The company reported $3.1 billion in total assets and $10.1 million in operating cash flow, generating $61.1 million in revenue for the quarter. However, it also recorded a net loss of $54.8 million, largely due to the changing value of its digital assets and ongoing legal expenses.

These results paint a complex picture of a company still finding its footing in the fast-changing media and digital finance landscape.

Digital Assets and Volatile Valuations

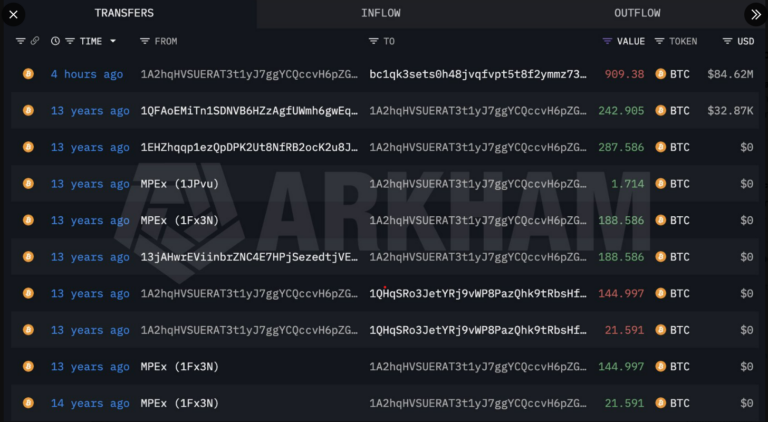

A major factor in Trump Media’s quarterly loss was the impact of digital asset valuation changes. Like many companies holding crypto-related assets, TMTG must adjust its balance sheet when the value of these holdings rises or falls. While this practice reflects transparency, it also means that swings in market prices can dramatically affect reported earnings.

This is not unique to Trump Media. In 2024, several firms with exposure to digital assets faced similar volatility. For instance, MicroStrategy, one of the largest corporate Bitcoin holders, saw major quarterly fluctuations in its earnings due to Bitcoin price changes. Such accounting rules often blur the line between operational performance and market-driven adjustments, making it harder for investors to judge long-term stability.

Trump Media (DJT) reported Q3 2025 results with $3.1 billion in total assets and $10.1 million operating cash flow, generating $61.1 million in revenue but posting a $54.8 million net loss mainly from digital asset valuation changes and legal costs.https://t.co/sA723CEazN

— Wu Blockchain (@WuBlockchain) November 7, 2025

Despite the losses, Trump Media’s strong asset position suggests resilience. The company’s digital presence, anchored by Truth Social, continues to draw a loyal user base, particularly among politically engaged audiences. However, with legal costs climbing and advertising competition heating up, sustaining profitability remains a steep hill to climb.

Media Meets Markets

Trump Media’s financial story also reflects a broader trend: the blending of media, politics, and blockchain finance. The company’s stock, traded under the ticker DJT, has become a favorite among retail investors who view it as both a media play and a statement of political support.

Trump Media $DJT Posts $54.8M Q3 Loss Despite $3.1B Cash Pile

Trump Media & Technology $DJT reported a $54.8 million net loss in Q3 despite holding $3.1 billion in financial assets and generating $10.1 million in operating cash flow.

The company earned $15.3 million from… pic.twitter.com/VBRcYXEZWx

— WOLF (@WOLF_Financial) November 7, 2025

At the same time, the firm’s involvement with digital assets connects it to the wider crypto market — one that has seen renewed investor interest through 2025. A CoinGecko report noted that crypto-related equities have risen by over 40% year to date, suggesting that investor appetite for digital exposure remains strong, even amid volatility.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Crypto Swings Hit Trump Media’s Q3 Results appeared first on Altcoin Buzz.