global political and financial conversations.

What This Means for the Bitcoin Ecosystem

Influential voices shape attention. Attention shapes liquidity. Liquidity shapes price. Kiyosaki brings retail confidence. Saylor brings institutional credibility. Trump brings cultural and political reach. When all three point in the same direction, it strengthens the belief that Bitcoin is still early in its transition from risk asset to global store of value.

It also signals a shift in how large players are preparing. Treasuries are buying more actively. ETFs continue to pull steady inflows. Mining difficulty remains near its peak. Developers are pushing new Bitcoin-layer innovations. The ecosystem is no longer waiting for approval from the world. It is acting as though it has already earned it.

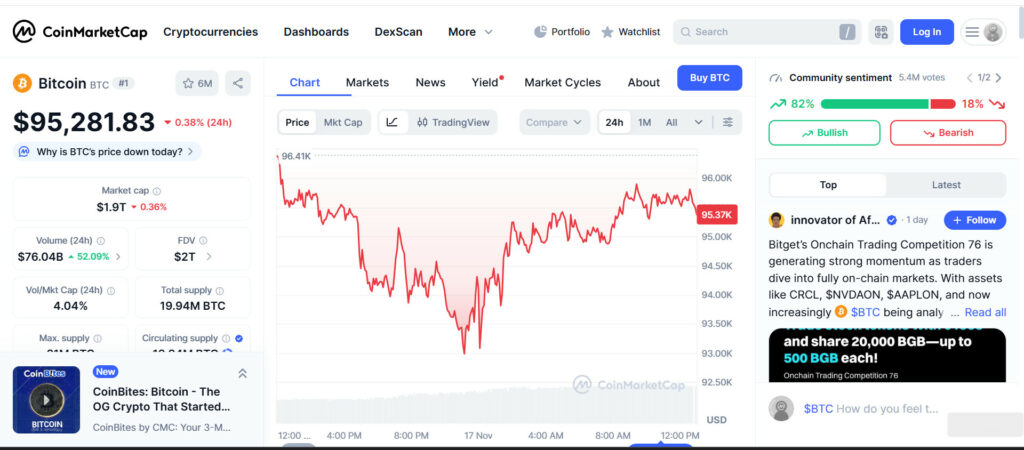

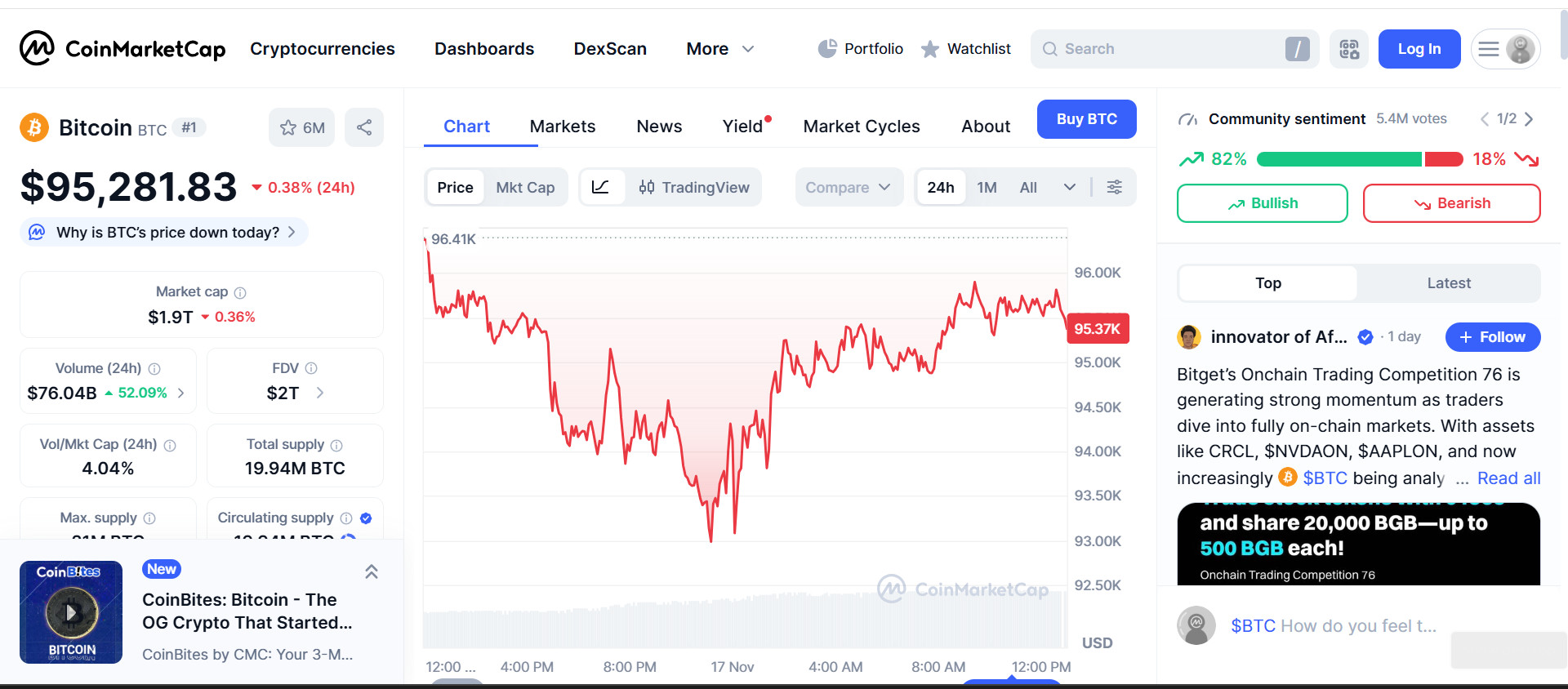

What Bitcoin Has Done Lately

Price action has stayed within $95k and $110k range. Volatility remains tight but stable. The market continues to hold strong above the ninety thousand zone.

Historically, Q4 delivers some of Bitcoin’s best performance. Returns often strengthen during this period. The major resistance remains at $110k. A clean breakout above that level unlocks fresh momentum.

What to Expect in the Weeks Ahead

Momentum is building slowly. Sentiment is turning positive again. Institutional interest is rising after a quiet September and October. If Bitcoin breaks resistance with strong volume, the path toward $125k before year-end becomes realistic. If it fails that breakout, sideways action may continue. Global macro conditions are still mixed. But the overall direction remains upward.

Regulatory conversations around ETFs and corporate treasury rules could introduce new inflows. Miner behavior is stable. Long-term holders are refusing to sell. The most reliable strategy remains disciplined accumulation rather than emotional short-term trading.

WARREN BUFFET trashes BITCOIN

Warren Buffet is arguably the smartest and maybe the richest investor in the world.

He trashes Bitcoin saying it is not investing….it is speculation….. ie gambling.

He is saying a blow off top will wipe out Bitcoiners.

And from his worldly view…

— Robert Kiyosaki (@theRealKiyosaki) November 17, 2025

Final Thoughts. A Pivotal Quarter

Q4 2025 is shaping up as a decisive moment for Bitcoin. Kiyosaki is buying more. Saylor is reinforcing the idea of digital capital. Trump is calling for a historic shift in global wealth.

These are not random comments. They show growing confidence from people who think long term. Bitcoin’s day-to-day movements still create noise. But its long-term story remains the same. The asset is slowly moving from speculation to infrastructure. From investment to foundation.

For the community, the message is clear. Stay informed. Stay steady. The big players are positioning themselves for what comes next. And this quarter may set the tone for the year ahead.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Big Players on Bitcoin: Q4 2025 Insights appeared first on Altcoin Buzz.